This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Youtube linked here :)

Also, it’s long because of all the graphs (gotta have the graphs) so might be cut off in your inbox!

Good tweet:

What Happened in the Stock Market This Week?

Short week, but that doesn’t mean it was SHORT of fun

Stock market ended the week strong, with strength (finally) in tech, and general strength in energy, real estate, and financials. Every sector ended positive on Friday!

The best performers on the YEAR - lesson learned! Never bet against energy or steel - or luxury

AMC: Please Read My Thoughts Here

I did a whole piece on AMC so I won’t talk about it too much - but main thing is, it doesn’t make sense, it will never make sense, and it only makes “sense” if you separate valuation from stonk and realize that things are driven by things not being real.

Right now, GME is one of the best performing stocks in the Russell 2000 Value Index. But all that could change when the Russell rebalances, which could put a damper on the meme stonk party.

The rotation trade is the meme trade, after all

Market Movers

Hedging inflation: When asked how to hedge against inflationary worries, a lot of people recommend investing in Emerging Markets. But a recent paper came out showing that “EM equities are highly correlated to US stocks & high yield bonds, limiting diversification benefits”

Source: Factor Research Basically, you can’t escape the influence of the United States, so it can be harder to diversify abroad

However, they do outperform when the USD is depreciating, making it a good currency play

The largest MSCI EM index members will experience 50% population declines as well, which could put pressure on those countries in the future. The article also notes that this is “more from an absolute than relative perspective.” Europe and Japan have poor demographic profiles too, and the US has exceptionally high valuations “which typically leads to low or negative long-term returns”.

The article concludes: “Investing in stocks today is like being between a rock and a hard place, with the low-hanging fruit harvested a long time ago.” :/

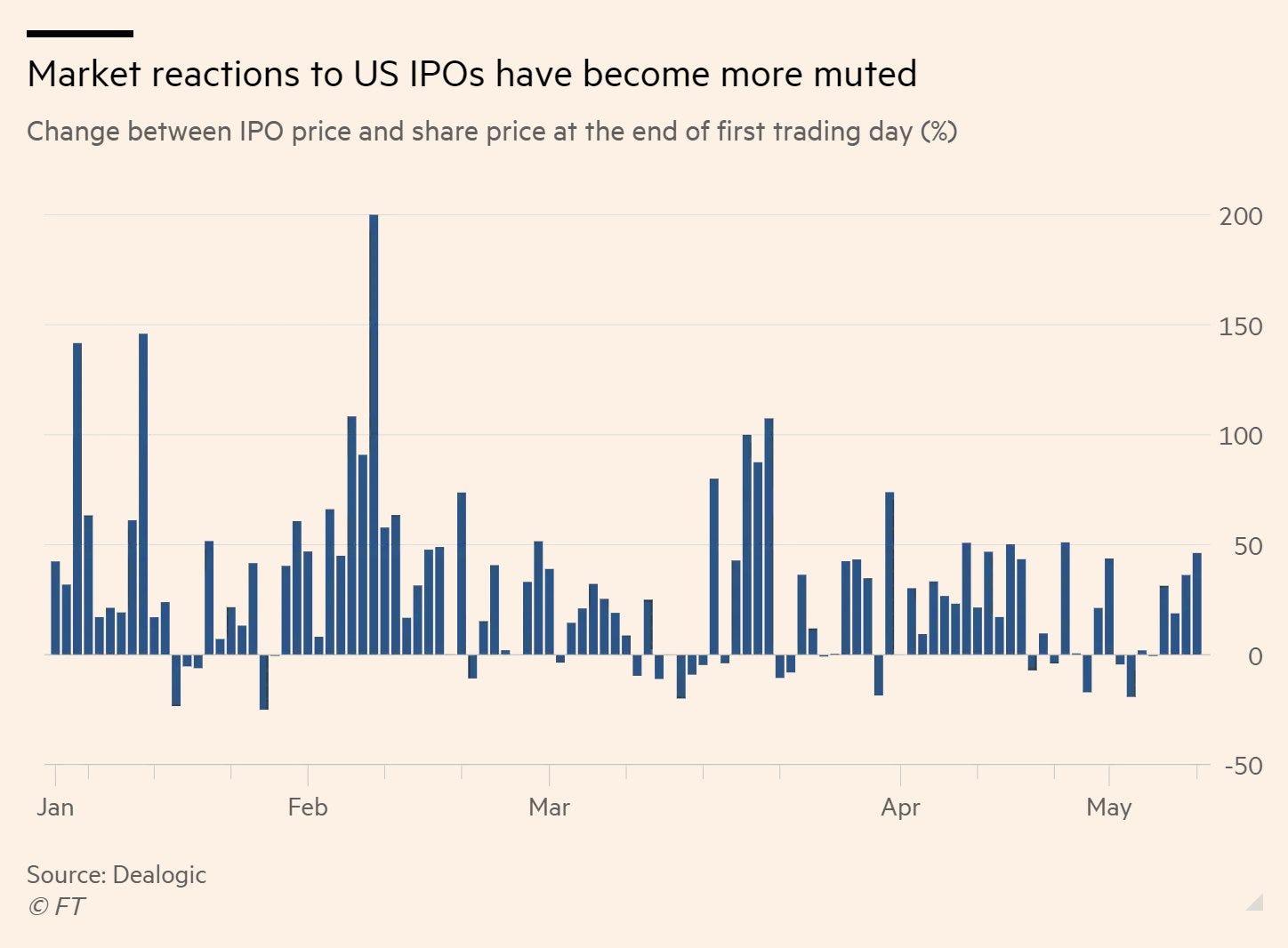

The market knows all: 'Investors are no longer falling over themselves to put money into US initial public offerings, reducing the chances that a company will be able to price their shares above expectations or enjoy a big share price "pop" on their first day of trading.'

My take is that the market has seen some stuff lately. IPOs are nothing compared to a meme stonk short squeeze and an NFT stockpile.

Where’s the meat? 1/5 of US beef capacity wiped out by another cybersecurity attack. JBS is the largest meat producer globally - so this is a big deal. I think we are going to see more attacks like this moving forward

(check out the podcast Hyperlinking Humanity episode that I have with my friend Grant for more cyber thoughts)

The Hard Collectables: Babe Ruth's 1914 Baltimore card, valued at $6 million, sold for a record price. The card market will be incredible over the next few years - we are going to see a lot of trading energy around physical assets soon (like we already saw with the Pokeman card run)

Source: Vice

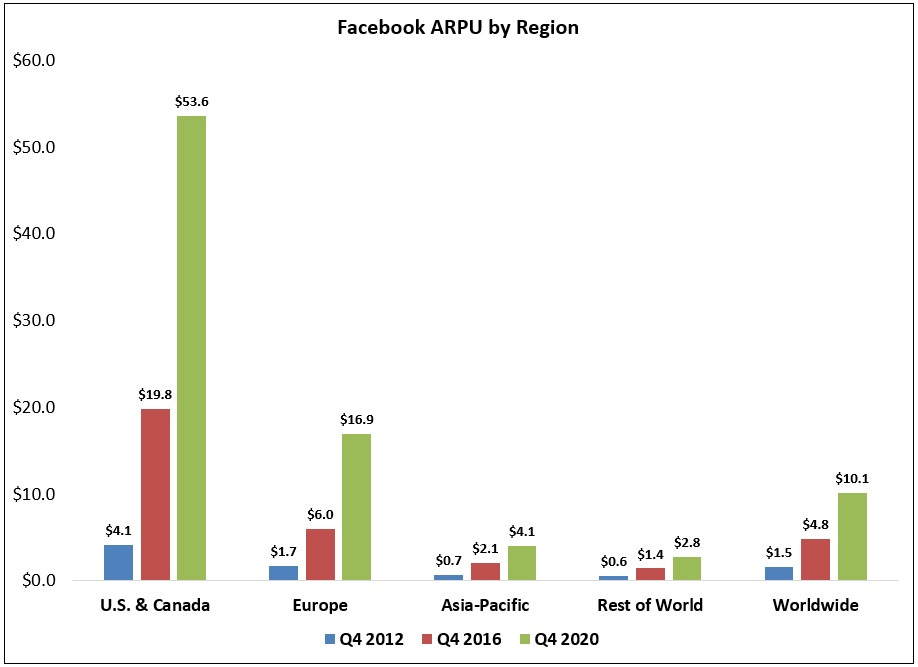

International vs Domestic: FB revenue abroad has been dominated by growth in the United States - but FB is still one of the most powerful companies in the world.

The second mouse gets the cheese: Ford is winning the Electric Pickup race - learning from Tesla. But maybe Tesla will just become a restaurant and stop making cars all together?

Source: Carl Q Ford the winner overall here - with their stock massively outperforming GM, Tesla, and NIO.

Speaking of Restaurants: Tesla might have some competition! CMG being an absolute banger “talking about $3-3.5M AUV (avg unit value, or revenue per restaurant) at Piper Sandler conference today. Its currently at ~$2.5mm, so this is a material increase” - meaning that their margins are going to be STRONG.

Costco is Disney World for adults

Economic Data

The Jobs

ADP payrolls were strong - “ADP May payrolls much stronger than consensus at +978k vs. +650k est”

But the U.S Department of Labor nonfarm payrolls were another disappointment, after a big miss last month.

A lot of people are just not going back to work, apparently.

However the market did not care! The miss in May Payroll showed the market two things:

The economy is not growing as quickly as we think it is - so inflation might not be as big of a worry as we *think* it is

Also, because inflation isn’t a worry now and the economy isn’t growing as quickly - the Fed can keep on doing QE!! A win-win, in the market’s eyes.

The Beige Book: There was a lot of discussion of labor market churn in the Beige Book, the Fed’s publication about current economic conditions across the 12 Federal Reserve Districts.

Also, a lot of discussion around wage pressures (higher wages as a response to the labor shortage) and the impact that supply chain disruptions will have on prices

PMI hits a record high. Lots of price movement for producers. Supply chain disruptions are hard to navigate, especially in the short term.

Economic Policy

The Fed IS TAPERING: Fed will wind down corporate credit facility says $5.2B in bonds and $8.5B in bond ETFs so about $13.7B total (not really material in the grand scheme of things). But the fact that they are starting this journey means that there is definitely more to come.

This quote from FT sums it up perfectly: 'It has never been about the actual dollar amount the central bank is buying or selling. Last year, the symbolism of starting up the facility was enough to revitalize the financial markets. Policy makers have to hope the reverse doesn’t hold true.'

Crypto

Bitcoin Miami is happening but…

It’s Ethereum’s time to shine: ETH has flipped BTC is some metrics!

Dogecoin listing: Dogecoin was listed on Coinbase, surges more than 25%, market cap to $54bn, so it continues.

Elon Musk tweets, Market Responds. Things are the same, but different, all the time, so. That’s really all I can say here.

What is the market pricing in?

Rishi had an excellent thread on this -

The market is pricing in rate hikes - but there is a disconnect as each is pricing in a different component of *why* rates should be hiked

Inflation is expected to be transient - rise then fall - but if it ends up NOT being transient, more hikes would be in our future.

Finally, the market is seeing things in “yes or no” - either we get rate hikes because things are INFLATING RAPIDLY or we don’t get any because the jobs reports continue to be bad, and the economy appears to not be recovering.

Next Week

The market has a lot to digest.

Earnings next week

Economic Calendar

Consumer expectations

CPI on June 10!

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Really helpful, thanks!