Evergrande: Tip of the Debt Iceberg

fund managers, contagion through exposure, and the ~system~

This is an update on the Evergrande story with more information about the funds that hold it and the systemic risk that it poses - with the underlying point being it’s not so much about contagion, but more so about exposure.

Youtube here (note, this piece likely cut off in email)

Evergrande and Contagion Risk

Last Thursday I wrote about Evergrande and Lots of Debt - I wanted to follow up here with a piece that goes more in-depth on the potential ramifications of this (if any) and general market technicals that become very noticeable when events like this happen.

I will talk about:

What are the potential implications?

Risk to China

The Burn of a Slow Fire

The Role of Wall Street

Not Lehman 2.0

What is a solution?

Final thoughts

The TL;DR of the last piece was that:

It is highly unlikely that a financial crisis is going to unfold on the back of Evergrande. This is probably not Lehman 2.0, mostly because China can step right in (update: they did) and restructure the situation (literally and figuratively). All of this has been expected for a while now - it’s more like a slow fire burning vs someone lighting a match all the sudden.

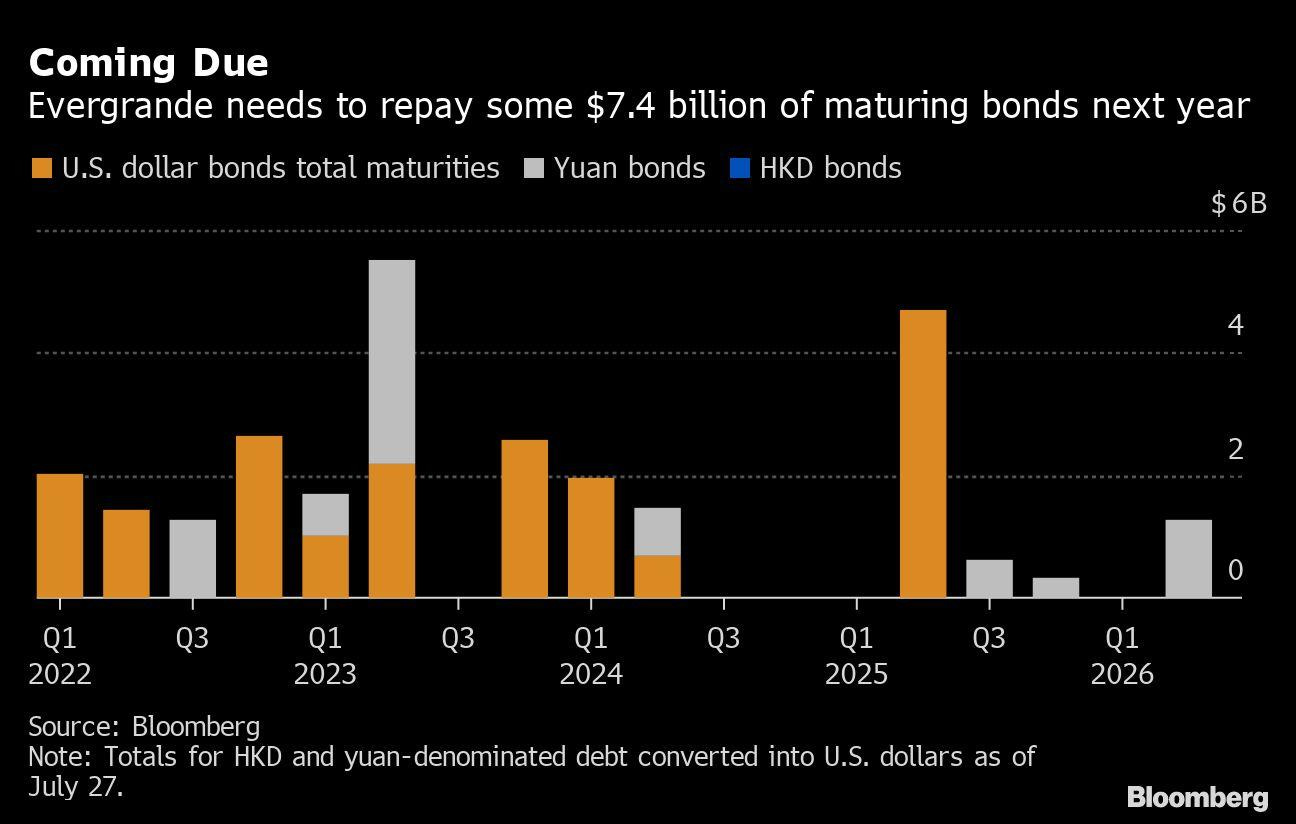

The big question is what will China do? Will they step in? Will they use Evergrande as an example? What does that mean for future credit unwinding? I think that there is a belief that the government will step in - and they have to a certain extent - with the main goal of showing the power of the CCP. But the shakeout here could be impactful for not only the Chinese property sector, but also for the debt bubble across the world.

But the question is how much exposure is there in U.S. markets? And narrowing down even more - how much *unnecessary* exposure is there? Even if the situation shakes out to be a wash across the board, there is still a problem of systemic risk here.

Everyone is still on the fence as to what Beijing will do.

S&P said “We believe Beijing would only be compelled to step in if there is a far-reaching contagion causing multiple major developers to fail and posing systemic risks to the economy”.

Citigroup has the opposite stance - “Policy makers will likely uphold the bottom line of preventing systematic risk to buy time for resolving the debt risk, and push forward marginal easing for the overall credit environment”.

The main point here is that if Beijing does see contagion, they will step in. They are not going to let this implode. This has a few different implications.

What are the potential implications?

Just one example: Evergrande is offering wealth management investors (those who hold the wealth management products from their “internet finance affiliate”) the chance to redeem their losses with real estate

(aka Evergrande has no cash to give them)

If you’re one of the many that own the $6b in outstanding wealth management products, you can redeem your investment for an office space or a car park (yikes).

These wealth management products (WMPs) like Evergrande offered were/are VERY popular in China. According to Bloomberg:

"Alarm bells are ringing as Chinese citizens keep pouring their savings into wealth-management products, a market that has tripled to more than $4 trillion in a little over three years… The outstanding value of off-balance sheet WMPs stood at 22 trillion yuan ($3.3 trillion)... equivalent to 24% of China’s GDP”

This is super messy because there is now a multi-trillionaire market that they have to wade through and potentially restructure.

Evergrande will have an impact on the holders of these wealth management products. Real estate is not cash. You can’t return your product to the store, and have the store offer you physical real estate in return.

Evergrande risk is also bleeding into other real estate and property companies (also overleveraged) and the iron ore sector (if Evergrande goes down, so does demand for commodities)

Despite that, the main takeaway is that contagion across all sectors isn’t showing up yet - just macro weakness (internal contagion) due to poor fundamentals and impending failure from the second largest player in the space.

But the wealth management fallout could be interesting from a consumer confidence perspective.

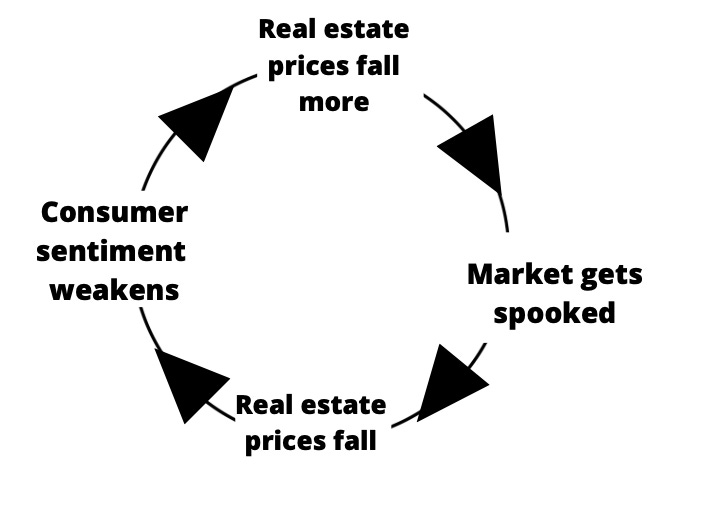

Like I touched on in the previous piece - consumer sentiment is often a core driver of performance - if people are afraid, they aren’t buying. And as others have highlighted, if consumers stop purchasing real estate (a big part of China’s economy) that could create the crux of the problem.

The impact of declining consumer sentiment in China could be an element of contagion risk that everyone is already talking about.

Risk to China

Beyond that, real estate is ~30% of China’s GDP, so a collapse in Evergrande could send shockwaves, sure. But the housing market has been shaky there for a while now, and stability will come at a cost. As the FT highlights:

Evergrande’s woes highlight the property sector’s importance to China’s financial system, but its weakness and those of hundreds of other developers in China would also have profound consequences for the wider economy.

The Bloomberg China HY USD index is 66% real estate - meaning there is some risk of downfall across those companies if Evergrande implodes. But on aggregate, things are relatively stable. Bond spreads across the board have not widened - meaning that they aren’t pricing in any extra risk or uncertainty.

Think of bond spreads like a heart rate. Everyone has a resting heart rate, and the more you deviate from that baseline (here bonds deviating from their benchmark) the more stressed you are (the more stressed the bonds are)

Wider spreads = more stress

This isn’t *really* about Evergrande, it’s about a very overleveraged, debt-laden industry which is the opposite of what Beijing wants. Beijing recently released their Common Prosperity plan, which essentially funnels the wealth from the very rich back into the rest of the country.

For example, in Zhejiang, according to Reuters:

China's wealthy eastern province of Zhejiang, which is a "demonstration zone" for common prosperity, also announced Thursday that by 2025, rural residents should have on average annual disposable incomes of 44,000 yuan per year… compares with average nationwide rural disposable incomes of just over 17,000 yuan in 2020

The government is going to shape the economy into what they want it to be. And Evergrande likely will not mess that up.

The Burn of a Slow Fire

Evergrande has been on the radar for a WHILE. This is not new.

In 2018, the People’s Bank of China singled out Evergrande, Fosun, HNA, Tomorrow Group in their Financial Stability Report as companies which control multiple financial intermediaries as well as have a lot of debt - so people have known about the Evergrande situation for a while, and it’s not a *surprise* that it’s heavy with debt and bogged down with illiquidity. With that, the PBOC is moving on it - they injected into the system recently, the most since Feb 2020.

The main concern is the exposure in other countries and banks (Evergrande is tied up across 128 banks and 121 non-banking institutions), which can get a bit messy.

Vanguard, BlackRock, and many other fund managers, have exposure here.

The Role of Wall Street

This exposure “makes sense” (more or less) as Evergrande is a big company - it has a huge market cap, so of course it’s going to be included in a lot of funds. ~$88bn with exposure to the Chinese real estate market and more? Perfect.

The overall exposure to Evergrande in individual funds is paltry in comparison to Evergrande’s debt (and very undersized compared to both of relative total exposure fund managers have to China) but still interesting in regards to the idea of contagion risk again.

Contagion risk here is the general *exposure* through fund managers

The inclusion of companies like Evergrande in broad EM index funds means investors are often inadvertently overexposed to this volatility and systemic risk.

Any fund based on MSCI or FTSE EM indexes will have exposure to Evergrande and overexposure to China in general, which gives weight to this idea of contagion risk - where exposure in funds is the contagion

And its getting worse - MSCI has increased China flows over recent years, 4xing their A-shares exposure.

There is still an element of risk with the fact that there is systemic volatility.

The Chinese government cracks down extensively on companies that don’t fit the bill of what they want it to achieve

Which means that investors are exposed to the whims of the crackdowns

The losses happen because of that - because the government could crack down on anything, at any time

This is harmful to investors for a few reasons:

Pulling from my China Crackdown piece:

The SEC has a paper on it - “more than 150 China-based companies with a combined market value of $1.2T were listed on US stock exchanges at the end of 2019.”

Why is this a big deal (according to SEC)?

Fraud: “limits on credible standards in corporate governance, the risk of insider dealings, market manipulation and other misconduct increases” - all the usual

Volatility: Mainland China is dominated by retail investors - they have shorter holding periods, basically it’s just a toned down version of January’s GME.

Corporate incentives: “In companies, Communist Party organizations shall...be set up to carry out activities of the Party.” The incentives are the companies are definitely not to “maximize shareholder returns”. State interests before shareholder interests.

Accounting practices: More than 80% of Chinese bond issuers are rated AA and above- which doesn’t *really* work. Not everyone can have that solid of a credit score. And that is often the problem - there are a lot of undisclosed risks.

Lack of hedging: there are not a lot of ways to protect your downside here - and China said that derivative products led to their 2015 market turmoil so :-/

National security risk: There are companies in the indexes that are considered “entities” by the US government so basically they are leaving the door open and complaining about the rain getting inside.

So when you look at the holders of Evergrande’s bonds, it becomes a more than meets the eye sort of story.

Ashmore has the most exposure to Evergrande specifically, but sizing here isn’t the biggest point - it’s general growth of exposure in the space - and it sure is growing!

Blackrock just raised $1bn to set up a mutual fund in China through its Chinese subsidiary, increasing their exposure to China even more.

This clip above is of Ben Powell from Blackrock, talking about how “The Evergrande crisis may bring bankruptcy and investor loss, but in the long run it could lead to more efficient allocation of capital” is a fascinating look at how they think of this exposure -

It’s a recognization that there is risk in China (which is inherent in any market)

China is moving towards more risk-based pricing

Which essentially means that market is starting to come into the risk that Beijing can’t hide anymore

42% of banking system assets in China are associated with the property sector - so this is more about the overall exposure and the risk that underlies all of this.

Even though the broad situation is risky for the property sector and potentially financial institutions (depending on how this shakes out), it’s still important to highlight that this isn’t going to be the next big global meltdown - however, it could start tipping dominoes in that direction.

Not Lehman 2.0

The reason that this is not Lehman 2.0 is for a few reasons:

These are assets, not levered structured products (as far as we know) - The problem with Lehman was that they had a bunch of stuff wrapped up, and some of that stuff was really bad. One really bad thing makes the entire thing really really bad - and multiply that by 100x.

IT IS JUNK - It’s been iffy for a bit! As Sri points out here, Lehman was wrapped up in investment grade credit. The market has priced in some element of default for a while with Evergrande.

Lehman was exposed across the entire economy as a point of funding and through sitting on the balance sheet of other companies - Evergrande is an iteration of that, but not nearly as extreme from a traditional contagion perspective.

This is imploding within a command economy - The Chinese government is still able to keep most risk wrapped - but that model is going to change moving forward (which is apparently why Blackrock thinks it’s a good time to invest there)

This is a slow train colliding - The government has been keeping tabs on Evergrande since 2018. So none of this is a surprise.

But with all that being said, it’s hard to price out contagion risk, especially with somewhat murky accounting like Evergrande has. A lot of stuff either exists

Off-balance sheet in the shadow banking system

And then disappears through different accounting standards.

And U.S. funds aren’t pricing in that underlying risk.

Think back to the delisting bill - it gives Chinese companies 3 years to comply with U.S. listing mandates (note, 3 years is a long time). But the goal is to standardize some of this uncertainty and clean up some of the unknown.

But in the meantime, investors are exposed to this sort of bankruptcy and loss. These usually end up being large tail risks due to government policies that incentivize debt driven growth with murky book keeping - and they tend to hide these issues until it's essentially too late.

What is a solution?

BROUGHT TO YOU BY:

Freedom weighting. Perth Tolle and the FRDM index solve the above problems of (1) contagion risk that arises murky accounting and and (2) the prioritization of state mandated debt driven growth above shareholder interests by investing in countries that prioritize personal and economic freedom. You can free yourself from benchmarks with the autocracy drag and get rid of distorted concentration.

FRDM is the only EM ETF with no allocation to China without having a specific mandate to exclude it. The exclusion is a natural result of freedom-weighting methodology.

Here is the thesis:

Freer markets grow more sustainably (not debt-driven pseudo growth)

Freer markets recover faster

Freer markets use their human and economic capital more efficiently, which leads to less capital flight and far less capital destruction

The Life + Liberty Freedom 100 Emerging Markets Index is a freedom-weighted EM equity strategy that uses personal and economic freedom metrics as primary factors in the investment selection process. $FRDM index

*This is not investment advice. See https://www.lifeandlibertyindexes.com

Final Thoughts

The stock market didn’t fall earlier this week because of Evergrande - it fell because the Fed will potentially begin to taper, which will definitely spook the markets. The Treasury Department is also severely flirting with the debt ceiling, which is Janet Yellen said could lead to “widespread economic catastrophe”.

There are a lot of mini-Evergrandes in the system

A lot of companies that are running solely on debt fumes

Evergrande is just one example of a very leveraged company, cratering once their trajectory shifted downwards.

The contagion risk here isn’t necessarily Evergrande failing - it’s the other Evergrandes that are embedded into the system

This is also a prime example of news spooking the markets. Evergrande has been on the radar for a while, with risk that was prevalent and essentially unavoidable with the China Real Estate bubble. It is highly unlikely that Evergrande is Lehman 2.0, but the shakeout could spell out other things for a global financial system that has relied on cheap financing and levered growth hacks.

If the Fed tapers (which they will likely do (maybe at some point?)) that will potentially lead to more shakeouts of companies that have relied on easy money for growth versus actually having a sustainable backbone of fundamentals.

Fund managers have outsized exposure to China, a risky space that is becoming less and less stable in terms of direction of stocks, and more and more volatile. And fund structure - endowments, pension plans, 401ks, the broad EM indices - are all apart of that. Overexposure to uncertain risk.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Freedom Weighting sounds interesting, I'm gonna look it up. Thanks!

this could be seen later on:

https://finance.yahoo.com/news/bank-china-oversteps-regulations-passing-093000146.html

China's commercial banks have sold financial derivatives packaged as wealth management products that slipped through regulatory cracks, giving individual investors access to risky foreign commodity futures contracts, according to several bank officials familiar with the matter.