I published a piece with New York Magazine on the 6 things that the Fed has to pay attention to - and how tough their balancing act is right now.

Corecore: Videos about the Void

There is a trend on TikTok called corecore. It takes from other trends like goblincore and cottagecore and pokes an ironic stick into the middle. Corecore is a reflection of the Internet on the Internet. It’s is a compilation of a lot of other videos like clips from movies such as Good Will Hunting or Inception or the Joker, from podcast interviews or news segments, from other TikToks - all stitched together to convey a deeper underlying message.

A message against Internet culture. A message against capitalism. A message about income inequality. For the good videos, the message is meant to evoke some sort of feeling. It’s similar to Dadadism in the post World War I era. The only response to an absurd world is to make absurd things.

The younger generation has grown up in a strange world. For many of them (myself included) 9/11 was a defining moment of their toddler years. Childhood was marked by the Great Financial Crisis. Young adulthood haunted by the pandemic.

Every generation has defining features similar to this. The world is constantly cycling in and out of bad and good. But for this generation, their time is marked by social media, by a constant pit of comparison and Internet Points.

I think that is why the corecore movement is exceptionally powerfu. It’s holding up a meta lens to what is happening. It’s a mirror reflecting upon itself, social media creating content about social media. If you watch some of the videos, you can sense the thread of pain that people are pulling on.

It’s different than Dadaism because it does have chaos and anti-bourgeois sentiment, but it isn’t nonsensical. It makes sense.

Gen Z nihilism is no secret, and it bleeds into finance too. As Elizabeth Lopatto wrote back in 2021 in the article Robinhood has figured out how to monetize financial nihilism -

Are there any people under the age of 40 who have ever thought markets were something besides a casino? Meme trades aren’t the cause of widespread distrust, they’re the symptoms of it. And those people under 40 who think finance is for gambling? They’re the lucrative part of Robinhood’s user base. Legal issues aside, it seems like Robinhood has a good business model for monetizing financial nihilism — which is the kind of thing investors might get excited about.

There was a recent piece that dove into what financial nihilism is all about - with a relatively dark take that stems from a belief that money means nothing, and therefore, it ends up meaning everything.

Not to get too metaphorical, but the Fed is charged with creating aspects of financial nihilism right now. The Fed has these really influential elements of corecore threaded through their actions.

There’s a short memoir called The Crane Wife by CJ Hauser. CJ had recently broken off an engagement and headed to Texas to study whooping cranes for a novel.

Here is what I learned once I began studying whooping cranes: only a small part of studying them has anything to do with the birds. Instead we counted berries. Counted crabs. Measured water salinity. Stood in the mud. Measured the speed of the wind.

It turns out, if you want to save a species, you don’t spend your time staring at the bird you want to save. You look at the things it relies on to live instead. You ask if there is enough to eat and drink. You ask if there is a safe place to sleep. Is there enough here to survive?

When you want to save something, you look at the things it relies on to live.

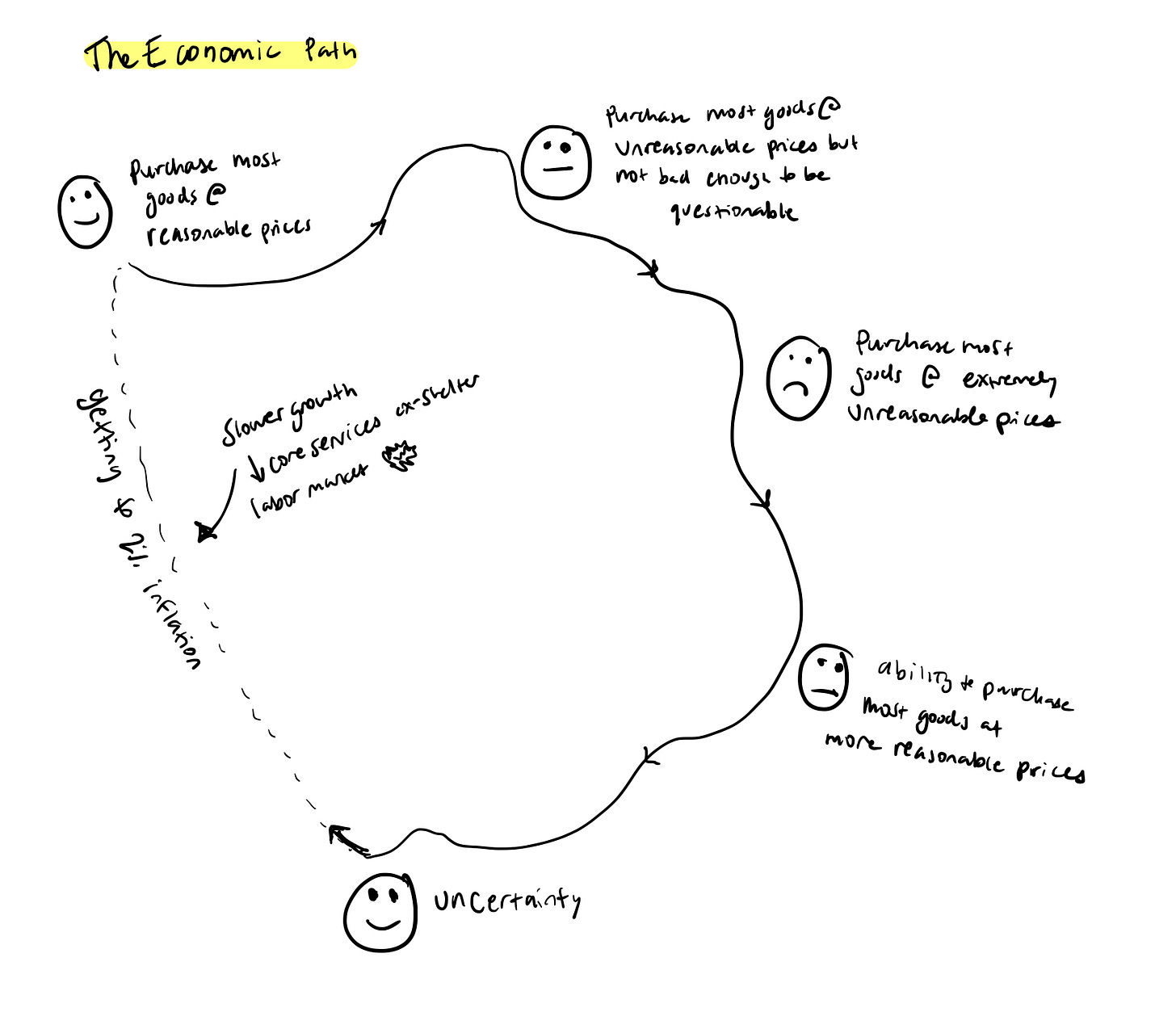

The Fed’s Economic Path

That’s how monetary policy works, right? Right now, the Fed is paying close attention to wages in an attempt to slow the labor market in an attempt to slow hiring in an attempt to slow the economy in an attempt to slow inflation. Wages are the things we rely on to live.

When you want to destroy1 something, you look at the things it relies on to live.

Instead of piecing together different clips to tell a story, the Fed pieces together different data points to fuel the narrative.

The Fed raised rates by 25 basis points at their meeting, a signal that disinflation is moving throughout the economy but that there is still more work to do.

Rates higher for longer: They said that “ongoing increases” would be appropriate, hinting that raising rates north of 5% would make sense. Then, the question will become - how longs should rates stay high?

And rates aren’t high enough yet: Jerome Powell actually sounded somewhat stoked on the disinflationary signals, but kept mentioning that they needed substantially more evidence to really believe that inflation was gone.

They are following their economic path. They really want to get us back to 2% inflation, the ability to purchase most goods at reasonable prices. But along the way, we are going to have to deal with slower growth, a tick down in the labor market, and a softening in wage growth.

What is the Fed looking for?

So they want to see softer prints in core services ex-shelter2 (which has been printing softer), see the labor market chill out, and expect the economy to grow slowly over the coming months.

But this disinflation is moving throughout the economy.

Recessionary warning signals are flashing, consumers are clearly showing some pain (despite spending continuing to run at 140% of pre-pandemic levels as Visa reported). The labor market is holding steady, even as parts of it get hammered, like tech. Rents are slowing. The housing market is kind of chilling out. More ships.

But the worry is that all of the things that have gotten better will get worse again. The Fed doesn’t want to declare victory while inflationary soliders are still on the battlefield.

What are the data saying?

But also the battlefield is melting.

Manufacturing is probably in a full on Recession. 15 out of the 18 industries said “yeah things suck a lot” and none of the industries saw a rise in new orders. They are still maintaining headcount in anticipation of a stronger next half of 2023, but buyers and sellers are in a full out brawl on pricing.

The labor market is doing okayish: but Powell thinks it’s “extremely tight” and “out of balance”. There are more job openings, quite noticeably in leisure/hospitality, construction, trade and transport, but the quit rate moderated.

As Skanda from EmployAmerica points out, the quit rate is really what matters here. It’s continously falling, which underlines some weakness in the labor market, which is what the Fed wants to see but isn’t paying attention to.

Wages are falling: The Employment Cost Index, which measures wages and benefits, increased only 1% in Q4 2022 which was the smallest move in a year. Real wages are lower today than December 2019. The Fed loves to see that. Wages are returning to trend.

Even in qualitative data, inflation is no longer everyone’s main concern. Instead it’s government/poor leadership, which is quite reasonable to be concerned about. Inflation expectations are anchored. Powell is getting his rational inattention for inflation, which is good.

There are hard data points showing a slowdown (and some showing a pickup) but all the indicators that NBER looks at to determine if we are in a Recession are saying “nope, no recession here”. The IMF increased their global growth forecasts.

Meta had a great earnings report, a good sign for tech at large, and part of the excitement is that they could be replacing the people they laid off with AI (and they are doing a $40b buyback). Like sure, fine, that’s technological progress I guess. The Instagram guys have a new AI startup and Sergey Brin returned to Google, so AI is definitely going to take hold over the coming years, and workers could be continously displaced. Hopefully we don’t expect the Fed to cut rates to fix this problem.

But the Fed is still charged (at least for the next few months) with purporting a narrative of nihilism. They can’t be dovish, because then the ultimate pricer of nihilism, the markets, will freak out. They will sing with glee, and did so when Powell accidentally was like “yeah markets all good go up” at the press conference yesterday. Markets are now pricing in rate cuts by the end of this year, high-fiving each other and saying “we got them this time”.

Jerome Powell basically accidentally gave markets the greenlight, saying that financial conditions have tightened and that everything is okay, so markets rejoice. Markets are loud, and market fundamentalism has moved many policy needles this year (BoE, for example).

Final Thoughts

The Fed wants the market to take it seriously. And there is a level of meta-irony to that because markets almost always completely lose the plot. Stock market is not the economy, yada yada, but watching stock prices jump on news of layoffs or AI integrations is just like… what are we doing here?

It’s similar with corecore. It’s an art movement that is meant to be reflective of monotony of the constant drive to be accepted into social media’s cruel embrace. But the creators will sometimes say “follow me” or “face reveal at x subscribers” which is also a weird level of meta irony. Falling into the pitfall of Internet points while making videos about Internet points.

We all crave acceptance. Corecore is visualized nihilism3, the Fed’s rate hike path is enforced nihilism.

Overall, the Fed is paying attention. They believe that they have more work to do in the battle against inflation, but it’s a good thing that they are slowing their roll a bit.

I make these economic tiktoks almost everyday, which recieve hundreds of comments, almost every day. Every day, I hear from people that things are not okay. That they are not okay. That things are hard and big and scary and confusing.

I think that’s why I’ve been circling this drain of “people are the economy” for the past few newsletters. Because people are the economy. The stock market is an inefficient mechanism for evaluating the position of the average person and the economy is clouded with confusion.

There’s another poem, called Ginsberg by Julia Vinograd. The poem tells the story of two friends during the Vietnam War, wherein one friend decided it would be funny to yell the “war is over”.

So when Ginsberg yelled I ran down the street

and leaned in the doorway

of the sort of respectable down on its luck cafeteria

where librarians and minor clerks have lunch

and I yelled "the war is over."

And a little old lady looked up

from her cottage cheese and fruit salad.

She was so ordinary she would have been invisible

except for the terrible light

filling her face as she whispered

"My son. My son is coming home."

I got myself out of there and was sick in some bushes.

That was the first time I believed there was a war.

Thanks for reading.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Destroy is much too intense of a word here. I geniunely believe the Fed doesn’t want to wreck the economy (JP doesn’t want to be Arthur Burns, but I don’t know if he wants to be Volcker either)

This is water, sewer, trash collection; medical care, transporation, recreation, personal services like haircuts etc

I don’t really like using the word nihilism for corecore because nihilism is so broad and misunderstood but for simplicities sake, I am going to refer to it as such

Hi Kyla - Longtime listener, first time caller. As a GenXer - I feel as though this description of GenZ and 'corecore' could have been written about us. GenX was steeped in post-modern 'meta' and irony and cultural commentary. With the exception of a few futurehistorical specificities, just change the Z to an X and backdate the article to 1998 and it still works :D. Some interesting parallels between GenZ and GenX for sure. Thanks for your writing, really enjoy your work!

Very well done. It’s been tried forever but wonder what the recipe is for widespread anti-nihilism..there’s got to be something. A uniting cause that isn’t tragic…