UST and USD: Everything is Monetary Policy

On UST, inflation, and the Federal Reserve

alrighty so everyone is talking about this but hopefully this is helpful

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

QUICK NOTE: I want to highlight that a lot of people lost a lot of money from this. It’s scary. Morgan Housel has a really beautiful writeup on the emotions that come during times like this - but if you need help, please talk to someone. You are not alone.

One Week Later

It has been one week since the Fed meeting where they said that they were going to raise rates by 50 bps (and plan to do so over the next several meetings too) and shrink the balance sheet. Since then:

Layoffs happened at many startups

UST, an algorithmic stablecoin, depegged from $1 USD

Inflation came in hot yet again

India is buying LNG from Russia and Qatar is negotiating with Europe

We are running out of baby formula

There are diesel shortages

MicroStrategy could get margin called

Americans are loading up on credit card debt

Tech stocks are getting throttled

The wheat market is under even more pressure as China tosses bad supply

Retail volume declined by 58% at Coinbase

I am going to talk about two of these things.

A Very Simplified Version of UST Depeg

Many, many, many people who are much smarter than I am have explained this in-depth, so I am going to link to my Terra Notion page if you want to check them all out.

Do Kwon, is the founder of Terra.

He essentially became Jerome Powell over the weekend, as Ryan said on Bankless.1

But first - what is Terra?

Terra is a "public blockchain protocol deploying a suite of algorithmic decentralized stablecoins which underpin a thriving ecosystem that brings DeFi to the masses.”

Terra’s main goal is to achieve Bitcoin’s goal of a peer-to-peer electronic cash system. They have lots of stablecoins, but UST is the most popular.

There are other types of stablecoins like Tether, DAI, and USDC (my notes on them here) and they are essentially utility tokens that are meant to bring stableness, payment systems, store of value, etc.

An important note is that Tether, DAI, USDC are all collateralized - USDC and Tether are fiat-backed and DAI is backed by ether and other crypto.

UST is simply not backed. There is nothing there but vibes.

As CoinDesk wrote:

UST gained the trust of the decentralized finance (DeFi) community as a truly decentralized stablecoin that does not need a central governing organization to ensure sufficient reserves to back the price

BUT, as it turns out, there is a central governing organization with reserves to back the price, because when your stablecoin goes into freefall, you’re going to protect it.

So What Happened with UST?

4 core components of what happened (Rekt has a great writeup on it here)

Two important crypto assets -

UST: an algorithmic stablecoin, which means that it tries to match the value of $1 USD (it’s like having USD, but in crypto)

Luna: Helps UST maintain its peg, trades on the law of supply and demand

There is also Anchor, which is a “money market built on Terra” which is sort of the incentive of the entire ecosystem because -

It offer(ed) a sweet, sweet 19.5% APY for UST deposits on the platform

The Luna Foundation Guard and their reserves (you can kind of think of them as the Federal Reserve for Terra) which I will discuss later

So it works sort of like this (very simplified):

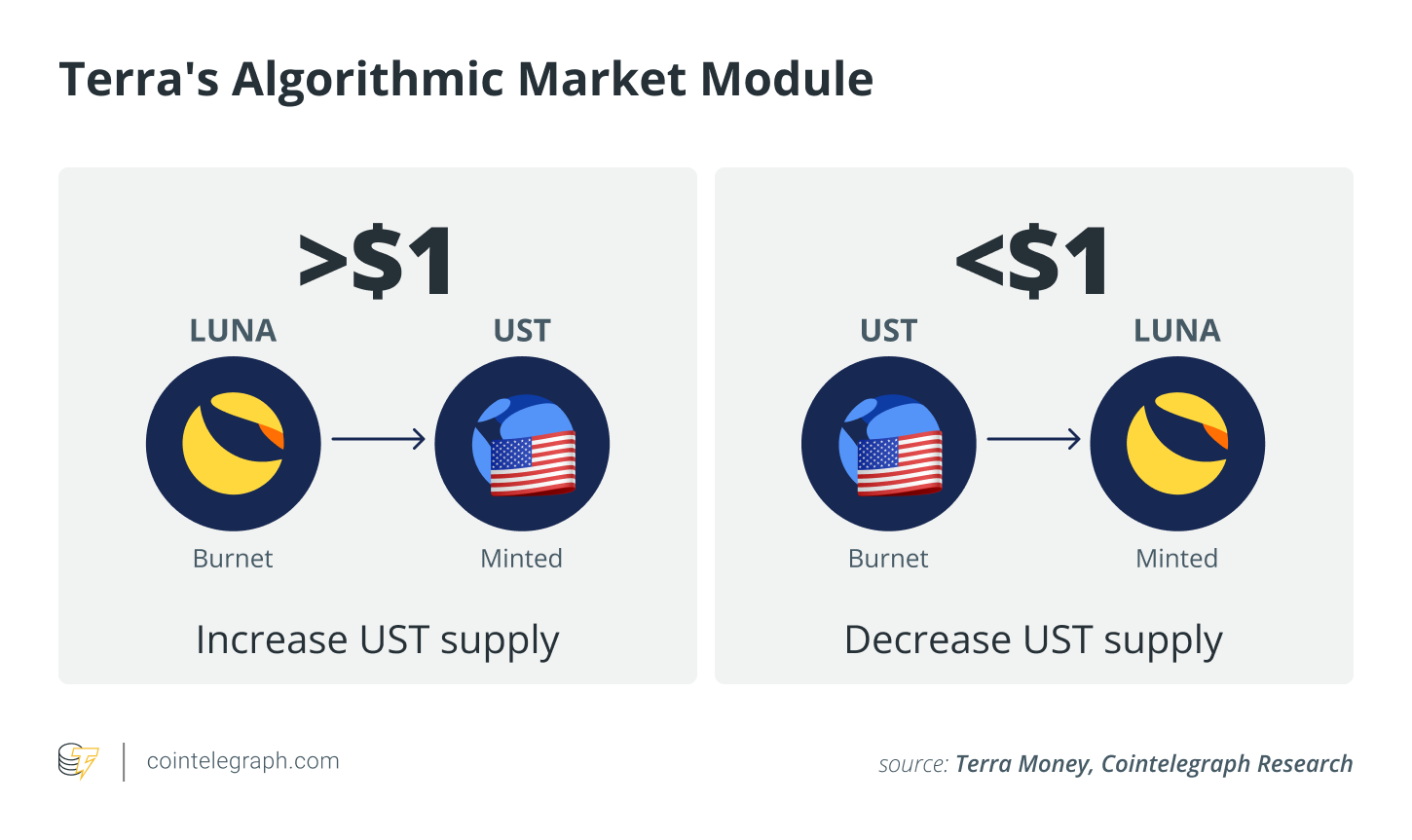

You have TerraUSD (UST) and Luna (LUNA).

Luna trades like any old crypto asset - on the laws of supply and demand.

UST is the stablecoin that trades off Luna

Most importantly, $1 UST always = $1 worth of Luna

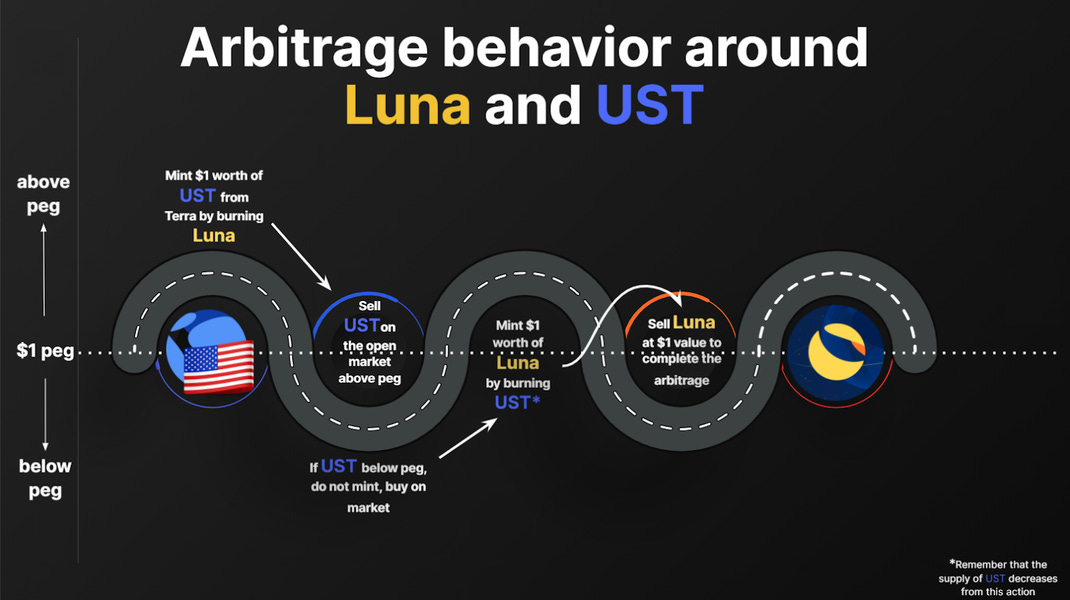

This is the stabilization mechanism - UST stabilizes at $1 USD because you can get $1 UST for $1 worth of Luna no matter what - even if UST is more than or less than $1 - and the arbitrageooors will smooth the market out

If UST is, say $0.98, the idea is that everyone would say “oh dang, I can arbitrage this and get $1 Luna, what a steal!”

And vice versa - buy $1 worth of Luna if UST is like $1.02 and profit!

This is probably the most important part - the system relies on arbitrage to maintain the peg (and the subsequent burning/minting of Luna)

And of course arbitrage only works if people *want* to do that

So that’s great - but why would someone do this?

YIELD: The utility of the UST stablecoin is the Anchor Protocol which pays 19.5% yield (much higher than the 0.05% a traditional bank account pays!) which incentivizes liquidity and everyone is like “well yeah I’d love to earn 19.5%, inflation is 8.3%, sign me up”

This 19.5% is supported by the Luna Foundation Guard (for now, think of them as the Federal Reserve but for Terra)

Collective belief driving value, incentivized by sick yield. Nice! What could go wrong?

Lots of things because this works until it doesn’t.

So what happened? The cascade of events began with incentives, of course.

Macro stuff: First off, all of this is compounded by a tense macro atmosphere where bitcoin is going through a massive selloff, selling pressure in the stock market (specifically tech, which crypto trades like) and a tightening liquidity environment

The Events

Illiquidity: There was a migration from 3pool to 4pool on Curve Finance.

Do Kwon withdrew UST to prep for this, resulting in liquidity dry up.

Also the LFG was selling UST to buy BTC to build up their reserves. So it was a double whammy of illiquidity and pressure.

If you’re someone looking to beat up and attack something, this is your shining moment.

Attack: So of course, there is speculation that someone then attacked! Dumped a lot of UST on the market, which resulted in Terraform Labs removing even more UST to balance stuff out, which resulted in even more instability.

Reflexivity: People and funds got nervous, so they sold their own UST, and then the death spiral began

Response: The LFG was like “oh no” - but luckily they had built up monetary reserves to defend against this and deploy their bitcoin to protect the peg.

Monetary Policy: They loaned out $750m in BTC and $750m in UST to defend the peg (sounds like monetary policy!!), and are asking other institutions to step in and help (also sounds like monpol!)

But they had bought bitcoin at ~$42k and were now selling it at $34k so the selling pressure on bitcoin was intense, which compounded the spiral

Bank Run: Death spiral - Luna is now absolutely printing in terms of supply, which is creating even more pressure, people are scared, which is creating even more pressure, and thus,

The Implications

So okay

Contagion: A is collateral for B and B is collateral for C and C is collateral for A, so if A goes down, the whole domino line ends up tipping. Pressure is coming for Tether because people are like “what is going on with YOU?”

It was supposed to be safe: Anchor got more inflows recently because the Fed is slamming the brakes on the economy - so people were going into something that they thought was safe. This is like the cash under your mattress - it’s meant to hold during times of uncertainty, which makes this even worse.

With that being said, many people including Bankless, Vitalik, and Nevin Freeman warned against this

Central Bank: The Luna Foundation Guard essentially acted as a central bank conducting monetary policy - deploying reserves to defend their currency. Russia did something similar with the ruble a few weeks ago.

Regulator attention: Ironically, the Federal Reserve released their financial stability report came out on the same day that this spiral began, and they specifically highlighted stablecoin bank runs as a risk. They are going to use this as a way to be like “crypto bad” which could be harmful for the space

Crypto ecosystem: Remember, this was supposed to be safe. So there were a lot of funds, people, etc that had their money in UST just like you would a savings account. This will have lasting consequences.

Human lives: Losing a lot of money and the subsequent feeling of desperation is unimaginably difficult. There is a human cost to this.

This could have long lasting impacts for the space, and a lot of people lost a lot of money. The biggest thing will be how things move forward - and the lessons learned.

More Monetary Policy

Do Kwon, Fed Chair; Jerome Powell, also Fed Chair.

Bank runs are the entire reason that the Federal Reserve exists, which is why I am personally interested to see if there will be some sort of entity that rises from this for the crypto ecosystem that acts similar to the Fed.

Also, lots of people dunking on the relationship between the actual Fed and crypto. The Fed is sort of like the blaring bell of Hope and Fear, and right now, it’s flashing Fear. They have a weird power that permeates all markets because They are Perceived to Be The Liquidity.

Brief History on the Fed

The Federal Reserve came into existence after the Panic of 1907, which coincided with the San Francisco Earthquake. Panics were occuring every 20ish years or so, where people would run on the banks, take all their money, and in general, Freak Out.

In 1907, the Knickerbocker Trust Company went bankrupt. The earthquake leveled SF. And no one could get the money they needed!

JP Morgan was like “omg ENOUGH we need a central entity in here to manage this stuff.” And Senator Nelson Aldrich was like “you’re SO RIGHT we need an entity to lend money to the banks so these bank runs stopppp because its so bad for the economy”

In 1913, the Federal Reserve Act was passed and now we have a central bank that would be independent from the government through 12 regional (decentralized) locations.

The goal was to keep the Fed insulated from both markets and politics and to let them decide on inflation, employment, and long-term interest rates.

Now

Monetary policy is basically vibes at this point.

The Fed nudge nudges the market around to achieve their mandates of price stability and maximum employment.

Right now, inflation is very high.

The Fed knows this. They raised by 50 bps last week in order to help chill things out, and seemed to be hopeful that inflation had peaked (and it might have in terms of PCE?).

But mechanically - The Fed raises rates through nudging around the Fed funds rate, which is the overnight lending rate between banks.

They do this through the discount rate, reserve requirements, and open market operations - increase the discount rate, increase reserve requirements, and sell treasuries to pull money out of the system.

Basically their whole goal is to make it more difficult for people to get money.

“Calm down the economy” is what the Fed is trying to achieve through pretty direct intervention, both mechanically and semantically (every time one of them gives a speech, that’s monetary policy!!!!)

But there is still a long way to go.

The CPI print came in at 8.3% versus 8.1% expected yesterday - but was lower than the 8.5% from last month.

Driving most of the increase in costs was airline travel, food, new cars, and owner’s equivalent rent.

The market is now pricing in ~75 bps of hikes for June. Dudley is calling for the Fed to hit the market with a rate hike hammer. But -

Its dominoes, just like UST. And the Fed had many headwinds -

Leadership challenges: The Fed didn’t hike last year because they didn’t know who would be in charge. Which is a systemic failure, in my opinion.

Weird world: And a literal land war erupted in Europe! Imagine making policy around that.

The world is weird, so markets are weird.

So now we have mega inflation that is sticking around longer than people thought, and the worry is that if the Fed slams on the brake, the whole economy will crash.

And just like crypto, the more FUD and fear around the Fed potentially mistepping (before they even mistep) causes a larger selloff.

We often make things worse for ourselves by existing in a framework of fear - markets recover, innovation continues, and humans continue to do cool things. I know it’s not easy - in fact, it’s incredibly difficult.

It’s kinda silly that the economy doesn’t march along, but human emotion doesn’t just march along - we feel sad, happy etc - and the economy (stock market too) prices out our emotions.

The market will recover, normalize, get better, eventually probably. But it’s not a straight line of progress, and we’ve had an absolutely absurd run over the past year.

And I think for a lot of people -

Compound interest is the eighth wonder of the world for a reason. This snowball effect - things piling into itself - whether that be fear, anger, hope, FOMO etc is all exacerbated by the human condition, causing compounding impact.

And that’s true for stablecoins, the USD, Do Kwon, Jerome Powell, and ourselves.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Terra is also sponsored by the Washington Nationals, the baseball team. The Fed should consider a similar partnership.

how does one correct an error that has manifested in the collective mind as a false security for over 100 years? one doesnt. the "weird" stuff usually brings out the real stuff.

Hi Kyla, I posted this on Joseph's twitter but I'm sure you are equally capable of answering! Just looking for a bright mind to bounce an idea off of... :)

Curious as to your opinion on the best policy response to the current inflation that we are seeing. It seems that it is likely the result of:

1: Increased AD from increased savings as a result of accomodative fiscal policy during COVID

2: Decreased AS from increased transportation costs, lead times, etc.

3: Decreased AS from increased fuel costs from Russia's invasion of Ukraine

?4?: I'm also wondering whether there has been a significant positive effect on AD from frothy markets (crypto, stock market) increasing the value of people's savings and leading them to feel wealthier and leading to more consumption.

What do you think the dominant effect is? I guess what I'm bouncing around in my head is whether I think the increased AD is more short term than the decreased AS and that by tightening the fed funds rate you are further exacerbating a problem that is playing out as higher inflation due to supply shocks. What happens when consumers burn through the helicopter drops of money and fiscal policy normalizes (which should happen very soon)?

Would love to hear your opinion!

Thank you!