What's Going On?

on thank yous, rats, and the market movement

Last time, divergence between expectations and reality. Today, thanks and an update on all the things in the market

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/Podcast up soon

Topics covered this week on Everything You Need to Know

Roblox Explained (Nov 9)

A Small Note of Gratitude

This is a quick note, as I know I have the tendency to be very long winded at times. I wanted to write a brief thank you, as I am so grateful for all the opportunities that have been afforded to me this year.

Brief Background on Me: I graduated college in May of 2019 and left Kentucky that June to go to Los Angeles for the first time (yes, I moved there without visiting!!). I started my first job (I sold cars and worked as a tutor in college) at Capital Group. It was wonderful, and I got pretty sharp analytically (still make silly mistakes) and learned a lot around communication and time management. It was a great company, and I learned a lot but I wanted to build (a common theme) and left in February to join On Deck. That was a weird challenge that honed my operational and managerial skills. During all of that, I was writing - I’ve been writing online for almost 6 years now (!!). Began writing about options, then more statistical stuff, now whatever the philosophical-markets-crypto-things that I write are. But I started making TikToks in February - and it changed my life.

I am acutely aware of how much support I’ve had - no one has ever had to show me the kindness that I’ve received over the past few months and years. So many people have taken chances on me (my professors, Capital Group, and YOU!!) and for that, I am so eternally thankful - to the point where mere words can’t express it (the irony of the newsletter writer). This gratitude is in everything I do - everything I write, create, film - it is backdropped by the support and love of so many. I know how lucky I am to be doing what it is that I do - educating, building, learning, reading - it really is a dream.

And so to you, my dear reader, I thank you. For signing up, for reading this, for caring about the markets. It really means the world to me. I hope you enjoy this newsletter and my other work, and again thank you, for simply being here. I appreciate you.

Okay, back to the markets

So there’s a bit of movement in the markets today, which is always fun.

Some catalysts:

Turmoil in Energy Markets

So not only are gas prices high in the US (partially due to increased demand due to the holiday season) BUT ALSO there is an electricity crunch in Europe.

But with the new strain of Covid, oil prices are rapidly falling.

This is to be expected - if countries go back into lockdown, people are going to use less fuel. But there are a lot of interesting dynamics in the energy markets.

Oil Markets

Here are my full notes on all this

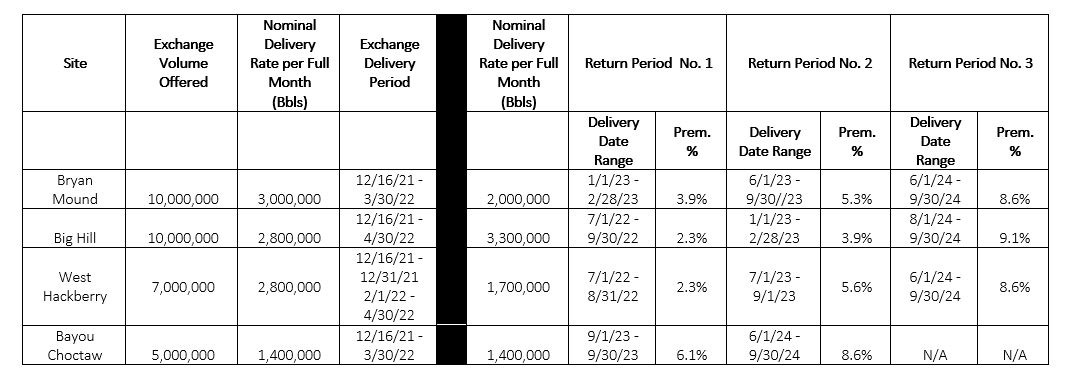

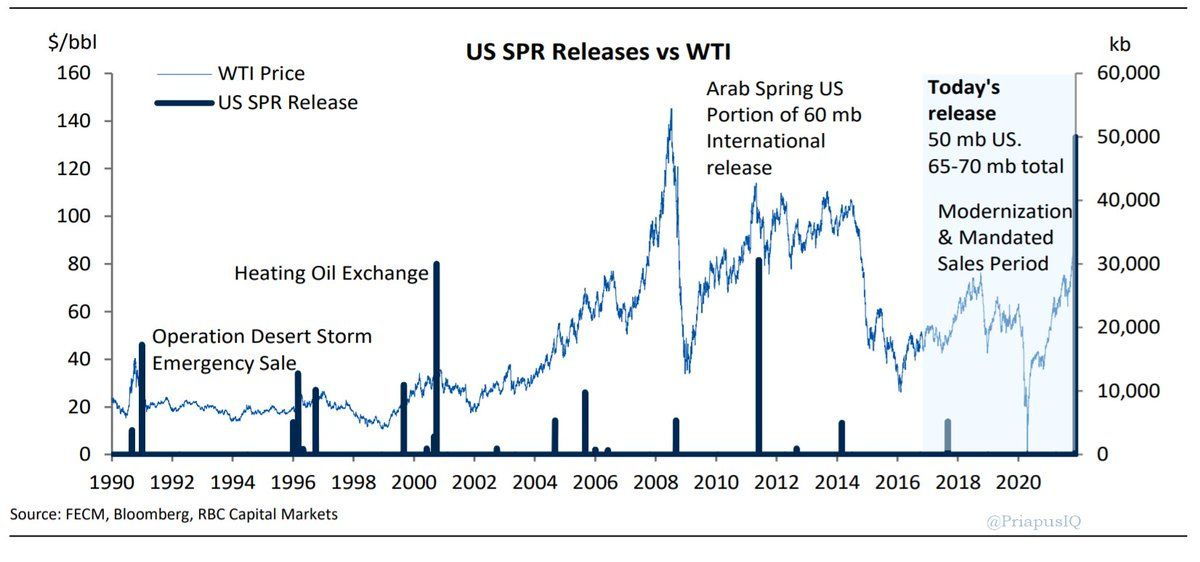

Inflation. High gas prices. The Biden Administration wanted to respond and OPEC was NOT helping - so they released oil from the Strategic Petroleum Reserve.

"The idea that Russia and Saudi Arabia and other major producers are not going to pump more oil so people can have gasoline to get to and from work, for example, is not right," Biden said in late October.

I am not sure why OPEC would care about this at all. Their whole thing is that producing too much oil now would hurt their pricing power moving forward, which is the exact opposite of what a cartel would ever want.

So because OPEC isn’t cooperating, the Biden Administration, in concert with other China, India, Japan, South Korea, and the UK tapped something called the Strategic Petroleum Reserve. The US will release ~50million barrels of oil on the market, which is roughly 2.5 days of demand (the US consumes 20m barrels/day).

So it isn’t going to do much, its more just a signal to the market

They are releasing sour crude, not sweet crude, so it’s really just not that helpful to anyone.

Approximately one-third of the oil will go to China

Those who buy the oil will also have to return the barrels with interest paid - which is just not that appealing of a deal

Biden did this because OPEC refused to produce more oil (mostly because OPEC seems convinced that demand will temper into 2022 and producing more oil would put unnecessary downward pressure on prices)

Monday is going to be a big day for oil prices too (and OPEC) because Iran negotiations will come up again.

If the sanctions are lifted (a big and unlikely if) we could see price alleviation from Iranian production hitting the market

We now know that the government will intervene around $80/barrel, which truthfully is not that high.

Overall, the problems that we have a really capital underinvestment in oil. Releasing oil like this is more of a narrative solution, versus a strategy.

There has been an element of capital efficiency improvements, but overall, just not a lot of great organic investments, which is why short-term influx policy is not the best solution to fix the pricing dynamics

We can’t have green energy policy without green energy investment.

Electricity

Europe is currently going through a natural gas crunch.

Power prices are through the roof there, and there is “no SPR to tap” for electricity.

As we go into winter, prices will likely increase more as people heat their homes.

Turkey Turmoil

Turkey is currently going through it, as the Lira tanks. Apple halted technology sales in Turkey, which is sad - technology is an investment against the rapidly inflated currency there.

All of this is very similar to what happened back in 2018.

They are arguably on the fast track to hyperinflation.

Things are normalizing a bit, but mismanaged monetary policy (the Turkish President slashed rates by 400bps) has severe consequences.

Dollar Stores as an Inflation Index

I know i know i know i know i knowwww but i just have to talk about this

I wrote a whole piece about the Badness of the Dollar Store here.

It has been implied that because the dollar store is increasing its prices by 0.25c that the inflation we have is 25%, not the ~6% implied by the last CPI print.

This is of course flawed reasoning, because:

This is directly implying that there has been no inflation up until this point

The Dollar Store has engaged in massive shrinkflation practices over the years, which we do a poor job capturing in the CPI/PCE

BUT

The Dollar Store/Dollar General whatever is not great!!!! From my piece:

Dollar General plays right into psychology and uses framing bias - often times, their products aren’t cheaper.

They trick people into paying less, but paying more per-ounce because the quantities offered are smaller.

People think that they are paying less for the product that they purchasing, but really they are paying more down the line. Paying $1 for 12 oz now at the dollar store, sounds a lot better than paying $1.5 for 24 oz at the supermarket, but that 0.50 cent difference coupled with the smaller quantity adds up over time.

Just because it’s cheaper doesn’t mean it’s ~cheaper~

As the Dollar General CEO once said, “The economy is continuing to create more of our core customer“. The shrinking middle class plays right into their target market.

Dollar General's might not be a net positive on society - they tend to cannibalize and prey on other stores.

“There’s growing evidence that these stores are not merely a byproduct of economic distress. They’re a cause of it. In small towns and urban neighborhoods alike, dollar stores are leading full-service grocery stores to close. And their strategy of saturating communities with multiple outlets is making it impossible for new businesses to take root and grow.”

So the Dollar Store is NOT a good proxy for inflation.

With that being said, there is definitely inflation right now - things are hot, people are demanding goods, supply chains are still a bit tight (but were showing signs of easing), and we have a labor/wage shortage in a lot of key industries.

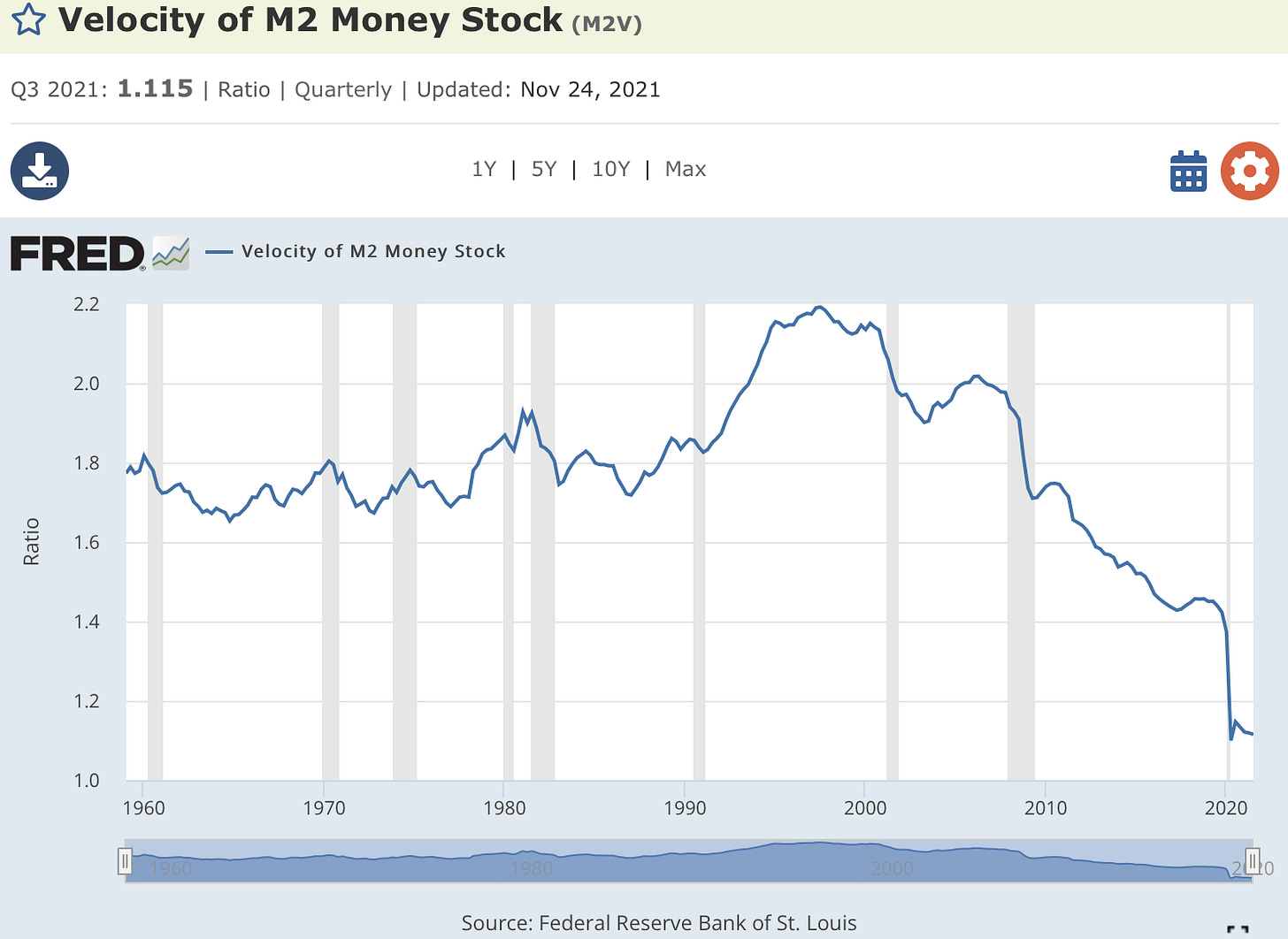

The fear mongering around inflation (ie, we printed x% of the money supply in the last 12 months) is a bit frustrating because

Yes, the money supply has expanded - this is very true. That isn’t as expansionary as people would be led to believe - you can’t look at policy and expect a 1:1 ratio impact on the market

Velocity/Liqudity traps: It’s not perfect but if you look at velocity, you can see that money isn’t moving around ~that much~

GDP Growth: Also as long as the money supply is matched by some element of economic growth, it’s being put to (hopefully) productive use

I always go back to Jeremy Rudd’s paper on this - the more people talk about inflation, the more that they are going to see inflation - that’s just how it is, a byproduct of being humans.

There are also fundamental misunderstandings of supply/demand mechanics - in a market economy, if people demand more, prices are going to go up

Fed Chair and Tapering

Jerome Powell was selected for his second term as Fed Chair. What does that mean?

The decision was between Powell and Brainard. Brainard was likely going to more dovish - she had expressed concerns over the recovery of the labor market, and had stated that most of this inflation was more transitory than not. So she was going to be slower to move rates, slower to pull back on easy money policy.

Powell (and even the most dovish Fed members) are now recognizing that inflation is here and that they are likely going to have to taper (pull back on asset purchases even more) and tighten (eventually raise rates).

The stock market DOES NOT like that kind of talk (unless you are a bank or insurance stock, because they benefit from higher rates usually).

Growth valuations and risk assets (like bitcoin) come under pressure as people rotate into safety stocks.

So the market is digesting the news that rate hikes will likely be sooner (although the new variant is sending everything for a spin).

The New Covid Strain

I am not even going to pretend that I know what is going on here. It likely originates from South Africa. It seems that it is more escape mutations but there is some element of vaccine efficacy. It also seems as though we can track it relatively easy, and figure out where it is going. But it will take time to figure out what is going on.

This is of course very bad and very sad. It will important to watch how it unfolds.

Crypto Markets

Crypto isn’t immune to the stuff that goes on in the world. It sold off this morning too, but lots of exciting things in the crypto market.

Some Axie Infiinity land sold for $2.4million, so rest assured that land will be expensive in the metaverse and the real world.

Over 1million ETH has been burnt, which is a pretty great milestone for the growth of Ethereum. Ethereum has been under a lot of scrutiny on crypto twitter, which debates around L1 solutions, L2, and just the ability for Ethereum to scale (as gas fees are viscerally painful).

Lots of NFT projects, and just in general more acceptance from institutions of the crypto universe (such as Citigroup’s belated request to hire a head of digital assets and 100 people for that team)

On Optimism

I have recieved a fair amount of criticism for how I talk about the markets (stop painting things in a positive light!!) - but I think it would be silly to operate without hope. Optimism predicates any decision making - even if the outcome is net-negative, we still usually have a glimmer of “what-if” in our hearts.

It’s funny, because we are biologically designed to be pessimists. From our hunter-gatherer days, we had to operate with extreme caution - the world has actively tried to kill us. I would argue that I myself am cynical! I don’t trust anything! But yet, hope is an asset that tends to outperform in the long run (on average, we must be reasonable and acknowledge some things are doomed).

Voltaire is most well known for being quite a pessimist, but he has a great outlook (inadvertently) on *why* we should be optimistic. We are ultimately responsible for the world around us - we might just be rats on a ship - but we are responsible for learning as much as we can about the ship around us, and our fellow rats.

So that is why I remain hopeful (perhaps the naivety) but we have the opportunity to be optimistic and build towards a better future - so why wouldn’t we at least try?

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Fantastic piece, Kyla! Can’t wait to see what you develop next.