How the Algorithmic Money Faucet Drives the Economy

things require nuance

some thoughts on how bad news is good news and good news is bad news but everything is bad through the algorithmic money faucet

UPDATE AND THANK YOU! I was published in the New York Times this week and got a really awesome shoutout in Bloomberg from Conor Sen. I am so grateful for all the support and love, and am so thankful to each and everyone for being on this journey with me. When I first started Scanlon on Stocks in college, I was focused on financial education and was testing out my own investment theses - I was writing about what I was learning. Now, I still write about what I learn - there is an entire cohort of people online that are unbelievably generous in what they share. Thank you to everyone who openly shares ideas and information, and thank you to everyone for reading and watching and being here. It means the entire world to me.

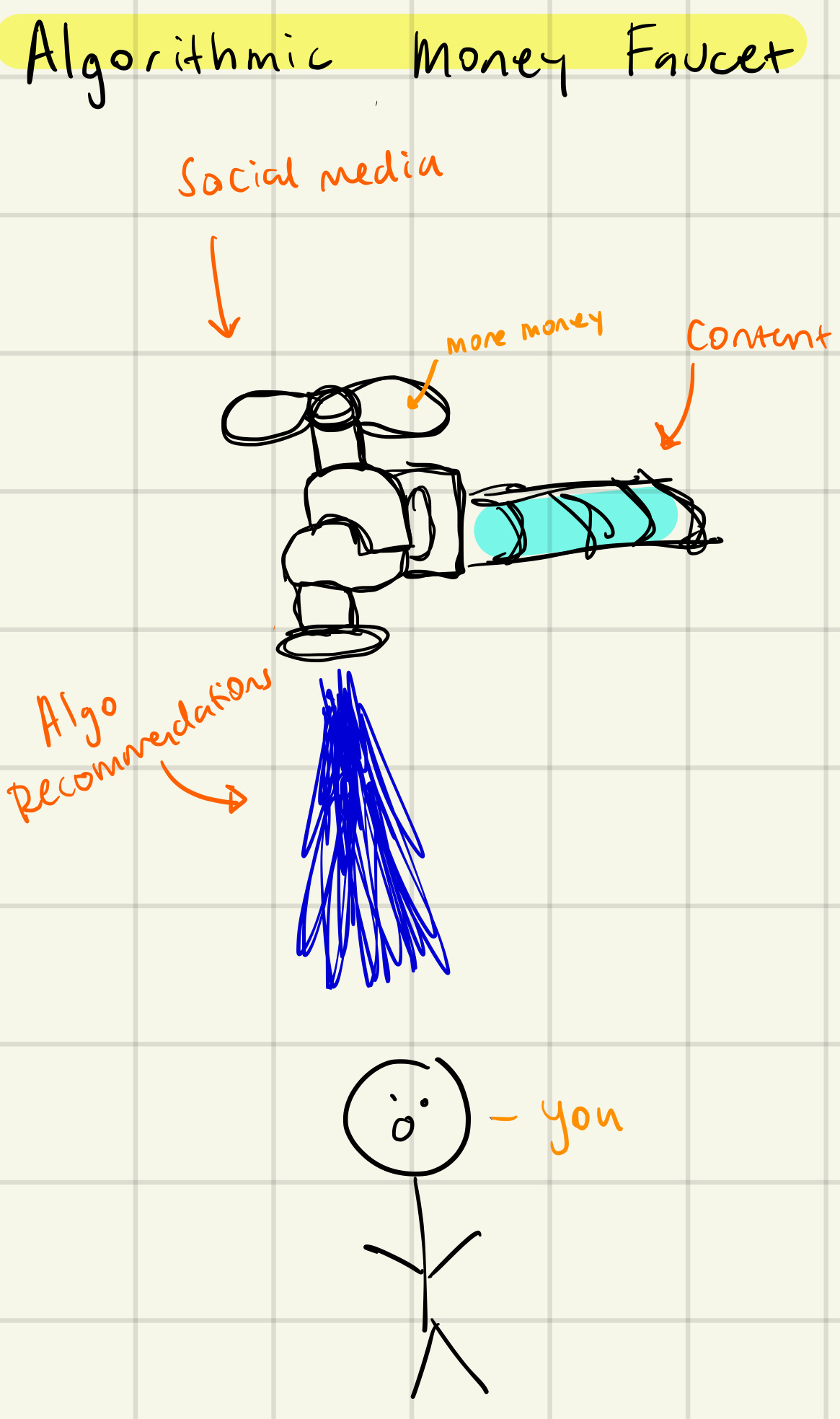

The Algorithmic Money Faucet

I’ve been thinking about Adam Mosseri’s video explaining why Instagram was trying to become TikTok - shifting to a full frame feed and video versus photo.

Instagram needs to grow: One of his underlying points was that Instagram needed to grow and make more money and that videos were the way to do that

Rekt: Kylie Jenner, who destroyed Snapchat with a single tweet, said “Make Instagram Instagram again. (stop trying to be tiktok i just want to see cute photos of my friends.) Sincerely, everyone.”

Users do not care about Instagram’s growth: Many of the comments were like “But *I*, the user, do NOT care if Instagram grows or makes money or whatever, I just want to see my friend’s pictures.”

But it’s not about users: Dan Toomey singlehandedly wrecked the entire concept with “the idea is to waste your time in new and innovative ways”.

Yeah.

There is an important thread within all of that - the growth at any cost mindset and the commodification of users.

Platforms pushing stuff no one wants: The reason Instagram got so much pushback was because they were basically like “listen *we* know what is best according to what is performing *best* on the market, and that is what we are going to focus on, sorry!”

Users wanting their wants to be respected: The reason people were upset because it felt like something that they liked (pictures of their friends) was being co-opted into a larger algorithmic money faucet - and it is. Our lives are content machines, for better or worse.

The content we consume and produce is increasingly being designed to appease to algorithmic money faucets, which can end up shaping who we are. As Gurwinder writes in The Perils of Audience Capture:

Put simply, in order to be someone, we need someone to be someone for. Our personalities develop as a role we perform for other people, fulfilling the expectations1 we think they have of us. The American sociologist Charles Cooley dubbed this phenomenon “the looking glass self.”

We are shaped by People and People shape us. People create content. Content inherently shapes us too.

Content is the “water” in the algorithmic money faucet and social media is the “faucet” itself - but More Money controls the “spigots”. And the social media platforms are going to turn those spigots on full blast - which means that the users get drenched in content - which isn’t great.

Our brains are not designed for a neverending downpour of everything.

A lot of problems today are shaped by social media - there are endless studies pointing to the negative consequences these platforms have on mental health. But it also causes strife and anger, and basically gives us full freedom to be Really Angry all the time, because there are so many things to be Really Angry about - and social platforms LOVE that. They want angry people, because angry content does well!!

This gets into vibes. Part of the reason that the vibes are bad right now is because

Things are bad, inflation is raging, rent is skyrocketing

But also social media amplifies the badness and rewards elements of doomerism, especially on TikTok and Twitter.

This is well known. As Molly Crockett, a member of the Yale team that wrote "How social learning amplifies moral outrage expression in online social networks” said

Amplification of moral outrage is a clear consequence of social media’s business model, which optimizes for user engagement… Platforms create incentives that change how users react to political events over time.

We are incentivized to be angry, so we are going to be angry. That’s what the algorithmic money faucet wants from us.

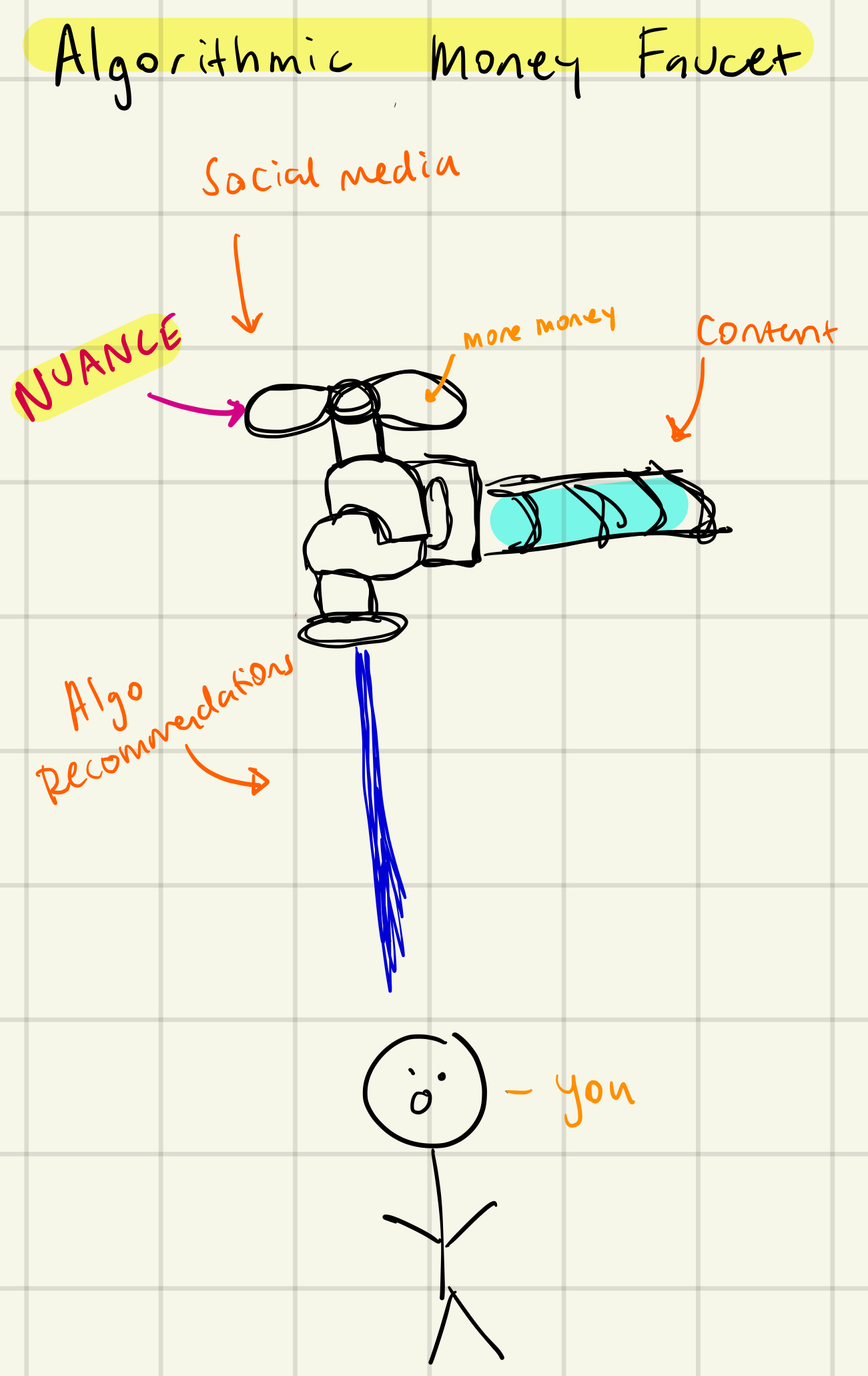

It doesn’t reward nuance.

Anger in Economic Data

This anger of course shows up in how we interpret the economy.

We had a really good jobs report yesterday. 528k jobs added, the unemployment rate ticking down - we have recovered all the jobs lost in the pandemic and did it at a much faster clip than previous recessions. Since the start of the year, we’ve gained 3.3 million jobs, which is phenomenal. But of course there is nuance and noise. Good news is bad news.

Jobs: Jobs are a lagging indicator, the labor force participation rate is not good, and there are signs that productivity is suffering (bad)

Production: We got a strong ISM report that showed a slowdown in manufacturing activity, (bad) BUT a huge drop in prices paid (good)

Wages: The ECI report showed as strong signs of spending and wage growth (good) but it showed that we could be nearing wage-price-spiral land (bad) which would give companies reign to raise prices because people make more, causing people to make even more, and companies to raise prices even more.

Corporations: U.S. Companies haven’t been going bankrupt (good) - however, investment grade spreads continue to widen, with BAA spreads hitting a 2022 high this week (bad). This will likely continue to get worse. The yield curve continues to invert as Treasuries trade like meme stonks (also bad)

Consumers: Delinquency rates are starting to tick up as people take on larger debt balances to try and battle inflation as the savings rate plummets (bad)

15% of Americans are falling behind on rent payments as rent continues to surge (bad). There’s been a huge increase in home builder cancellations, but the housing market shows signs of easing (partially because mortgage rates mooned).

People seem to be feeling better as gas prices ease (good) but there will likely need to be a “double catch-up in demand as consumers fill up their tanks AND gas stations refill faster” as Josh Young and Mason Hamilton highlight (bad)

Mixed. It’s good news that the labor market is strong, but the corollary to that is the Fed now has full room to go even more Fast and Furious mode. The economy is doing “Too Well” and that’s not good for their inflation fighting goals. So they could rip rates, and going full throttle could end up risking a Recession.

Things are so “good” that they are “bad”.

Messy. Confusing. As the Richmond Fed highlighted, the main reason people don’t like inflation (beyond everything getting really expensive) is that it creates uncertainty. We do not like uncertainty, as creatures. It’s confusing and noisy.

The Economy is Changing

And the way that we interpret these metrics is confusing and noisy too. As I discussed last week, I think the way that we think about the economy is going to have to evolve. As the Federal Reserve Bank of Dallas wrote:

As trend GDP growth slows due to aging demographics and slower productivity gains, there may be more frequent periods of negative GDP growth without an increase in unemployment, making the distinction between increasing slack and declining activity more relevant than in the past.

GDP may be negative, but it doesn’t mean things are *bad*. It just means that growth at any cost might not be the most sustainable model, or reflective of the state of the economy.

New lens: This isn’t gaslighting or lying (which the algorithmic money faucet loves to highlight) - it’s just a different way of thinking about the economy, which is likely necessary.

This applies for how we think about markets too. Benn has a really great thread on how theory (just like data) isn’t always reality - the ‘invisible hand’ is sometimes swayed more by the narrative of building versus the actual building itself.

I think a lot of people like to think of theory as this perfect framework, but it’s really just that - theory. When we think of the algorithmic money faucet, it rewards Big Takes on What Theory Says About Things Being Bad and when it does that, that purports more Things Bad takes, and so on and so forth.

Badness is rewarded, and because of that, it clouds our view.

With all that being said - there is nuance.

No one is denying that things are hard right now. We are starting to see flashing red bells in consumer credit profiles, in elements of the labor market, and still have further to go with the Fed.

But extrapolating a bit from Leigh’s point on crime in NYC - we are fueled by perception.

Final Thoughts

The algorithmic money faucet does not like detail, but that is what this economy *requires*. Things are bad, things are good, and it’s important to understand where and why both are happening versus saying that Everything is Actually Hell.

Nuance is required, especially as we navigate the next few months of a Fast and Furious Fed, who is hellbent on fighting inflation.

The way that we think about the economy and markets might have to evolve as the economy and markets evolve (as Matt Klein has written extensively about).

This a “with a grain of salt” economy - and data, theory etc does *not* always reflect reality. Be cautious with what the algorithmic money faucet tells you.

As a reminder of life outside the algorithmic money faucet, in A Philosophy of Walking, Frédéric Gros beautifully explores the concept of walking through the lens of thought (reflective power) and action (taking a stand). It underscores the simplicity of our lives, but highlights the complexity. He writes:

Being someone is all very well for smart parties where everyone is telling their story, it's all very well for psychologists' consulting rooms. But isn't being someone also a social obligation which trails in its wake – for one has to be faithful to the self-portrait – a stupid and burdensome fiction? The freedom in walking lies in not being anyone; for the walking body has no history, it is just an eddy in the stream of immemorial life.

Thanks for reading.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

It’s always expectations!

Thanks for this, you are one of the most accessible sources for understanding the economy. I look forward to ever tiktok and article.

congrats, going from TikTok content to writing NYTimes opinions has more dimensions of authenticity than the Washington Post creating content for TikTok, I dig the vibes