I was on Trillionaire Mindset this week! And on Compound and Friends last week, and also gave a presentation at MIT (just speechless at the support and opportunities - thank you).

If you’re an educator, and would like someone to come with mediocre drawings to talk about the economy, I would love to join your class!

Nature is cyclical, life is cyclical. It’s a series of seasons, spring, winter, fall, summer, repeat. Humans reflect these aspects of nature in how we live, cyclicality in the days, months, and years. Right now, reading this, you are the youngest that you have ever been and simultaneously, you are also the oldest. There is also an argument that everything that you are is everything that has ever been.

Off the soapbox - people are the economy. People are cyclical. The economy is cyclical. It’s something I’ve continuously repeated to myself the past few weeks as I’ve been traveling. I had a conversation with my Uber driver about the current state of affairs, and he asked me - “how could you be so jaded to choose money over people” when I was explaining the well-that’s-just-how-it-is-ism of the Federal Reserve.

And I haven’t been able to stop thinking about it.

I did a piece for Bloomberg Opinion on three main economic players - fiscal policy decision makers, the central banks, and the markets. The markets are increasingly dictating policy as we saw in the U.K. recently. We are seeing demands of austerity, and demands of reconciliation between fiscal and monetary policy. And of course the question is with these intertwined players - who is really driving the economic car?

Central Banks

The Federal Reserve is increasingly between a rock and a hard place. They are losing $80b a year (previously *earning* $100b) and of course, the Fed doesn’t exist to make money. But it’s another straw on the proverbial camel’s back. Everyone is getting mad at them.

There is increasing backlash to monetary policy - by political leaders such as Sanna Marin to Emmanuel Macron. And the question that these leaders are asking is the question everyone is asking - “why do we *need* to destroy the economy to fight inflation?”

In the United States, two senators - Sherrod Brown and John Hickenlooper - have openly come out to tell the Federal Reserve to slowdown, which is wild. The Fed is hypothetically “independent” (with a Congressional mandate) so this is… bizarre. But it shows how the interlinkage between policy makers is becoming more prevalent. Fiscal and monetary policy have never really been that separate.

And then there are critcisms of the mechanics themselves - long and variable lags to monetary policy… suck. That was one thing that I noticed in my interview with Mary Daly last week, is that the Fed is acutely aware of the constraints to their toolkit, but it’s very much “we are doing what we can with what we have”.

Fiscal Policy Decision Makers

The Federal Reserve needs supply side help. But whenever you bring up fiscal policy or government spending to people, they will often say “that’s not right, the government is up to its eyeballs in debt!”

If you pay taxes, you should want government programs to exist. That’s what the money is meant to go to. The government exists to govern (hypothetically).

If you exist within it’s regulatory bounds, there should be small cheers for certain types of decision making. Why wouldn’t you want the government to make life marginally better for some people? (of course, the question is the effectiveness of said policy and decision making, and that’s a whole different story)

There was a good FT article that talked about the supply side of the economy - how we don’t need to focus on tax cuts to boost supply, but rather we should reexamine the labor market, reform the childcare sector, redo immigration policy, build training programs, incentivize R&D, and focus on innovation.

Yeah! I think most people would agree.

But of course, the thin line between governance and politicking has gotten increasingly blurred as the U.S. goes into midterms - but supply driven inflation is a HUGE problem that the Fed cannot fix alone - it relies on fiscal policy.

And it also relies on *fixing * the problems we have. Right now, the Fed is just putting a band-aid on a gushing wound. Mary Daly even said this in our interview - the Fed is only “responsible” for 50% of the inflation we have.1Fiscal policy has to step up.

The Markets

However, the markets are demanding austerity, not only from policy makers but from companies too. As we barrel into an economic downturn (and come out of ~10 years of excess) this makes sense. But as Jon Sindreu wrote in the WSJ:

The return of austerity to the U.K. will hopefully mean the end of bad economic plans like Ms. Truss’s. Unfortunately, it will also tightly constrain good ones.

Same thinking applies to markets. Both the bad and good are drained in times of worry. Of course, markets are influenced by decision makers too - like index providers.

The Power of Index Providers

Tracy Alloway, Dani Burger, and Rachel Evans wrote a piece on the power of index providers - being put in an index “controls the the fates of companies’ and countries’ access to capital markets.” Providers “choose” what is passive - to the tune of $3b a day of inflows.

Market participants will mull just what the growing number of indexes, and the expanding sway of their providers, really means—especially when there’s a sense of unease that markets at record highs are being driven by investors chasing inflows rather than fundamentals.

Zuck and Elon

Basically, markets are dictated by individual actors as well - and index providers have an increasing amount of sway in all of that. And then you have individual stocks like Meta and (formerly?) Twitter that are basically now ruled by one guy.

Mark Zuckerberg is being punished heavily by the markets for going all-in on the metaverse, something he clearly thinks will make money. He’s put up an immense amount of personal wealth (and when you have infinite money to lose, why not?). When criticized on their recent earnings call, he said “I think those that are patient and invest with us will end up being rewarded”

But patience has a price.

The Stock Market is not the Economy

I made a TikTok about the Exxon CEO saying that dividends were how they were returning excess profit to the American people, and of course, people were in the comments saying “well that’s Exxon’s profit 😡 and they deserve to keep it!” As I say “you can’t have green energy policy without green energy investment” and that’s reflected in continuous investment in fossil fuels (and the accompanying subsidies).

Price gouging is a whole other thing (and yes, it applies to healthcare and pharmaceuticals, everything that scrapes money out of people right now) - and truthfully deserves it’s own piece.

Of course, profits are necessary to keep businesses going - Exxon simply won’t do business if they don’t make money. Lots of people do own Exxon in their 401ks (outside of ESG mandates) so people *do* benefit from the dividend

So it’s a nuanced and weird argument where you have Incentives butting up against Ideology and that’s always a sticky place to wade into. But the top 1% of Americans own ~50% of the stock market, the top 10% own 89%, so there’s more that can be done in the distribution of assets - and dividends probably aren’t the best way to reach the American people.

A lot of people conflate the stock market with the economy - and when you see a huge selloff in big tech, it’s like “oof okay things are BAD”. The economy is the stock market - the big tech firms are reflecting macro-woes from lower ad spend, cutbacks in consumer spending, and general uncertainty. However, the stock market might be a mirror to the economy, but the economy is not a mirror to the stock market.

GDP came in higher than expected at 2.6%, driven by spending and exports, and was heavily weighed down by residential investment and private investment.

The Federal Reserve is clearly slowing down the economy in some parts - housing specifically - but there are worries on how long consumers can hold on. Exports will likely be decimated by the stronger dollar moving forward, so the pluses for GDP growth are coming under increasing pressure.

The employment-cost index rose by 5% in Q3, which underlines the tight labor market - but wages didn’t rise *as fast* as Q2.

So the Fed probably isn’t stoked about these two things. The softer labor market isn’t manifesting as quickly as they want. And there are arguments that the 3.5% unemployment rate isn’t inflationary - it wasn’t inflationary in 2019! The economy is still strong.

But the Fed wants *softening* now - and patience has a price, right?

The Fed will have to keep hammering with the rate hike tool in order to cool off the entire economy, so inflation comes down. It seems like they are going to slow down in December according to Nick from the WSJ - but going from 100 mph to 80 mph is still pretty fast.

Final Thoughts

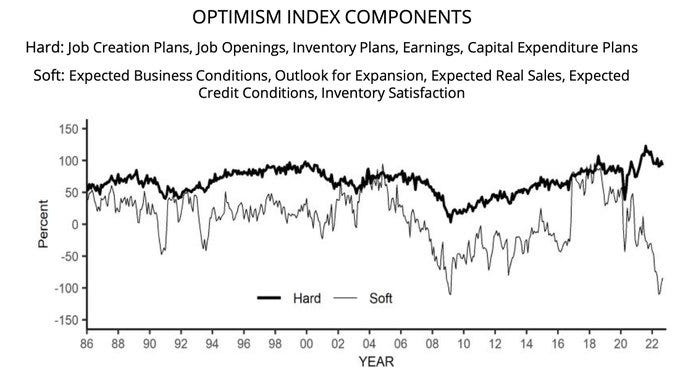

People are still feeling okay. Expectations of business owners are positive in their *decision making* but not quite in the expectations that they report.

I think the “I’ve been hearing rumors” economy is quite strong. Consumers are okay, credit-wise. Social media is an economic forcing function in its own right. But people are of course still struggling.

There is a quote from Ro Khanna

If you have an economy that is shaky because you have both inflation and a looming threat of, if not recession then declining growth, the only thing that can actually tackle both of those phenomena is an increase in productivity and increase in production

I think the biggest thing is that the Fed is doing what they can with what they have, but slamming the economy into a brick wall isn’t maybe the best solution (as so many have said). There are a lot of interesting things that we can explore to boost productivity and production:

Labor allocation policies that allow for immigration expansion (Byzatine immigration powered the Renaissance!), working parents support, support for people with disabilities, etc

Continuous investment in traditional fossil fuel sources (with some managment around how profits are reinvested into more sustainable sources2) This ties into other supply issues, like housing affordability, etc.

Focus on community building. I think a lot of our current issues stem from a lack of connection and empathy because people don’t really see each other. The American suburbs are necessary (and people should live there if they would like!), but they are also inherently isolating. I do think some of our political fracturing is because we simply don’t connect with a broader community.

There is a poem by John Hegley that I like -

Is there any body out there?

Have you got ears for this?

Have you got osmosis?

Do you ever say ‘to be honest’

Do you ever say ‘for my sins’?

Or are sinfulness and honesty

where another world begins?

Do you wear a pair of glasses

for maybe you have eyes.

Do you start off small and increase in size

but lose your sense of wonderment in the process?

Do you have those things on tube trains,

I don’t know what they’re called

do you have things in your world that you haven’t got a name for

is it the stars you aim for?

Do you ever get appalled

if your brand new central heating

has been shoddily installed

by a bunch of cowboys?

Thanks for reading.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

One could argue that the Fed is responsible for all inflation because of their price stability mandate, but I think nuance is important here

I recognize the skewed incentives here

I saw Kyla’s MIT presentation - every bit as good as you might expect. The drawings are also much better than she advertises.

Thanks for another wonderful view of our complicated world from your brilliant perspective. I shudder at the finger-pointing and fault finding by so many as to why we have the inflation dilemma that faces us right now. I too love the idea of continuing to invest in fossil fuels while continuing to nurture ESG future sources.