The Inflation Narrative

better numbers but bad feelings

data and expectations and the gap between knowledge and truth

So honored to be a part of Fast Company’s Most Creative People in Business 2022. Thank you again everyone for all the support and kindness.

Is Data Even Real?

This week, we got the CPI print. The *best* thing about the CPI print is that it was 0% (technically -0.02%, unrounded) in July. The *worst* thing about the CPI print is that it was 8.5% year over year - we still have inflation.

The *interesting* thing about the recent print was the response online, where people seemed to be insistent that the 0% print for July was fake or a lie or both.

I mean, even Twitter (?) added a fact checking note to Biden’s tweet on the inflation print, stating it was misleading, which is truly bizarre.

Arindrajit Dube broke out this difference here

We all got the same information, but somehow came to very different conclusions!

And as Sri Thiruvadanthai said, this divergence in information and conclusion impacts how things work.

If you think about rational expectations theory - which is a theory that people come to decisions based on 1) rationality 2) information available and 3) past experiences - if all the sudden everyone’s information and interpretation is wildly different, that impacts overall outlook.

There is nuance to all of this, of course. The thing is (and I think part of the reason people were mad) is when you say that things are getting better, people often interpret that as you saying that things are good.

Those are two different things - good versus getting better.

Velocity and acceleration. Inflation is still high - the car (inflation) is still zooming along, as shown in the first picture of this article - but it’s decelerating. The rate of change in July prices was zero.

Things are still not great - people are relying on credit cards, real wages are still consumed by inflation, food prices are high, rent is still exorbitant. But things are improving, at least a little bit

But why does Data matter?

But data, at the root, is of course important. Even if expectations are wacky, the data is an anchor in the sea of fluctuations, which is why it is important to pay attention to. There was a lot of good discourse around what the numbers really mean -

Data makes policy: As Joe highlighted, the Fed uses the monthly and yearly CPI metrics to make policy decisions (although they do largely use PCE, they look at all numbers).

Brainard said herself that the Fed looks at monthly prints. Even if you personally don’t agree with the metrics, the Fed *does* and they make decisions based off that, which is why it’s important to understand what the Fed will think about it (convoluted, I know, but it matters).

Data doesn’t always define reality: But of course, the CPI print does lag reality to a certain extent. Policy is just one of the many things that shape our experiences. As Adam said - there is a difference between ‘is’ and ‘was’.

And of course, everyone’s microeconomy is different - for example, I don’t drive at all, so I don’t really pay attention to gas prices. How people experience the economy is going to shape their ‘is’ heavily.

But short term data drives long term expectations: However, people notice month-to-month changes which is why monthly prints are important. We got inflation expectations this week and they ticked down (probably because of gas price relief, which is a short term change)

So data is important because it makes policy and drives long term expectations - but it’s also important to recognize it isn’t the perfect picture of reality.

The numbers weren’t wrong - but if someone says say inflation was 0% and your grocery bill went up 10%, people are going to have some cognitive dissonance and confusion around that. And I think a lot of the anger from people on the inflation print was because it *felt* like a July 0% inflation print was writing off the lived experience of inflation entirely. If people deny your reality, that sucks a lot and creates anger.

So, what was in this inflation print?

The CPI Print

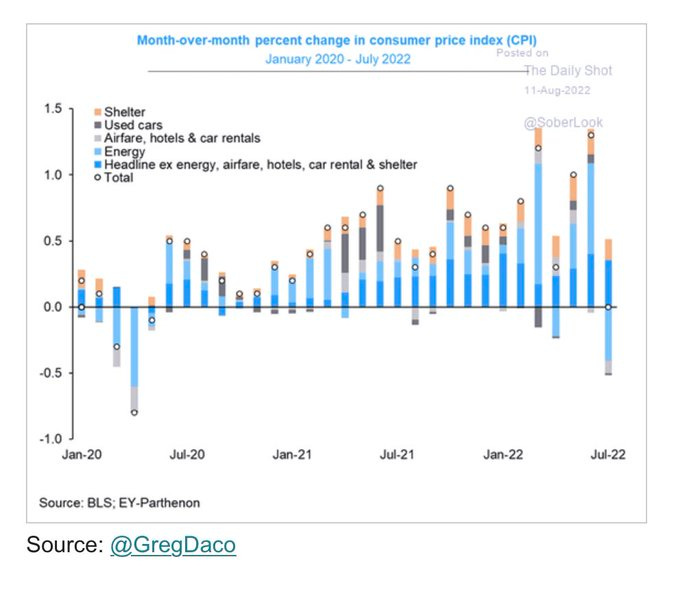

Month-over-month

CPI did decrease 0% in in July, after increasing 1.3% in June - prices did not increase at all in July. It’s really clear in this chart from Greg Daco - the negative and the positive price pressure balance each other out.

Shelter costs were a big contributor to number go up, and the fall in energy was a huge contributor to number go down.

Things still got more expensive! The 0.3% m/m increase in core CPI is still 3.75% m/m as Brian Chappatta highlights.

But some stuff didn’t: Energy prices fell 4.6% , but food got much more expensive, rising almost 11% in the month. Rent prices increased as well, but not at the rip-roaring rate of June. Core services and used cars all slowed in price.

Producer price pressure easing too: The PPI also declined! That’s great news, as it’s the first decline since April 2020. If prices are softening for producers, that will have some downstream easing for consumers (theoretically).

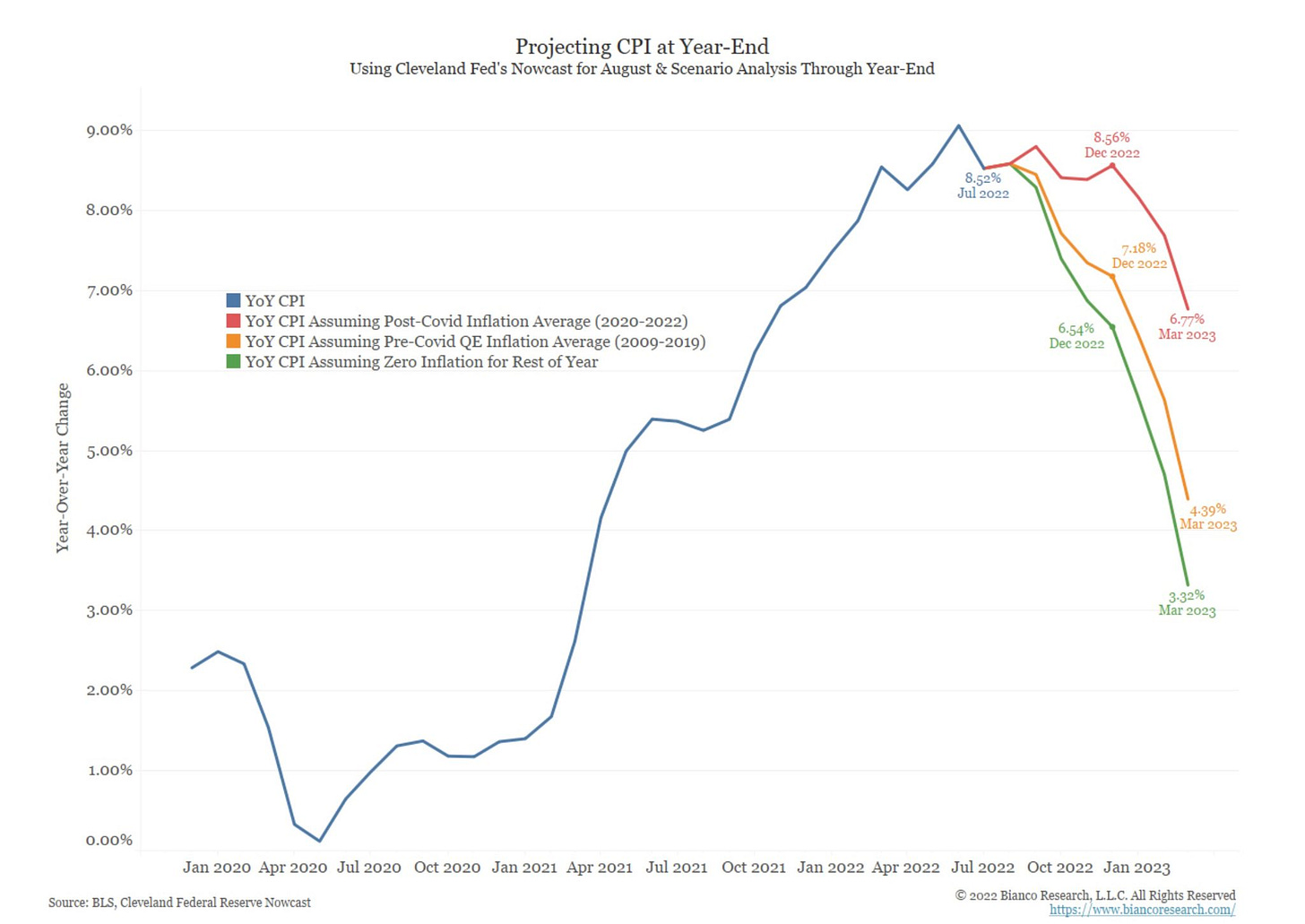

But year over year inflation is still high.

Year over Year

As shown in this chart from JP Morgan - things eased in July, but it’s still gross. Shelter is ticking up, as well as food at home costs. Energy costs are still high (in July, oil is still up 75.6% y/y but quite the pullback from the June 98.5% y/y number).

Rent: Even though rents ‘only’ increased 0.8% in July 2022, they still are incredibly expensive, rising ~14% y/y. This chart from Jay Parsons highlights it well - like sure, it went down, but that doesn’t mean it’s necessarily cooling - it’s more so ‘normalizing’ as Jay says.

Yikes: Mortgages are up almost 50% over the same time frame. The median price of a home is now above $400k. Core inflation is still ripping - driven by rental costs and service sector pressure.

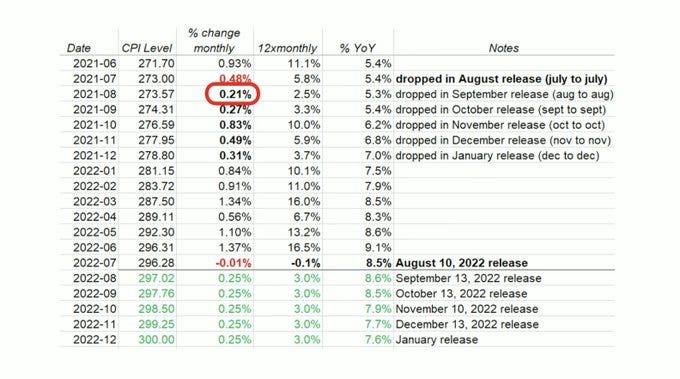

And the biggest thing of all of this - even if we got 0% inflation for *every single month* until December, we would still have really high year-over-year inflation - roughly 3.32% which is well above where the Fed wants it to be at.

Cam Harvey has a good video on it too - and a great table that highlights it further. Even if we got really low changes in the monthly CPI print, we would still have ripping numbers into the rest of the year.

So what is the Fed going to do?

Of course, the Fed wants to see inflation at 2%! And those metrics are much higher than their goals.

Neel Kashkari doesn’t seem to be swayed at all by the CPI print.

He wrote a piece back in June “Policy Has Tightened a Lot. Is It Enough? (An Update)” which summarized - the Fed has to keep raising rates. He wants to raise rates to ~4% by the end of the year to get to !!2% inflation!! - but this was likely more sentiment setting to the market than anything.

The Fed is essentially squaring up with the market right now - a game of chicken, if you will - and the Fed doesn’t want to swerve first. But things still need to get a lot better and the Fed probably won’t be able to achieve this alone.

They have their toolkit - rates, balance sheet, and credibility - but they are basically just like “hey everyone STOP”. There are likely more productive ways to manage inflation versus smashing demand. Alex Williams wrote a great piece for Noema on the true cost of leaving the Fed alone to fight inflation (both domestically and internationally).

Inflation is complex… that difficulty should not justify a decision to leave the entirety of inflation management to the Federal Reserve. The tools they have are blunt and imperfect and have a history of exacting heavy costs on the labor market, investment picture and economy at large.

The Fed is going to keep ripping - and that could come at a high price.

Right now, people are feeling better: The University of Michigan’s sentiment index rose 4 whole points - with people thinking that prices will rise, but at a slower clip.

People don’t feel great about now, but they feel better about the future. That is good news!

But the Fed could wreck that if they aren’t careful: If they go a bit too fast and furious, that is not good for anyone.

But right now, things are getting better - both in terms of data (to an extent, there is always nuance) and expectations.

Inflation being 0% in July doesn’t diminish that pain and worry that so many are experiencing. There is still a long way to go. But even marginal improvements can tip the dominoes in a better direction - which should help shape expectations to be more positive, and the compounding impact of that is a good thing.

Final Thoughts

There is a poem by Kai Skye that I really like -

I want to do important work, I said. Then smile at people you meet, she said & play with dogs & tuck a blanket around someone who falls asleep. That's not what I meant, I said. Of course you did, she said. You just had a smaller idea of important.

I think that sort of underscores the expectations-divergence problem we have (although paints it in a rather rosy way). We have different ideas of what matters, and the issue with that is it gets into the spiral of everything-matters-nothing-matters.

There are people that have “Stockholm Stockholder Syndrome” - who are positioned (whether politically or in their portfolios) for Things to Be Bad, and therefore *want* things to be bad. Different ideas of what matters.

And that’s not a good or bad thing, it’s just a thing. But as I wrote last week - social media loves to purport negative narratives.

And people love narratives!

This is human. Narratives are an anchor. As Eve Kosofsky Sedgwick wrote in “Reality and Realization” about the gap between knowledge and belief - and the time it takes to truly process -

Perhaps the most change can happen when that contempt changes to respect, a respect for the very ordinariness of the opacities between knowing and realizing.

Knowledge is not realization! It takes time to incorporate into narrative. It takes us time to process the change around us (which there has been so much).

It’s similar to our current economy. Things are changing, improving - but progress is never a straight line. The Fed still has to square up in Fast and Furious mode, consumers are still struggling, and corporations have to deal with a slowing economy.

There is probably a marginal difference between truth and acknowledgement right now, and the gap between the two shapes expectations in a strange way.

But just because things are still nominally bad doesn’t mean that they aren’t improving. We shouldn’t hang our hats on it, let’s be clear - it’s still early in this journey - and perhaps good news is the true lagging indicator and really bad news is right behind it, which is a whole cycle we don’t want to be in.

But right now, things are looking a little bit brighter - and that’s something to be happy about.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Love the poem Kyla. Thanks for putting that in there. We need so much more of the expanded thinking the prom points out.

Another really great article, thank you! You can really hear your voice in your writing, my fiancée and I took turns reading this out loud on our Saturday morning.