How Trump Won, What Happens Next, and How Disconnects Drove Democracy

How Trump Won Through The Lens of Data, Trust, Media, and the Vibecession

So here is my best attempt at a summary of the absolute barrage of information that has come out over the past week. It’s been a total whirlwind and there are a lot of important takeaways for the economy and for the direction of the country. This article is very long. In this piece, I summarize 1) how Trump won 2) what he plans to do 3) what he is doing 4) the role of information.

The Victory

Why did he win? He won because of voter unity, economic dissatisfaction, and broad desire for change.

Symbolic Capital has a great piece walking through why Trump won, specifically focusing on the claims of racism, sexism, elites, weak turnout, etc. Every narrative that people had about the election ended up being wrong.

Trump didn’t win just because of white voters. He didn’t win because all the rich people voted for him, he won because the working class shifted toward him. Trump won because an incredibly diverse electorate voted for him.

The ‘manosphere’ influencing young men helped Trump win. There is a lot of talk about how young men are failing and getting sucked into incel culture and basically being horrible people. My little brother is a very smart, very kind, 25-year old living in Cincinnati, Ohio. He was in a fraternity at the University of Kentucky. He has talked to me a lot about the narrative ‘men suck’ and how it makes things hard for him. How frustrating it can be, especially when he just wants to help. A lot of his friends feel the same way. So of course, some of them are going to end up going to the right. Allison Schrager wrote an article talking about Trump’s appeal to young men, talking about how they made more money and worked more under him, how they are falling behind in education now, etc. And like yeah, there’s the economic part, but there’s also the policy alignment part. Society has really alienated a lot of young men, and that’s what we saw in this election. Trump won’t help. But there needs to be a shift in tone and understanding.

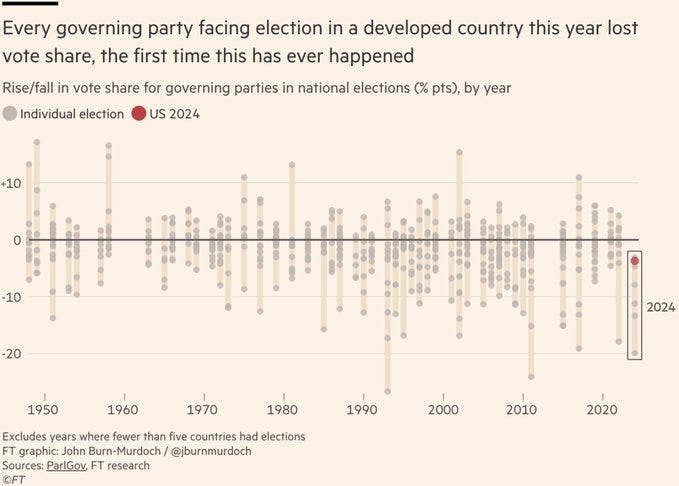

But with that being said, part of his win was that an incumbent (Harris) is always going to be punished for an economy that doesn’t feel good. No incumbent won an election this year. I heard from many people that they didn’t want Trump - but seemed like a better, more personable option than Harris.

People wanted what they thought they had under Trump back in 2016. Stability, no pandemic, low inflation, reasonable housing costs. So they vote for that again. Everyone is searching for answers in the bottom of a tea cup.

The Economic Disconnect

Roughly 2/3rds of voters rated the economy as "not so good/poor," per Washington Post exit polls. Of course, this is surprising if you only look at the data - how can people feel bad about the economy when the labor market is strong, the stock market is up, when inflation (ahem, not prices) has fallen, and when GDP is booming?

The economic disconnect is rooted in three key issues: persistent inflation, deepening inequality, and a structural affordability crisis that is especially pronounced in blue states.

Inflation

People told everyone that inflation was the thing that they hated most and that the high cost of living was one of the most important problems.

When people tell you that, it should be all that you talk about! When I first wrote about the vibecession back in 2022, the economy was completely different and we were making real progress on inflation, the labor market was strong, and the economy was surprisingly resilient. Two years later, inflation is near 2%, the unemployment rate is near all-time lows, and GDP is still exceptional.

The real pain point isn’t that inflation is down; it’s that prices remain high. This distinction between the rate of inflation and actual price levels has left many feeling poorer despite positive economic data.

There are parts of the inflation narrative that are never going to feel better, because it doesn’t matter that inflation goes down, it matters that prices go down. But prices going down is an entire complicated mess of deflationary pressures that usually don’t bode well for the economy, but it’s what people naturally want. Amazing economists like Isabella Weber and the team at EmployAmerica suggest solutions including increasing spare capacity at ports, utilizing the Strategic Petroleum Reserve, building buffers for critical minerals, and implementing policies to curb price-gouging and windfall profits.

No one cares about the flattening, they only care about the run up.

And with that being said, rates are sky-high because that's what the Fed does to fight inflation. Rates zoomed up - forget financing a house, credit card debt stings, etc etc etc. Compound that with the pain of inflation, and you have a problem on your hands.

Inequality

Part of it is that there is economic stagnation in a lot of the country because of the fragmentation of industry, because of the slowing down of the labor market, because of the continued growth of AI and what that could do to replace jobs. So there is a bifurcated economy, a chasm, rich getting richer etc.

Expensive products got about 10% more expensive, but cheap products got 20% more expensive. This is largely people buying nice stuff at grocery stores versus buying necessities. The necessities went up a lot in price, and the basket might not reflect that. As Annie Lowery wrote in The Atlantic “Inequality may be declining, but it still skews GDP and income figures, with most gains going to the few, not the many. The obscene cost of health care saps family incomes and government coffers without making anyone feel healthier or wealthier.” She continued:

Real median household income fell relative to its pre-COVID peak.

The poverty rate ticked up, as did the jobless rate.

The number of Americans spending more than 30 percent of their income on rent climbed.

The delinquency rate on credit cards surged, as did the share of families struggling to afford enough nutritious food, as did the rate of homelessness.

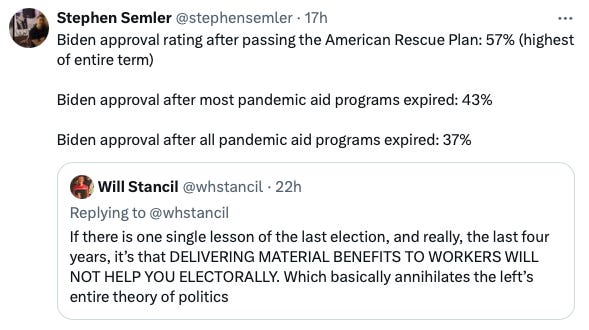

People felt abandoned. Also, pandemic era relief was important to people and when it stopped, people were not happy. A lot of policies, like the Child Tax Credit, unemployment insurance, Medicaid expansions, really helped people. And when they were pulled, it made things extremely difficult. It would have made a lot more sense to keep parts of the American Rescue Plan permanent, like they did for SNAP.

Structural affordability

Housing, eldercare, childcare (people spend about 20% of their income on it), etc. Housing is enormously expensive, and many have written about how to fix it, but this is a giant part of the economic frustration that people feel. I was getting a haircut a few days ago, and my hair lady told me that she felt like “all the promises had been broken” primarily because she couldn’t afford a house (or afford healthcare).

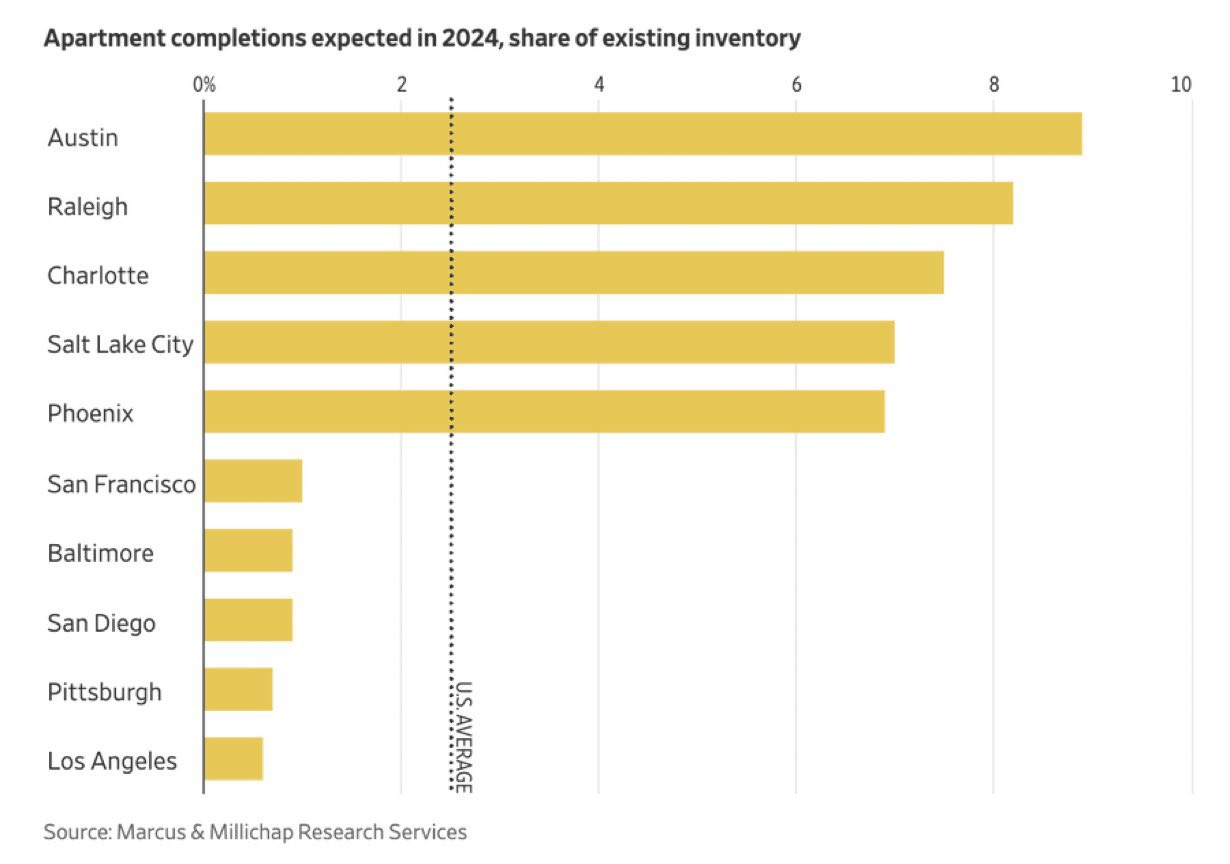

Of course people are going to be mad, even if GDP is up or their wages are higher. They don’t feel prosperous in one of the wealthiest countries in the world. It’s even worse in blue states. As Nolan Gray highlights, red states like Austin, Texas, have built housing and blue states like California simply hasn’t. That doesn’t translate well for Democrats.

The disconnect between data and sentiment isn’t just about the numbers — it’s also a symptom of a fragmented media landscape that shapes public perception. In an era where people get their news from radically different sources, the story of the economy looks entirely different depending on who you ask. This gap between data and lived experience isn't just about economics - it's fundamentally about how information flows and trust operates in our current media landscape

The Information Problem

One part of this is that people feel okay about their own situation. One thing that makes this pretty confusing is the personal/national disconnect. ~70% of people rate their own personal financial situation as fine but the national economy as terrible. That’s a tough circle to draw a square around.

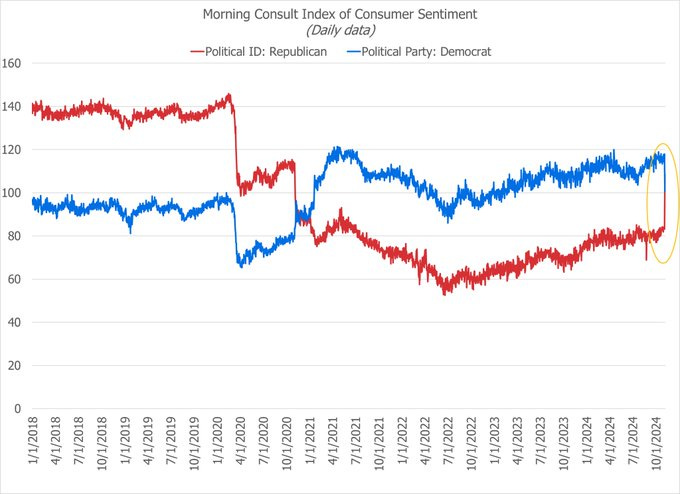

The immediate partisan sentiment flip also makes the situation tough to analyze. Will it hold? I don't know. Views on the economy are very polarized depending on who is in office. Everyone likes to be on the winning team. So maybe a bad economy now will be good under someone else.

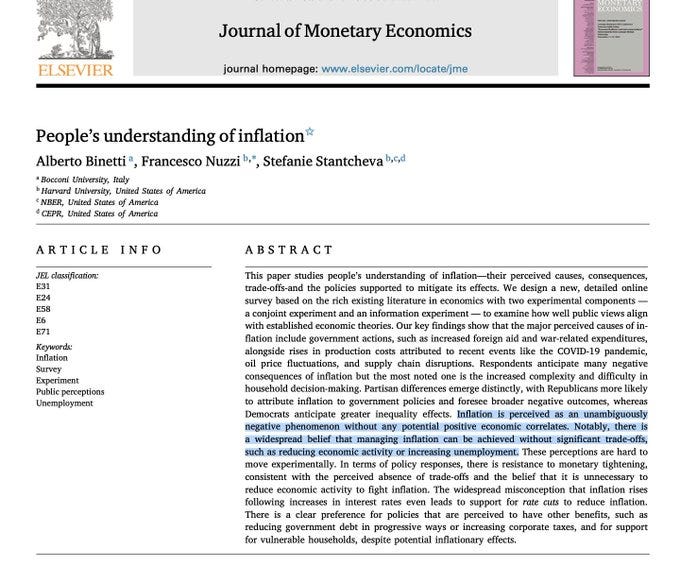

And that disconnect gets into terminology. There is a lot of general not understanding what policy is what, and that's not the voters fault - it's how WWE Smackdown politics has become with everyone screaming instead of talking about what they plan to do. Same thing with tariffs. But people also think that managing the economy comes without tradeoffs as Stefanie Stantcheva wrote about, which is another disconnect. Part of what we see this election is an education problem.

The disconnect also gets into information sources and media. Alternative media like podcasts were a huge part of this election process, and Barron Trump advised his dad to go on Theo Von and go on Joe Rogan and go where the people are (Kamala Harris should have done this). That worked. In the time of rapid information, going on broadcast television doesn’t really work. It’s much more interesting to go and chat and be a personality talking anecdote than it is to be a president that talks reality. Misinformed views were also a big part of it.

People think that violent crime rates are at all time highs, that inflation has still skyrocketed, that the market is at all-time lows, and that unauthorized border crossings are at all time highs. None of those are true - it’s all the opposite. But those misinformed views informed how people voted.

Trump supporters are more likely to get their news from social media, heavily influenced by the collapse in local news and the news sources that came to fill the vacuum (and how inflammatory they became to capture one iota of attention).

These economic and information disconnects raise an important question about institutional trust. Nowhere is this more evident than in the Federal Reserve's current position.

Institutional Credibility

The Fed decreased (in the orignal piece, I said increased because apparently I am stuck in the past) rates by 25 basis points as expected at their recent meeting, and Jerome Powell highlighted continued improvements in inflation, a ‘solid’ labor market, and strong economic growth. They will remain data dependent, and he didn’t comment too much on Trump’s proposed fiscal plans except reiterating that the deficit is on an ‘unsustainable path’.

But something very important happened.

Jerome Powell said that Trump cannot legally fire him - it was a clean, concise ‘No’ when asked if he would leave if Trump told him to. It was honestly super cool. Powell’s term ends in 2026, and Powell made it very clear that he plans to stay on for that long. So why does this matter?

It matters for the integrity of institutions and for holding power to account. There is nothing in the Constitution or the Vesting Clause or whatever that is like ‘let that President run free, man’. In fact, I truly believe the Founding Fathers would be a bit aghast at the state of things. Washington didn’t even want a two party system! Look at what he said in his farewell address -

However [political parties] may now and then answer popular ends, they are likely in the course of time and things, to become potent engines, by which cunning, ambitious, and unprincipled men will be enabled to subvert the power of the people and to usurp for themselves the reins of government, destroying afterwards the very engines which have lifted them to unjust dominion.

The people that were escaping a King, would never want things to be implied that one guy should be large and in charge, despite the direction we seem to be headed.

Powell’s firm ‘No’ underscores a critical message: the independence of the Federal Reserve is vital to maintaining economic stability and institutional trust. In an era where trust is eroding, this stance is a necessary assertion of integrity. But Trump is going to make their jobs hard regardless. As Bloomberg wrote -

The Trump trade — with long-term borrowing costs sharply higher — means tighter financial conditions, threatening the housing market and adding impetus to cut. But as monetary policy works with long lags, officials also need to anticipate the effect of proposed tariff hikes and tax cuts — which they probably assess are inflationary. Who knows if it will actually work - right now, the market seems confused too.

We need to be able to trust in our institutions in order for them to work.

The Disconnect

Overall, the economic metrics we use clearly didn't convey underlying sentiment. There is a gap between numbers and lived experience. That needs to be addressed.

Inflation is a huge cost. That’s why Volcker the way that he did to it by hiking rates to 20% to preserve central bank credibility. Unemployment weakens governments, inflation kills, some say. Unemployment only impacts some people - but inflation impacts everyone.

Also, it feels like you’re losing money. It’s a loss aversion bias - wages have gone up, but everything is extraordinarily expensive, so it doesn’t matter.

It’s the asset economy vs the wage economy, all compounded by institutional credibility crises and the appeal of alternative narratives via inflammatory media with some lost educational opportunities.

I also think there is a lot of validity to the failure of institutions to provide certain things in some blue states (like housing) despite things being really expensive, taxes being high, etc. It's like all talk zero action (and like too much talk about stuff that just doesn't resonate with the average person).

So that’s the problem. The media environment and lack of economic education (not the voter’s fault) plus real economic pain in the form of structural affordability and wealth inequality. That’s (it seems) a big part of how Trump won. People are tired and scared and feel left behind.

Policy and Person Disconnect

But people wanted Kamala. 80% of Republicans favored Kamala Harris policies over Trumps in a blind polling. Paid sick leave just passed with 74% of the vote in the GOP stronghold of Nebraska, which was a giant part of the Harris campaign as Walz highlighted. Also, as Amanda Marcotte wrote -

The problem wasn't Democratic policy or messaging. It's ignorance. As Heather "Digby" Parton wrote at Salon Wednesday, people backed Trump's "aesthetics and attitudes" but knew nothing about his policies. Before the election, Catherine Rampell and Youyou Zhou at the Washington Post polled voters about policies without revealing which candidate proposed them. Harris' were far more popular — even Trump voters generally liked her ideas more, as long as they knew they weren't hers.

The whole Salon article is interesting but it gets into bias and lies and the media ecosystem and just how loud everything is. Wajahat Ali -

A reminder that when Trump supporters were given Harris policy proposals blindly they supported them. Also, those who had incorrect facts about the major issues - economy, inflation, crime, border - they overwhelmingly went Trump. Those with facts went Harris.

This election underscores another fundamental disconnect: voters support progressive economic policies when unaware of their source but vote against the candidate endorsing them due to a gap in information and partisan framing.

So what happened?

A Very Short Retrospective on Biden

I think objectively, the Biden Adminstration accomplished phenomenal things - and I would say the same about Trump if he had been able to do the CHIPS Act, IRA, IIJA, etc. But there were shortfalls in the adminstration (naturally) and that ended up hurting Harris.

It was a lot of manufacturing and not a lot of housing. The Biden administration was heavily focused on manufacturing with the CHIPS Act, the IRA, the IIJA - and that doesn’t really impact the average person who is struggling with inflation and housing costs. It's an important policy, but it missed out on what people needed, which was support in the face of higher costs and what feels like falling living standards. Even if you follow the money, Biden poured an immense amount of money into states like Arizona that ultimately flipped for Trump. But people just didn’t care.

People didn’t feel listened to. The US has a paradox of prosperity - it is a very rich country, but as discussed earlier on, many of its citizens struggle with rent and food and eldercare and childcare and there were policies around all of that, but it didn’t resonate. People want immediate answers for their pain. GDP growth and higher stock prices do not matter (to most…).

Blue cities are sort of horrible in some places. We saw a lot of blue states turn purple - they moved Republican. Anecdotally, I spend a lot of time in Los Angeles and New York City. In LA, I think there is a sense of disorganization and poor government performance. It’s an exceptionally expensive and beautiful city with very little housing that feels extraordinarily dirty and unsafe despite very high taxes. Those things can only exist in juxtaposition for so long. We are already seeing a move happen as people search for a solution. Counties with the highest cost of living shifted toward Trump.

Red states can build better. People have been leaving California in droves and going to Texas and Florida. And Texas is very good at building clean energy because they have a streamlined permitting process as Alec Stapp pointed out - and they expect to build another 35 GW over the next 18 months, more than 3x California. California should be able to do this. They do not. That is frustrating. No wants that, clearly.

And things take forever. CHIPS and the IRA are massively impressive, but the headaches are things like Biden’s $7.5 billion investment in EV charging station which only produced 7 stations in two years. Red tape is strangling the party.

And are very expensive or feel slightly dumb. For more specific examples, Zuckerberg has to cancel plans for a nuclear plant because of concerns about rare bees. We need to save the bees, 100%, but we also desperately need alternative sources of energy. La Sombrita, a sun shade that cost millions of dollars and provides about an inch of relief, took years to develop. Los Angeles has spent 3 years and $7 million on free carts for food vendors - and no cart has been distributed yet.

Josh Barro wrote an excellent piece on this -

But mostly, I think Americans look around at how it goes when the government actually tries to help, and they have a healthy skepticism about how helpful the government is really going to be, and about whether the benefits are really going to flow to them. Democrats are making too many promises; they instead need to pick a few things for the government to do really well, with a focus on benefits to the broad public rather than to the people being paid to provide the services, instead of trying to do a zillion different things and doing them badly at great expense, as was the approach with the moribund Build Back Better Act.

Blue states need to change. Seattle is now doing some design review changes to expedite processes. Thomas Hochman wrote an incredible guidebook that provides ‘a comprehensive understanding of the key environmental permitting issues affecting economic development and to highlight potential areas for reform.’ More of that!

And with all of this, Trump seemed like an answer. Simple. Straight forward. A bull dozer in a world where people tiptoe. People even said that the top reason they didn’t choose Harris was because she "is focused more on cultural issues like transgender issues rather than helping the middle class." This actually isn’t true - she spent a lot more time discussing economic issues like the ‘Sandwich Generation’.

But where people get their news matters. And if they didn’t hear it, it didn’t happen.

Jonah Furman summarized it well -

One thing I think people miss about the fact that many deep red states approved economically progressive ballot measures is that a core difference between a ballot measure and a candidate is the ballot measure is going to do what it says.

Also, people are sick of politicians acting like they have no power. There’s a lot of ‘we better stop this guy, everyone!’ happening, which is like yes, there are clear issues at hand and perhaps that is entirely your job to handle as someone who has been given the power to handle this. (Mostly, Tyler Cowen was right.)

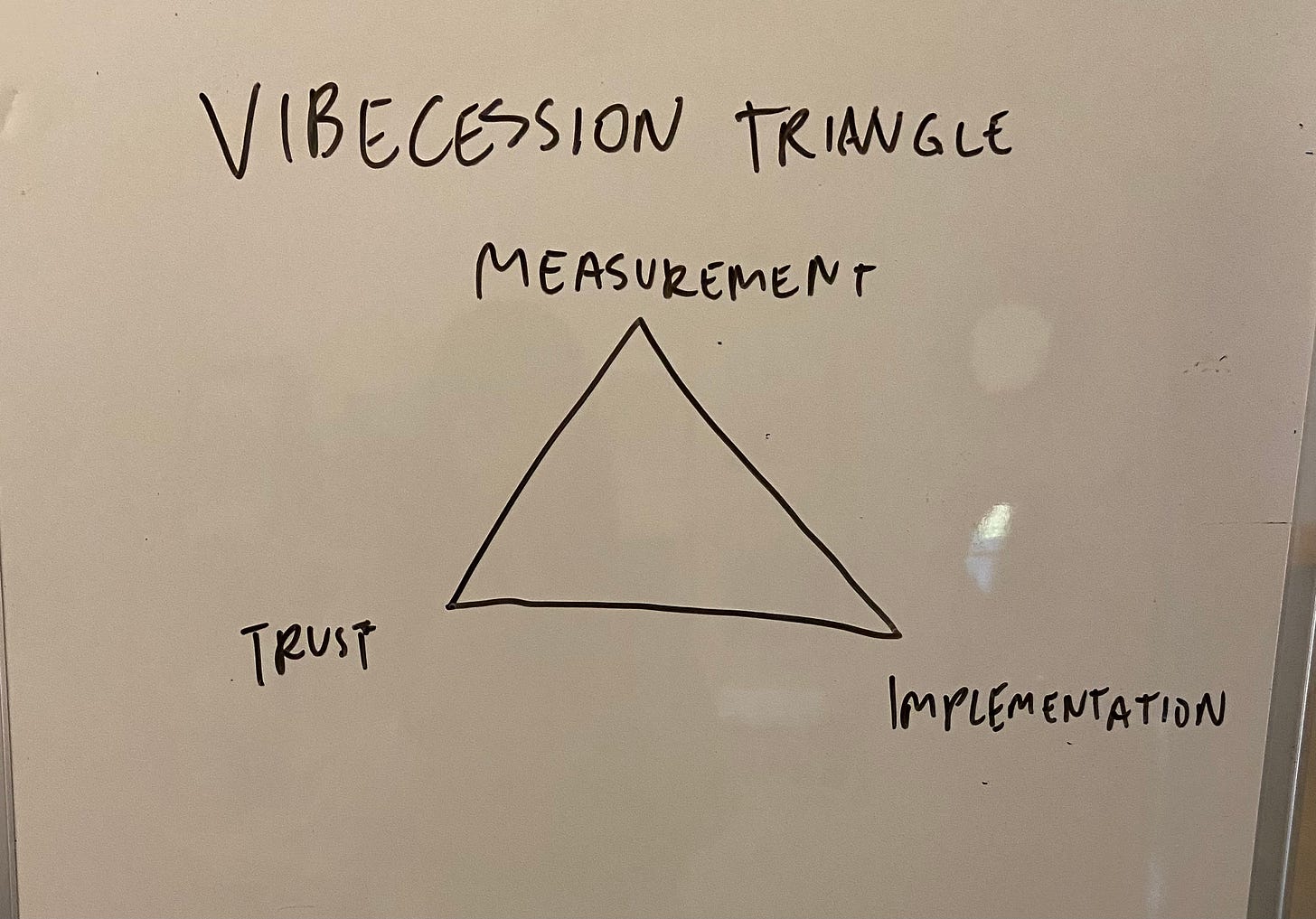

These various disconnects form what we might call the Vibecession Triangle.

Closing The Vibecession Triangle: Data, Experience, and Policy

The vibecession reveals three important disconnects that policy must address:

The Measurement Gap: Traditional metrics (GDP, inflation rates, unemployment) don't capture lived experience. We need new economic indicators that measure housing affordability relative to local wages, total cost of care (childcare + eldercare) as percentage of income, real purchasing power at different income levels, and quality of life metrics

The Trust Gap: People don't believe economic data even when it's positive. We need visible, tangible improvements. Focus on price levels, not just inflation rates. Prioritize fast, visible wins. Do local implementation over national promises and a clear connection between policy and daily life

The Implementation Gap: Good policies fail due to poor execution. Need streamlined delivery via Texas-style permitting reform, fewer, better-executed programs, clear metrics for success, and visible progress markers.

The vibecession isn't just about feeling bad when the data looks good - it's about the gap between policy promises and daily reality. When California spends years and millions on La Sombrita while Texas rapidly builds clean energy infrastructure, that's the vibecession in action. When the Biden administration celebrates GDP growth while people struggle with housing costs, that's the vibecession materialized. When Harris's policies poll well but people vote against her, that's the vibecession in political form.

The vibecession tells us something important about policy: it's not enough for things to get better on paper - people need to see and feel the improvement in their daily lives. Until we close these gaps, we'll continue to see this disconnect between data and democracy, between policy and politics, between what we measure and what matters.

Trump’s Agenda

Understanding these three gaps - measurement, trust, and implementation - helps explain why Trump's proposed policies might resonate despite their potential to worsen the very problems voters want solved. We also have a Republican trifecta on our hands, with Republicans winning the Senate and winning House.

Immigration

Trump said that he would launch the ‘largest deportation effort in American history’ on his first day in office. As Bloomberg highlights, this would hit economic sectors such as construction, hospitality, and retail. Prison stocks were very happy about that, but the cost of deportation would be about $300 billion, potentially reducing the U.S. population and labor force by about 9 million people. People do not believe that he will do this for some reason. One voter voter believes Trump will not deport “family oriented” Latinos since that would be “unfair.” That is likely not true.

Housing

He does not have a clear plan on housing yet, except for ‘promoting homeownership through tax incentives and support for first-time buyers’ both of which could exacerbate the demand issue. He has also discussed immigration policy as a tool to curb housing demand (kicking people out of the country to free up homes).

Education

Trump plans to end student debt relief, as well as shut down the Department of Education. If he achieves this, it would impact all the special education and special needs program in public schools and public colleges in all 50 states.

Tariffs

Of all Trump's proposed policies, his tariff plan best exemplifies how policy decisions could widen the gap between economic data and lived experience. Trump has said he would enact 10-20% tariffs on all foreign goods and 60% tariffs on goods coming from China. He does not need Congressional approval to do this. Some say that he is trying to negotiate with other countries and show them who the big dog is, which is probably true - but it’s also probably true that he sees sweeping tariffs as a way to pay for tax cuts.

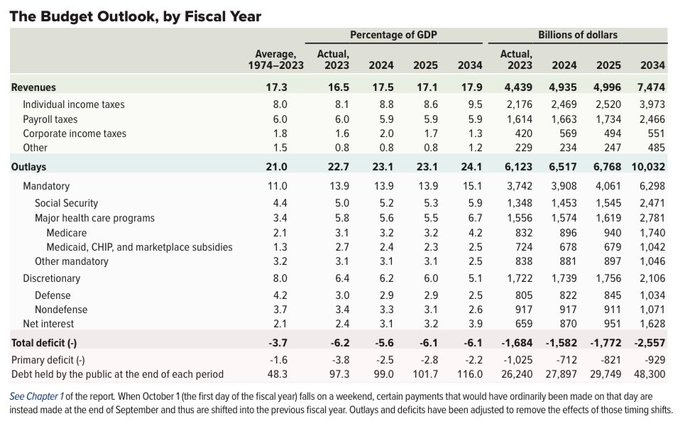

Tax cuts: Trump plans to extend the 2017 TCJA, which reduced federal income tax rates, increased the standard deduction, and increased the child tax credit. It will cost ~$4 trillion to extend, plus the cost of the additional proposed ‘end to taxes on tips’ and ‘end taxes on overtime pay’ and ‘end taxes on social security’ and the presumably very expensive ‘end income taxes entirely’. This would explode debt to about 150% of GDP.

Back to tariffs - tariffs are a tax on consumers. Tariffs are charged to importers, so people that bring products into the US, but the importer is like “lol no way, that’s going straight into markup” and then you and I, the consumer ends up paying the price. Broad-based tariffs promised by Trump would likely hurt economic growth and worsen inflation, economists say.

Companies have already said that they are going to do this. As CBS reported:

U.S. retailers that depend on foreign suppliers are prepared to pass along the cost of his proposed import tariffs to consumers, potentially leading to higher prices for a range of products.

So depending on what happens with tariffs, things could get pretty expensive.

Brendan Duke has estimated that it will cost Americans $4,000 a year. Erica York of the Tax Foundation estimates that 10% universal tariff will equal a $1,250 tax increase per household and 20% universal tariff will equal a $2,045 tax increase per household.

Also, if it’s meant to expand domestic production, it will impact all other production. As Jason Sorens wrote “when the U.S. has to make more steel domestically, we’ll make fewer lasers and advanced microchips.”

Other countries will probably get mad at us. It’s just a mess.

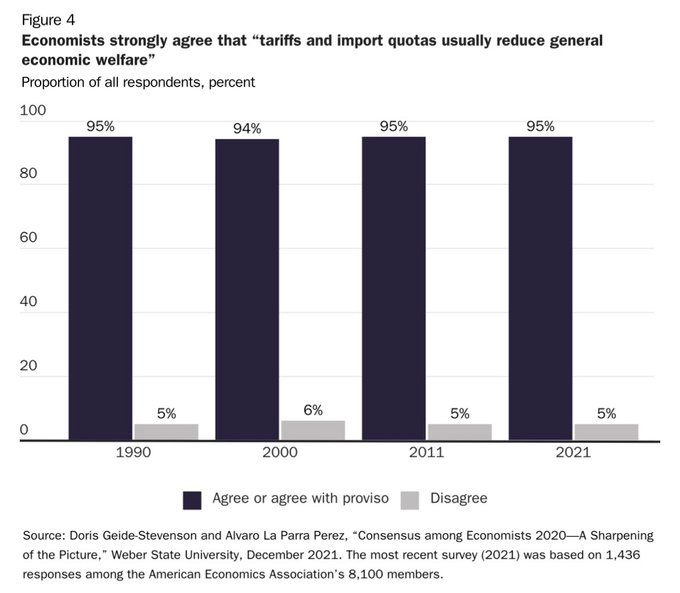

There are already stories rolling in from companies that are preparing for the eventual tariff impact by cutting off Christmas bonuses. Most economists (surprisingly) agree that tariffs and import quotas will reduce general economic welfare. Literally no one likes broad tariffs and they’ve never really worked.

If you want to read more, Cato has a great list of papers. To anchor this, video game consoles could go up by about 40% and laptops could go up about 50%. That will make the Fed’s job very hard.

What the Markets Are Saying

First off, this is an election where prediction markets were the right thing to pay attention to. The French Polymarket guy that bet $30m on the election under the presumption of a Silent Trump Voter was right. He woke up $80m richer today by simply betting that polls were wrong yet again, just like they were in 2016 and 2020.

But from a traditional market perspective, this is where things get tougher, first from a market perspective, because Wall Street Analysts are forecasting higher inflation and higher interest rates as a result of Trump’s win. Some sectors are very happy, like crypto and banks. Some are not, like real estate (higher rates) and clean energy as John Authers highlights.

The stock market is happy because it’s responding to narrative versus data - there is also probably some happiness that the outcome was quick. Joe Weisenthal has called it Rumspringa - all the rules will go away, along with taxes, and maybe some stimulus to spice it all up. People are more bullish on deregulation than they are on populism and tariffs.

The market is trying to figure out what will actually happen (bond yields are one example - especially considering the potential inflationary pressure of Trump and the current stickiness of present-day inflation). And the reason that this matters is because markets are boss, especially to a President like Trump. He has made the stock market an important barometer to his success. He will listen if the market goes down - and respond accordingly.

The stock market vigilantes, as Joe Weisenthal discussed, could be the arbiters of what gets done and what doesn’t get done. Same with the bond market (and higher bond yields hurt equity prices by reducing future cash flows). So if they think he is going to fan inflation too hard or don’t like tariffs, etc, the selloff would inform. Basically, there is a fourth branch of government - and it’s the market.

The Paradoxes of a Trump Presidency

The market's reaction reveals a deeper paradox at the heart of Trump's appeal. While he campaigns against elites, his victory and proposed policies have already enriched them - demonstrating another disconnect between narrative and reality.

People think Trump is smashing the elite, but his victory added $64b to the wealth of the richest 10 people in the world due to an already surging stock market- but these people are also jockeying to get a position in office.

Elon and Vivek are now the heads of the Department of Government Efficiency (DOGE)1 which feels very on the nose for the sort of post-truth political arena we are barreling into. It also feels corruption-y because of the incentives that Elon has to not cut federal government commitments to his businesses.

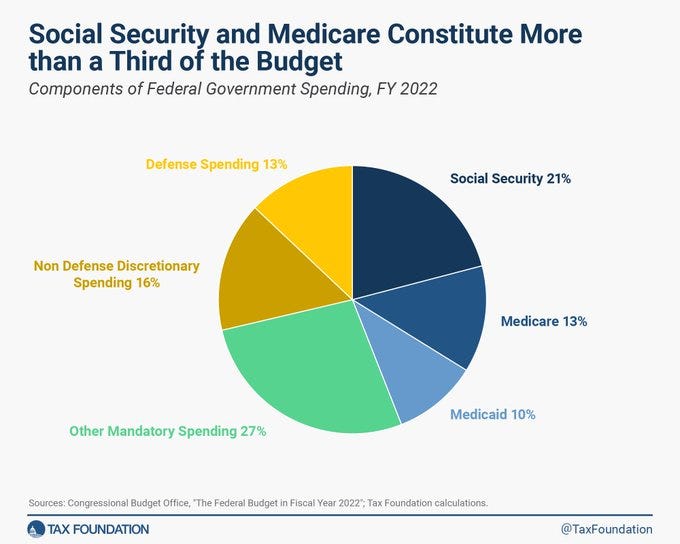

But they want to cut the deficit by about $2T (and are looking to raise about $50 million to do so) - which is very much needed if Trump imposes tariffs and extends tax cuts. They will need to cut social security and medicare. That will be unpopular.

And of course, if they can achieve it, it would be spectacular. Marc Goldwein had a great list of what the two men could tackle to reduce waste and make the government more efficient just in healthcare alone. But it will require tradeoffs, which people seem to think do not exist.

Trump is also making some appointees, and has picked Pete Hegseth, a Fox news host and a Army National Guard officer as Defense Secretary. He has also named Matt Gaetz, who was accused of child sex trafficking and several other things, as Attorney General. It will be an interesting test of the thesis of the Trump administration that experience doesn’t equate to success. Trump himself was a real estate mogul and a TV star that has now won the Presidency twice. Neil Postman has an idea on one way it could all go -

And in saying that the television news show entertains but does not inform, I am saying something far more serious than that we are being deprived of authentic information. I am saying we are losing our sense of what it means to be well informed. Ignorance is always correctable. But what shall we do if we take ignorance to be knowledge?

I don’t know. It’s definitely a sign of the times.

The Path Forward

These various disconnects - in measurement, trust, and implementation - point toward a clear framework for change and a triangle to forward. The path forward requires addressing all three at the same time.

There is a lot of good writing on what can be done - Santi Ruiz wrote an excellent article talking about the five things that Trump should do on day one. But this was an information election.

The country will have to continue to exist in this sort of weird paradoxical state. Like will Trump be able to ‘drill baby drill?’ Not if oil companies have a say. Will tariffs boost domestic production and make us all wealthly? Highly unlikely. We like superheroes and there is a reason the marvel cinematic universe was so successful.

Alternative media has created sealed ecosystems. As we saw, Trump supporters are more likely to get their news from social media, heavily influenced by the collapse in local news and the inflammatory sources that filled the vacuum. The traditional methods - press releases, policy speeches, even local news coverage - often just bounce off these bubbles.

It's not just that people don't listen - they can't. We're dealing with information overload, attention spans fractured by social media, deep distrust in traditional information sources, algorithm-driven echo chambers, and a very apparent collapse of shared reality. We know what works -

The Joe Rogan Effect: The success of long-form podcasts tells us something important: people will pay attention to lengthy conversations if they feel authentic. They want real conversations, not scripted talking points! People also like discussions that acknowledge complexity (not being like “the economy is good because GDP is strong”) and space to process information

The TikTok Translation: TikTok is for better or worse, the place to be. You need to have 30-second explainers, personal stories, and visuals when you talk about policy (or talk about politics). It’s all soundbites now.

The Beshear Blueprint: Beshear (from my home state!) penned an excellent op-ed on how he, a democrat, wins Kentucky, one of the reddest states in the country. And a lot of it is being there in person, staying on message, and making that message so incredibly crystal clear that you can see the future in it, and relating to people personally. He is a dude being a guy who makes his morals well known, and people like that.2

There’s a lot of people bemoaning the current state of information consumption, and that’s fine, but we also need to accept reality. Stop scoffing at social media, and go on the platforms and talk to people.

The people are on social media! And in order to serve the people, you have to be there too. It needs to be multiple formats, multiple platforms, a consistent core message, with as much IRL talks that then get posted to socials as possible. Connect with translators too, like local leaders and community organizations, not just influencers.

Trust is clearly the most expensive thing in the world right now, anecdote is more powerful than data and people want to understand things, they sometimes just don’t know how. The solution isn't to fight this reality.

This is about creating multiple paths to understanding, building trust through action, maintaining consistency in messaging, and creating networks of voices that go beyond politician and pundit talking heads.

The path forward requires closing three gaps: measurement, trust, and implementation. Only by addressing all three can we begin to bridge the divide between economic reality and lived experience.

In an era of fractured realities and declining institutional trust, it’s clear that policymakers must go beyond surface-level metrics and engage directly with the lived experiences of Americans. The pathway to rebuilding trust lies in meeting people where they are — both online and offline.

That’s how real change will happen. It’s time to do it.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

The irony of two people. The conflicts of interest - Elon owns a lot of dogecoin. They plan to sell merch. Elon also has a tremendous amount of government contracts. Elon also wouldn’t have to disclose his financial holdings because this is a commission outside of the government. Carter had to sell his peanut farm, just remember that.

He also has a dad who people liked a lot. That helps.

I very much appreciate the effort you put into this article, and I love the links to external resources. As an older retired person, I may have too much time on my hands, but in following some of your links, I found a few very good resources I didn’t know about. You are a very hard-working human and I’m glad to benefit from your passion. I very much hope you too are benefiting from your efforts.

This is a fantastic summary. I appreciate your efforts here.