The Great Entertainment

Can you govern the world like a reality TV show?

Good morning! This piece is an attempt at synthesis of all the news we’ve gotten over the past few weeks - a combination of media logic and market structure and geopolitical trust and lessons from history.

How Reality TV Ate American Governance

In 1954, actor Ronald Reagan became the host of General Electric Theater on CBS, an anthology drama series mixed with America’s first reality TV experiment - the Reagan family living as stars in GE's first home of ‘total electric living.’ As Tim Raphael wrote in 2009’s The Body Electric, this was the beginning of the fusion of “popular culture, corporate capitalism, and electronic media” that would define the next 70 years of American life.

The show sold the idea of the Consumer Republic. Prosperity, like that afforded in this entirely electric home, would trickle down through technological progress and corporate expansion. Reagan carried that idea into his governorship and presidency, that consumerism was the answer, and yes, indeed, of course, absolutely, tax cuts could fund government revenues.

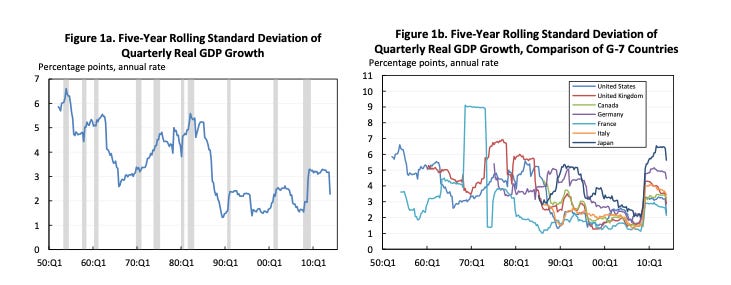

This occurred against the backdrop of the Great Moderation, which began in the middle of Reagan’s presidency. Despite turmoil, from the mid-1980s onwards, the economy was somewhat stable, moderate, defined by an independent central bank with transparent communication and a systematic monetary policy approach, technological growth, a shift to services from manufacturing, international trade, perpetually rising asset prices, and… good luck.

During the Great Moderation, the United States was afforded great privilege. They had been the arbiter of world peace1 for many years. As Robert Kagan writes in the Atlantic, the world was horrendously scarred after two world wars back to back. It needed a watchdog, and the United States, insulated geographically and rich, could be the one to do it:

Far from regarding the United States as a danger to be contained, most of the world’s powers saw it as a partner to be enlisted. America’s allies made two remarkable wagers: that the United States could be trusted to defend them whenever needed, and that it would not exploit its disproportionate might to enrich or strengthen itself at their expense. To the contrary, it would promote and benefit from its allies’ economic prosperity.

Trust! The world uneasily trusted that the US would not get greedy and that it would take care of the world, to ensure some form of global peace and stability2.

This trust and the subsequent globalization allowed American corporations to offshore production while capturing economic and market gains. Cheap manufacturing flooded the US with affordable goods. The TV allowed for consistent policy messaging.

There was also a tremendous amount of financialization. After all, total electric living required consumer credit. Consumer credit required financial deregulation. Financial deregulation enabled securitization and the rise of shareholder value as the singular corporate purpose. Eventually, the Consumer Republic became the Shareholder Republic, finally manifesting the outcome of the Dodge vs Ford Motor Company court case that ruled in the favor of shareholders in 1919.

But stability never lasts. Hyman Minsky wrote about how this stability breeds instability, that comfort leads to complacency. Asset prices rise, people think everything continues forever, they gorge themselves on debt. People get too greedy. Things blow up.

The Great Moderation was pockmarked with periods of crisis, but the shocks were smaller than they were before. Then the 2008 Recession hit. The shock to the economy was extraordinarily severe. As the economy recovered, inflation was so low that the Federal Reserve’s job was to stoke it, not to fight it. And slowly, yet again, asset prices went up. The world was still mostly stable.

It seemed like Fukuyama was right about the end of history - that liberal democracy had won, and the great ideological battles were over. But he also warned about what comes after - in a world without genuine struggle, people seek conflict. They get bored.

Enter Donald Trump, reality TV star, complete with Reaganesque immunity from any accountability. Trying to assign ownership to actions is similar to “trying to convict a squirrel of trespassing” as Daniel Immerwahr writes in The New Yorker.

In Trump’s first term, the market was on his side. Ultra-low rates from the 2010s provided cushion. Institutions bent, but held. Allies grumbled, but stayed. But Trump 2.0, a year in now, arrives in a different world: rates have risen, fiscal space is constrained, and now, the US is treating former friends like foes.

As Prime Minister of Canada Mark Carney warned in his harbinger Davos speech:

Let me be direct: we are in the midst of a rupture, not a transition. Over the past two decades, a series of crises in finance, health, energy, and geopolitics laid bare the risks of extreme global integration. More recently, great powers began using economic integration as weapons. Tariffs as leverage. Financial infrastructure as coercion. Supply chains as vulnerabilities to be exploited. You cannot “live within the lie” of mutual benefit through integration when integration becomes the source of your subordination.

You cannot live within the lie. The Great Moderation seems to be officially wrapping up. Carney underscores that the “rules-based international order” has always been not real, but people believed it was real because it was useful. After all, as Reagan said, “the greatest leaders in history are remembered more for what they said than for what they did.” But now, as Carney says, the gap between rhetoric and reality is closing.

The Great Entertainment

I interviewed President Mary C. Daly of the San Francisco Federal Reserve and President Tom Barkin of the Richmond Federal Reserve last week. The conversation centered on how astoundingly resilient the American economy has been over the past five years. Consumer spending has been strong, the labor market decent, the economy growing. Neither president was commenting on politics, only on macro conditions. President Daly brought up the Great Moderation:

What’s the most unusual circumstance we’re in right now? It’s that we have a lot of volatility and much more uncertainty than we had through the whole 40-year period of what’s called the Great Moderation.

In the interview, President Barkin pointed that the persistence of uncertainty is the greatest uncertainty we are facing:

[The modern version of uncertainty] is actually the persistence of uncertainty [...] I just think you’re going to have higher volatility, higher uncertainty, and that’s going to be a persistent part of the economic environment. People are going to have to do things about that. It’s not like that’s never happened before, but I actually look back in the last 40 years and I think that was relatively stable compared to the environment we’re in and are likely headed toward.

Uncertainty is certainly the theme of 2026. And to be clear, Martin Wolf points out in the FT, the US could still have a strong economy, even with all of this, due to the AI of it all:

It is possible that even such an uncooperative and unstable environment will not impair the willingness of business and policymakers to take big bets on the future. Look at the AI boom. But this must be doubted. The costs may not come swiftly or even visibly. Yet we know that populist policies erode domestic economic performance. The same is sure to be true when the regime in question is a global superpower.

It doesn’t feel very hopeful - AI is such a strange thing to pin the economy on. 71% of Americans feel like things in the United States “feel out of control.” If you imagine America like a great reality TV show, it all makes sense (or at least more sense). We are all unwillingly living through a social experiment that is defined by fabricated drama that eventually becomes real through sheer repetition. As Reagan’s press secretary Larry Speakes said: “If you tell the same story five times, it’s true.”

Everything is close shots and zoom outs, hair perfectly done for the clip, segments scripted exactly to go viral on social media. Constant, neverending, mindnumbing tension. To exist on reality TV is to exist in a world that is fundamentally not real, built-up cruelty for the sake of entertainment, shock value just to keep people watching. And Trump certainly knows good television.

Before his address on the US capture of Venezuelan leader Nicholas Maduro, Trump called into Fox: “I watched it, literally, like I was watching a television show. And if you would have seen the speed, the violence.”

Trump told Kevin Hassett, one of the two Kevins up for Fed Chair, that he might keep Kevin 1 in his job as National Economic Council because “he likes how Hassett defends his policies on television.”

During a terrible TV-broadcasted dispute over gratitude (?), he told the war-weary Ukrainian President Volodymy Zelenskyy that the debacle would make “great television”.

This is the Great Entertainment3, the period after the Great Moderation. We are no longer in a world defined by alliances and mutual agreement. Instead we are rapidly entering a time of instability and uncertainty, driven by the appearance of success (not success itself) on TV.

The White House posts AI-generated pictures of Rubio, Vance, and Trump hoisting an American flag in Greenland. There are thinly veiled threats disguised as memes on official government accounts, strangely capitalized captions, noise for the sake of noise.

When it comes to Great TV, the currency of Great Entertainment, you must do crazier and crazier things to keep people engaged. There is great risk of audience capture. You start to define yourself by the bloodthirst of the fanbase, people who are detached from the outcome but quite interested in the process. It’s why so many people crash out. That seems to be what happened to the President.

Trump’s spectacle is colliding with extreme debt, demographics, poor approval ratings, and geopolitics. There is constant messaging: performance without prosperity and image without substance. Baudrillard’s America, symbols of greatness circulating faster than the conditions that once sustained them.

It’s why there are so many RETVRN posts from the government, an imagined past-America that allows for everyone to have whatever they want (usually it references 1950s, when everyone certainly did not have whatever they wanted).

This is why “Make America Great Again” is so resonant. It promises a return to a moment that never existed for most people and cannot be recreated through performance alone. Nostalgia works as content but it certainly fails as governance.

Through its attempts to redefine the past into something it never was, with promises of returning to manufacturing and whatnot, the US is actively destroying its most valuable financial asset: trust. It misunderstands that none of this would work - the US dollar, the Treasuries, the stock market, the full faith and credit - without trust. Commerce Secretary Howard Lutnick at Davos:

The Trump Administration and I are here to make a very clear point—globalization has failed the West and the United States of America. It’s a failed policy… and it has left America behind.

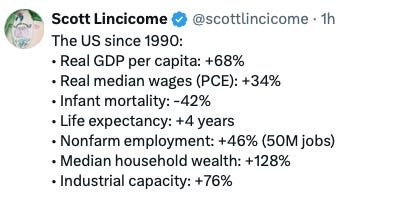

America is successful because of globalization and the Great Moderation. America is successful because the dollar is the reserve currency, which would only be possible with free trade. America is successful because the world believed in it.

The Greenland threat reportedly is because of (1) Trump’s personal grievance that he was not awarded the Nobel Peace Prize and (2) because he thinks Greenland is very big, at least according to the maps (image, reality, etc). He is threatening to levy tariffs against anyone who gets in his way.

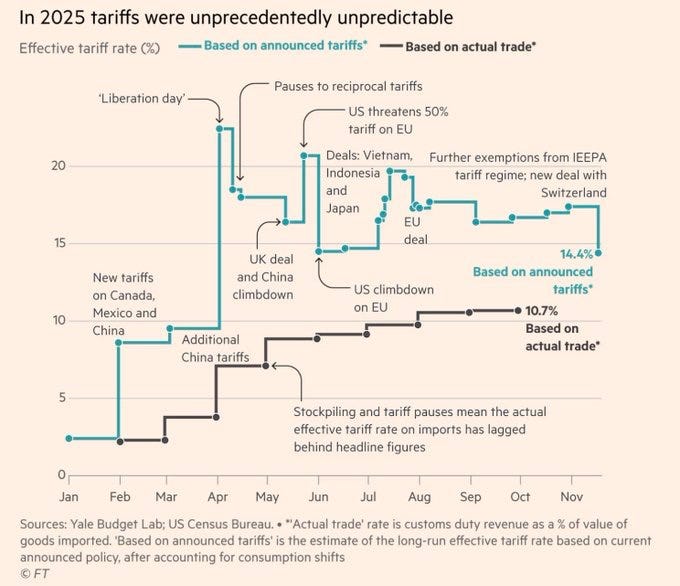

This certainly doesn’t help the rest of the world, but it definitely hurts Americans. Tariffs, which are meant as a punishment against other countries, are mostly paid by Americans. Americans bear 96% of the cost of these tariffs, experienced through higher prices or lower wages or lost investment. These tariffs, which perhaps might be illegal (!) if the Supreme Court ever does its job, have caused pain that really hurts the American people.

As Carney continued in his Davos speech:

The old order is not coming back. We should not mourn it. Nostalgia is not a strategy. But from the fracture, we can build something better, stronger, and more just. This is the task of the middle powers, who have the most to lose from a world of fortresses and the most to gain from a world of genuine cooperation. The powerful have their power. But we have something too—the capacity to stop pretending, to name reality, to build our strength at home, and to act together.

Nostalgia is not a strategy.

Jerome Powell and the Importance of Truth

And how do you fight siren call of nostalgia? You tell the truth.

Trump’s Department of Justice served the Fed with grand jury subpoenas, threatening criminal indictment. This follows Trump’s investigation of Fed governor Lisa Cook’s alleged mortgage fraud. Powell, in a remarkably direct and somber address, stated:

The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.

Powell spoke truth during a time when no one can make much sense of anything. The pretense of the reality TV show we are all unwillingly a part of has begun to fade away. This is an incredible moment of realness, a shocking instance of courage. And that is the only thing that can combat falsehoods.

And the only thing that is governing the administration right now and keeping falsehoods in check is the market. Forget about Congress or the Supreme Court, bond traders are the most important government entity we have.

Trump needs the stock market to go up and the bond market to remain calm. If stocks go down or yields spike, there is no celebration of strong 401ks or low mortgage rates. Markets are his scoreboard. That’s how he measures whether this TV show is working. And currently, it’s not working.

Trump said in Davos:

The stock market took the first dip yesterday because of Iceland [he means Greenland] so Iceland has already cost us a lot of money. But that dip is peanuts compared to what it’s gone up […] that stock market is going to double in a relatively short period of time

Again, the Trump administration misunderstands what America’s role in the world is, but they do understand what makes their agenda possible. As Katie Martin writes in the Financial Times, Trump “needs a strong bond market to help fund his fiscal agenda, not a weak one that jacks up his borrowing costs”. The dollar and Treasuries are selling off as people trade out of US assets, wary of the volatility generated by the Administration in the name of Great TV.

What’s Going On in the Bond Market?

When the US government needs money (which is constantly, because it runs deficits and unfortunately, erratic tariff revenue will not cover the cost of increasing the military budget by $500 billion) it sells Treasury bonds. Someone (a foreign government, a pension fund, a bank) gives the US government money, and the US promises to pay them back with interest later.

For decades, US Treasury bonds have been considered the safest asset in the world. When everything else is falling apart, people buy Treasuries. But what happens when the US itself becomes the risk?

We are currently finding out. Treasury yields are spiking for two reasons - (1) a big selloff in Japan and (2) massive geopolitical risk. People are watching the President of the United States threaten to invade Greenland - a territory of Denmark, a NATO ally - and they’re thinking: “Wait, can I actually count on getting my money back from this government? Maybe I should… sell?”

The largest foreign holder of US Treasuries is Japan. Japan holds about a trillion dollars of US debt. For a very long time, Japan has been stuck in deflation, stagnant growth, and has kept interest rates pinned at zero. The Bank of Japan had to buy a lot of bonds just to keep the system from collapsing.

Japan is trying to exit this regime. The Bank of Japan has slowly let interest rates rise over the past year. But, complicating things, newly elected Prime Minister Sanae Takaichi is trying out unfunded tax cuts and snap elections. The last time a world leader (Liz Truss in the UK) tried unfunded tax cuts, the bond market slaughtered them faster than it took a head of lettuce to wilt.

But cheap Japanese liquidity has underpinned global markets for decades. Investors around the world were:

Borrowing a bunch of yen in Japan (costs you almost nothing)

Converting those yen to dollars

Buying US stocks, or bonds, or real estate, or whatever yields more than zero

Pocketing the difference

Because Japanese rates have been so low for so long, this trade where you borrow low and invest high has been absolutely massive. Trillions of dollars worth of positions built on borrowed yen. The trade works great as long as two things remain true:

Japanese rates stay near zero (so your borrowing cost stays low)

The yen stays weak relative to the dollar (so you don’t lose money when converting back)

But now Japan is raising rates. The borrowing cost goes up. You look at your spreadsheet and realize: “Wait, I’m borrowing at 2% to invest in something yielding 3%, and that’s not as good as it used to be when I was borrowing at 0%.”

When Japanese rates rise, the yen tends to strengthen. Which means if you borrowed 100 million yen, converted it to dollars, invested those dollars, and now you need to pay back your yen loan - you need more dollars to buy back those yen than you originally got. You’re losing money on the currency conversion itself.

What do you do? You unwind your trade. You sell your US assets, convert back to yen, pay off your loan. This creates what Albert Edwards calls “a loud sucking sound in U.S. financial assets.” The carry trade that underpinned the global financial system could be ending. And it’s ending precisely when the US needs it most.

Timing, as they say, is everything.

There is also more pressure on US Treasuries coming from Europe. Danish Funds are dumping US treasuries, pointing out weak fiscal discipline. Other European countries, who own roughly 40% of the foreign held Treasury market, are threatening to follow suit. It’s not clear exactly where they will park their money, but there is a reason gold is up 75%4 over the past 12 months and a reason China is trying to create a gold-backed alternative to the dollar. If this does happen, the US has a real problem:

Fewer buyers of US treasuries means higher yields

Higher yields mean higher debt service costs for the US government

Higher debt service costs mean larger deficits

Larger deficits mean more Treasury issuance (more bonds to sell)

More issuance into a market with less buyers means even higher yields

Return to step 1

The EU has frozen its trade deal with the US. The real world always catches up to reality TV.

AI and the Real Economy

Larry Fink, CEO of Blackrock, pointed out in his Davos speech:

For many people this meeting feels out of step with the moment: elites in an age of populism, an established institution in an era of deep institutional distrust [...] But it’s also obvious that the world now places far less trust in us to help shape what comes next.

He highlighted extreme wealth inequality, the over-reliance on market cap as a barometer of economic health, the concerns about AI and the echo chamber that wealth has created around itself. TRUST is what matters. During the Great Moderation, this could be mostly ignored. Goods were cheap enough. White collar work and college education offered new heights to climb to. There was a sense the US would continue this way, forever.

It’s funny, the two conversations that are sitting side-by-side right now. The end of the rules-based order and the rise of AI. Dario Amodei, the CEO of Anthropic, spoke at Davos and repeated that Anthropic, one of the top AI labs, is “6-12 months away from models doing all of what software engineers do end-to-end”, or 6-12 months from taking a lot of jobs. Palantir CEO Alex Karp says AI will displace so many jobs that it will eliminate the need for mass immigration.

Ken Griffin, CEO of Citadel, says that “the world needs a savior, and the hope is that AI is the savior that we need for productivity”. He also says that much of the AI rhetoric is hype, and that the “United States and China” are the two big beneficiaries of this moment.

Again, the difference between rhetoric and realness. Canada has already struck a trade deal with China, and the EU is searching for something similar. China has focused on the real while America flirts with this strange performative economy, mixed at once with endless TV and endless financialization.

China is welcoming other countries with open arms. Their soft power is growing, with people embracing “a very Chinese time in their life” in a recent TikTok trend, a hyperreal embrace of a world that is decidedly not American. It’s even beating the States at the game it has staked its entire economy on - the AI of it all.

To get away from the reality TV show analogy for a second - it’s important to understand what the AI race is actually about, which is energy. It fundamentally 100% does not matter who has the best AI girlfriend/boyfriend if they do not have a grid to support it. China now generates more electricity than the US and the EU combined, with 40 new nuclear power reactors under construction, compared to… zero in the United States. Energy is what matters, the real economy.

Peter Ryan shared a piece from 2009 Mark Carney, when he was Governor of the Bank of Canada (he was also Governor of the Bank of England, wild run this guy is on) where Carney focused on this real economy, the world beyond gambling (the second fastest growing sector of the economy over the past five years) and speculation:

The financial system must transition from its self-appointed role as the apex of economic activity to once again be the servant of the real economy.

This is a sentiment echoed by President Xi Jinping of China, that the real economy is what matters. The US seems to be slowly becoming aware of this, that there has to be a focus on energy as a way to win the AI race. But the real world doesn’t make for good TV.

The Material Constraint

President Barkin talks about businesses needing “multiple options, multiple irons in the fire” to navigate this era of uncertainty. You need real things!

Reality TV demands that the story throughline remain the same. Trump refuses to back down on Greenland, tweeting private messages between him and world leaders, threatening 200% tariffs on France because they refuse to pay the $1 billion to him (not to the US, to him) to join his Board of Peace.

The President must be allowed to stir up drama5, and no one is allowed to fight back (or if they do, it should be in the name of Great TV). The Administration can go on TV and assure everyone that all of this is happening because of the Globalists, a made-up foil to advance the narrative, or because of the immigrants, or because of the UN or because of NATO - they can say anything and everything and they will. But the world is not a reality TV show. People’s lives cannot be governed by what makes ‘good TV’. It must be governed by trust. It must be governed by realness.

As Wendell Berry said, “I am speaking of the life of a man who knows that the world is not given by his fathers, but borrowed from his children.” And we’re teaching those children that governance is spectacle, that alliances are disposable, that cruelty and showmanship is the path to success, and that the only thing that matters is whether something makes great television.

The cameras keep rolling. Trump keeps performing. But the infrastructure that made the entire show possible - the dollar as reserve currency, the bond market, the alliances - appears to be already changing channels. Reagan proved you could use TV aesthetics in governance. Trump is proving you cannot replace governance with TV. That clarity, however painful, might be the most valuable thing this moment offers.

The real world still asserts itself.

What comes after the Great Entertainment won’t be a return to the Great Moderation. But it might be something better: where material reality matters more than the TV scoreboard and where governance is measured by what it builds rather than how it plays. A return to the real.

Thanks for reading.

Whatever that means, as noted in Footnote 2

To be clear, the US has always meddled in external affairs, often stirring great violence. There was perhaps peace in Europe and other developed nations, but certainly not elsewhere.

Open to other names but it seems like this one is fitting

People are calling this the debasement trade - fiat currencies will be made worthless by questionable fiscal and monetary policy decisions, so people buy gold

I find it interesting that so much of his personal wealth is in crypto, about one-fifth of his total fortune according to Bloomberg.

A dense, but critical read. Long dispersed chickens are coming home to roost. Reality is going to bite.

Nostalgia is not a strategy. You are brilliant. Please continue to speak truth to power.