Getting POW'ed

The labor market, trust, quiet quitting, and Fed moves

the labor market and distrust on the micro and macro stage

Beginning with Zoltan

Zoltan published a pretty intense piece this week titled “War and Industrial Policy” with big takeaways around the world’s main transitions over the next few years -

Re-arm (defend)

Re-shore (get around blockades)

Re-stock and invest (commodities)

Re-wire the grid (energy transition)

He dove further into the importance of commodities (which have been underinvested in, as we can see from the energy crisis in Europe), nationalism, and insensitivity to interest rates - essentially, a changing world.

Basically, because trust has evaporated from all corners of modern society, people are going to start duking it out because things are inherently unstable.

Which isn’t great! The thematic of domestic protectionism has already shown up in things like ‘friendshoring’ and OPEC+ cutting oil production - in a world of scarcity, there is a difference between friendship and alliance as I wrote about in Changing Economic Regime.

But I wanted to explore this concept of a changing macro on a more micro level - from the level of workers, who sort of get chucked around in these broader conversations. I think there is something really interesting happening with *how* people work, and how distrust shows up in workers.

Quiet Quitting

What a term, this quiet quitting is! It’s the idea that people are going to work their entire job and nothing more - clock in when they are supposed to, leave when they are supposed to, and do the work they are supposed to. Victoria had a great take on it -

Aspiration mismatch: This concept makes sense - a lot of people don’t really want to be managers according to a survey from HBR.

They just want to collect the paycheck and go home- they are “content with the role that they have”. Which like - yeah! That’s completely reasonable. Life isn’t work for many, and that’s a good thing.

Cup overfloweth: Numerically, there is probably a productivity surplus (at least on the margins) from people that *do* want to scale that corporate ladder - who are willing to grind the grindstone.

The HBR piece shouldn’t be used as “No One Has Ambition” but if all the sudden people are like “no thanks, medium work for me”, does that have an impact on the broader success of firms? How much of overworking’ vs ‘quiet quitting’ are firms able to take on?1

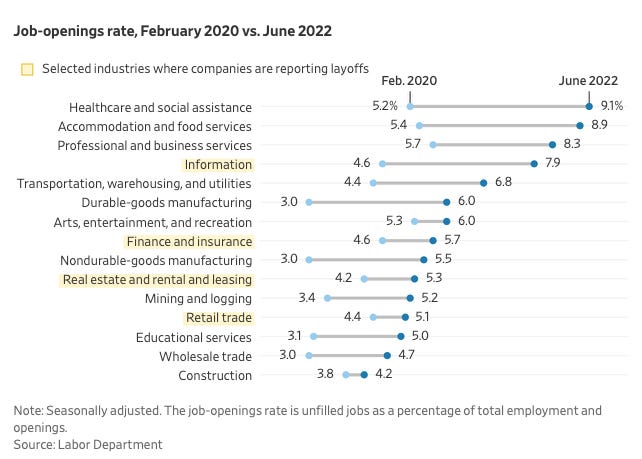

The labor market is strong right now, enabling elements of this ‘quiet quitting’ as Victoria highlighted. There’s a mismatch in strength though - companies want to hire, but really can’t find qualified workers. So, people (especially qualified people) have more power in employment. The Fed manufacturing surveys highlight this -

From the Philly Fed survey -

The firms continued to indicate overall increases in employment and widespread increases in prices paid and received.

From Kansas City Fed -

On the other hand, the employment index remained moderately positive, and the finished goods inventory index increased slightly.

From NY Fed -

Employment is expected to pick up and delivery times are expected to decline over the next six months.

The labor market is doing okay right now, giving workers more power in the conversations that surround their work - which is a good thing.

Workers are demanding more, in more ways than one.

Because of the changing labor market, it seems that people are discovering their human value as well as the monetary value of their work, but there is still an underlying passion crisis fueled by broader distrust.

Human value: The WSJ published a piece examining how people that lost their jobs are very quickly able to find new - and better - jobs. We’ve seen a lot of turmoil in tech employment but “labor demand is still strong… there are nearly two job openings for every unemployed person seeking work”

Monetary value: The New York Fed published their Labor Market Survey data this week, which included the reservation wage, the lowest wage at which respondents would be willing to accept a new job - and expectations increased across the board.

People want more money for the work they are doing. The reservation wage ticked up from ~$68k in July 2021 to $72k in July 2022. In the face of ripping inflation, this makes total sense.

What *is* your value? There is a good paper that explores how people don’t really know their value on the labor market, highlighting "if workers had correct beliefs, at least 10% of jobs, concentrated in low-wage firms, would not be viable at current wages" which is !!wow!!

Passion Value and Choosing a Major - Even in college, salary is the main focus (which of course, makes sense). In college, there is much more demand from students for STEM and medical majors, with people turning to these degrees in the hopes to land a solid job - which isn’t always how it works. Ben Schmidt wrote about this in The Humanities are in Crisis and points out impacts of this -

Decline in culture - Gen Eds exist for a reason, and it’s so people can have a well rounded education. I am firmly in the camp that we learn more from literature than we do from anything else. Ben underscores that the rotation away from humanities might not be a great thing for American culture (which is probably more subjective than objective, but it’s an interesting point).

Increase in ‘for the money’ - Ben also explores in the piece how choosing a major doesn’t really impact earnings down the road (at least, on the margin) - which is sad (?) because it seems that most people are choosing majors in order to be marketable to the job market (which makes sense) - but it doesn’t really turn out that way (unless you’re majoring in something highly specific like pre-med, of course).

I think one thing that strikes me about ‘Quiet Quitting’ is the clear lack of passion for the work, which again makes total sense2. A lot of jobs don’t really have things for people to be passionate about - but is passion disappearing entirely?

I wrote about the Passion Crisis a few months ago -

We need more opportunities to explore, but in a safe ? way. Which is hard, right? Like no, you really *can’t* major in Underwater Basket Weaving because like your skills have to be in demand, and that’s a whole different thing and I don’t know the answer to that. Our passion crisis is broadly a function of tapping into the uncomfortable parts of ourselves - in order to find out what you love, you have to be vulnerable. You have to care - and caring itself is an act of rebellion in a world that seems to constantly want to put you down.

And the debate of “do work you love” is an endless loop with no answers, but I think it’s interesting to reflect on how many people don’t really know what they care about (which is okay!) but how that might show up in a broader nihilism and distrust of the world that they inhabit - which circling back to Zoltan’s piece, is reflected in distrust in general showing up in broader macro thematics.

To be clear, I don’t think lack of passion for work means lack of passion for general. Anecdotally, a lot of people around my age (22 - 27 let’s say) don’t really have passion for *work* - they have passion for *life*. But there is also a group that has passion for neither - and a lot of distrust institutions - and that’s important to reflect on.

Now to the Fed

The Fed had their big Jackson Hole meeting this week which markets hated -

The main takeaway was “yeah, we are going to keep raising rates lol”. But Jerome Powell did directly address the labor market, highlighting that some softness was going to need to appear as they battle inflation. They are going to cause some pain.

He also highlighted this concept of ‘rational inattention’ which is people paying attention to inflation when it’s really high - it takes up their time and brain processes, which is also something that the Fed has to battle in the form of inflation expectations

And the Fed is very very focused on fighting inflation - as Jack Farley pointed out, Powell said “maximum employment” ZERO times in his speech - it’s all about inflation right now.

Of course, the old debate of “is raising rates the right tool to use here” comes up - and the answer is yes, if you want to burn the house down to kill a spider. Would it be better to ethically capture the spider in a cup and let it loose into the wild? Yes. But if your main goal is simply spider eradication - there are a lot of ways to that.

The Fed is sort of on the path of burning the house down. They don’t want to be wrong again. However =

Fed can’t fix supply chains: The NY Fed released research that highlighted that “inflation in the U.S. would have been 6% instead of 9% without supply bottlenecks” - Fed can’t fix that.

Companies are also passing off costs to consumers: The NY Fed3 also wrote a good piece on how wages (due to existing inflation) and import prices (due to supply chain bottlenecks) are driving inflation because firms treat them as a pass-through costs to consumers - Fed can’t fix that

They also can’t fix globalization or lack of oil: The WSJ wrote a good piece analyzing how a lot of the forces of inflation are mostly outside of the Fed’s control - things like globalization and energy costs.

Dollar strength: Then there is a whole conversation to be had around the strong dollar (a function of Fed hawkishness which could influence the Fed path) and the impact it has on emerging markets as well as domestic corporations.

The Labor Market Impact

Zooming back into labor - corporations seem to be getting ready to respond to a weaker conditions, with a PWC survey finding that 50% of companies have reduced headcount and 40% are rescinding job offers.

So a lot of it is confusing?

How can the Fed beat down the labor market when there are jobs that need to be filled? And will them doing this result in a reallocation of labor or people leaving the workforce entirely? Does the fact that student loan debt forgiveness happened and the structural changes to how students take on debt incentivize more people to go to school, and how does that impact the broader market?

But as Brian points out no real pain has happened yet in the labor market.

The Fed could be all bark and no bite until we actually see softer labor numbers - but for now, they seem to be intent on a bit of arson.

Final Thoughts

My TikTok comments are my main sentiment indicator, and someone commented that they were pretty frustrated with a group of people (the Fed) gathering in Jackson Hole to essentially cast a spell on the economy - it felt removed from reality.

I think there’s an element of truth to that.

I mean, they are a central bank so it’s a centralized decision making process but some of the unintentional theatrics around it (as I wrote about last week) can make it feel like we are just puppets on an economic stage (which, to be fair, we kind of are).

I truly think the Fed is doing the best they can with the tools that they do have - but as I and many others have written about before, their best might not be good enough here. I think using the labor market as a tool is of course an economic necessity for what they *can do* - but it’s a tool that has long lasting morale consequences and enhances distrust in a world that is increasingly losing trust in everything.

Neil Hilborn is one of my favorite poets (his stuff is brutal) and this excerpt from his poem This is Not the End of the World feels connected to this piece on the labor market and worker value and etc etc - how we often lose humanness in the metrics.

Isolation is not safety, it is death.

If no one knows you’re alive, you aren’t.

If a tree falls in a forest and no one’s around to hear it, it does make a sound but then that sound is gone.

I’m not saying you will find the meaning of life in other people,

Im saying other people are the life to which you provide the meaning,

Thanks for reading.

TikToks this week

What is This

I also updated my about page for some more clarity on how this newsletter is structured and what I am doing right now. My goal is accessible, fun economics education for current and future generations.

I am doing two things right now

Company: Building a financial education company, Bread

Bread is my company to build with and for this audience - bringing accessible and trusted financial information, tools and self-empowerment to a digital generation.

Content: Building out my content across my YouTube, Substack, Instagram, etc

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

What do you get as a paid member (beginning September 2022)?

Q&A drop box + links roundup - This will be sent out in a biweekly email which will include a place to ask questions (which I will *search* for answers to!) as well as links of what I’ve been reading recently, ranging from Dostoevsky to Deese.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

A very capitalist conversation

Sorry for saying “makes sense” so often, I just want to highlight the logic of these decisions

Big fan, clearly

Incredible content as always! FYI the Zoltan link at the top of your article is broken.

there's just so much confusion, isn't it Kyla?

there's a saying: change is the only constant, after experiencing everything that's happening around us, i'd like to alter it a little:

change & confusion are the only constant

i seriously support & appreciate what fed is trying to do (genuine work) but sometimes no matter how much effort you put, the outcome is not meaningful & fed is going in that direction in large parts. its basically solving a problem (unique in many ways) with tools that have been the same (monetary policy).

in such times, when an institute like fed is unable to solve the kind of crisis we're in, it hits credibility & leads to immense distrust in an increasingly unstable world, im incapable of diving into the specifics of human value etc but we'll float through it, just a matter of time

this is not the end (it might seem like apparently) but losing guard at this moment essentially lets nihilism cloud & it hits the long-term worldview which is not healthy

Again, Kyla, your piece has been a guiding material to navigate an apparently complex & confused state of the world, with a dose of optimism!

Thanks!