I was on Kalani Scarrott’s podcast this week! Go check it out!

There is a difference between intention and impact - and the line between the two is blurry. In Burn it Down, Lilly Dancyger writes

I began to understand that there’s a difference between someone actively trying to harm you and someone’s specific constellation of shortcomings being harmful to you

The way we exist in the world has impact. Peeling an orange, walking in the woods, sitting in a coffee shop - all of these are a conversation between us and our surroundings. What we do in the world doesn’t merely happen, it’s a series of choices and occurrences, shaped by those before us and lived by those after us.

And of course, we exist in a world occupied by humans. We live in a society, if you will. One of the core parts of a society is empathy, and empathy is a function of intention, an active choice we make. We have to choose to pay attention, to reflect, to think “ah, this is what that means to them”.

It is very hard to do! Especially when we are distracted by the noisiness of the world around us, the world that currently keeps us in a state of just-enough-despair that we never feel quite comfortable. We often stay busy to ignore this, to drown out the noisiness, to ensure that we are protected.

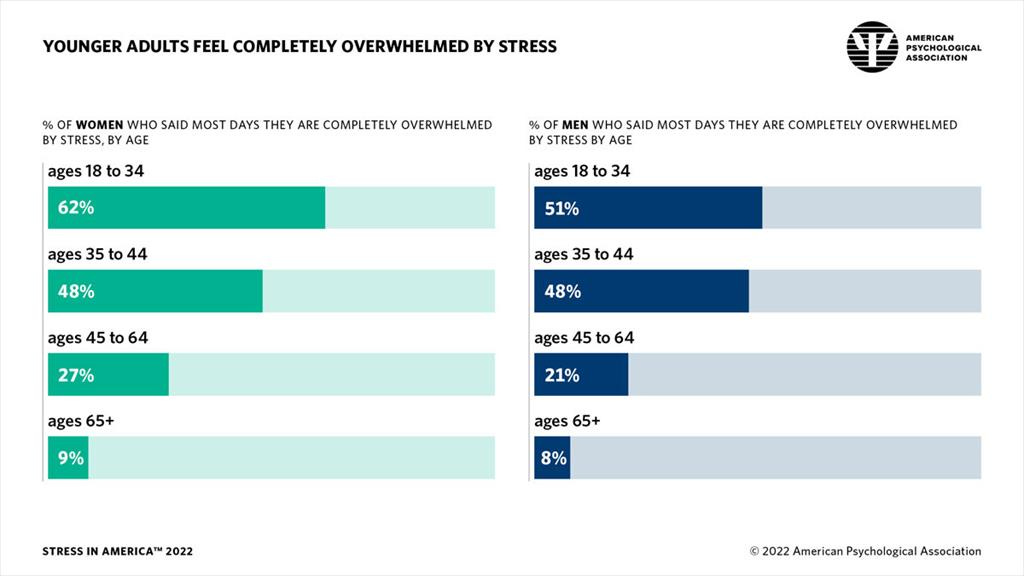

And this shows up - we are completely overwhelmed by stress. Almost one-third of all adults are so stressed that they cannot function, and our young people are in a state of distress over inflation, the government, and more, according to a study done by the American Psychological Association.

There are consequences from excess stress - health being a main one - but also stress, a byproduct of fear, keeps us from connecting with others. We lose community. And that’s when the cult of personality happens. People *need* something to rally behind. And when people are fundamentally worn out, we of course stagnate and are much more willing to accept what is happening around us.

The reason I started this newsletter with a reflection on intention versus impact, a look at empathy and a reminder that the glorification of busy is something deeper than just working is because all of that matters in some sort of laws of motion way for how we think about the following - Elon Musk and the Federal Reserve.

What Elon is doing at Twitter is a microcosm for what the Fed is doing (somewhat) to the economy (thanks to Matt for the inspiration here).

Elon Musk and Twitter

So first off - I do not care what you think about Elon Musk. If you think he is the greatest person ever, that’s terrific, if you think he sucks, that’s also terrific. But objectively, there is an important thread to pull on with the concept of intention vs impact here.

When Elon Musk sought to buy Twitter, it seemed as though he wanted to evolve it into a SuperApp, provide a platform for ‘free speech’, and some other stuff. That was his intention (and of course, maybe the intentions much worse, no one knows)

His impact, however, is *objectively* very different than any potential good intentions he could have had.

People are losing their jobs. Of course, there are other variables - did Twitter overhire before Elon took over, layoffs via tech austerity could have happened anyways, etc.

Twitter is also losing advertising dollars. Angelo Carusone highlights that there were concerns even in early 2022 from advertisers about Elon’s impact that lead to a loss in upfront ad sales for Twitter. And of course now, there are even more concerns because there was a massive surge in the usage of slurs1 since the takeover - and no one wants to advertise beside that. The advertisers were not pressured by activist groups, they simply don’t want to be on a platform that is a conspiracy theory output machine.

There’s a lot to be said about shifting away from an advertising model. Rethinking how to make money is a good thing. But Meta, Twitter, and Google are advertising firms at heart. So without a solid revenue plan in place, things beome iffy.

As Allie Wassum said:

Unless Elon hires new leaders committed to keeping this 'free' platform safe from hate speech, it's not a platform brands can/should advertise on

Even if the intention is to have a place where people can freely speak their mind, some form of moderation still has to take place - not only for advertising dollars, but also to protect freedom of speech.

Many people don’t seem to understand that freedom of speech does have limitations - libel, slander, hate speech are not really free speech etc etc. This is part of John Stuart Mill’s harm principle:

…the only purpose for which power can be rightfully exercised over any member of a civilized community, against his will, is to prevent harm to others.

A free-for-all is not free for all.

The intention of ‘free speech’ is not the same as the impact of ‘free speech’.

There are many other things to say about Twitter- verification and status are not the same thing, rather verification is a public service; you do need employees and you can’t manage via “totalizing political purge missions” as Venkatesh points out - even if with a cult of personality. The users are the product. The Trust Themocline, when loss of trust results in abandonment, is a delicate balance. And finally, all this happening right before midterms… is not good.

There are real world consequences to the balance of intention and impact. For Twitter, it’s that conspiracy theories do work on people, and they do wreak havoc, as those with families impacted by QAnon know. Navigating misinformation is incredibly important. And as Hank Green said “maybe “the public square” is just kinda hard to monetize.”

The Federal Reserve

Jerome Powell and the Federal Reserve are trying to battle inflation by raising rates to make it more expensive to be alive temporarily, so people stop spending money, so the supply side can recover, so inflation goes down.

The FOMC meeting was this week (I did a recap here on TikTok and YouTube) and the initial Fed statement appeared dovish - they highlighted the cumulative tightening of monetary policy and the lags with which monetary policy affects economic activity and inflation, which seemed to be a recognition that they have indeed been ripping rates, and indeed, some parts of the economy are in a pit of hell (like the housing market).

However, Jerome Powell clearly thinks that the fire and brimstone are not quite boiling yet (which also likely shows a divergence between Powell and other Fed members).

He repeatedly highlighted in the press conference that the Fed has to maintain “a restrictive stance for some time” that the “labor market is still tight” and that it’s “very premature to think about pausing”. Basically - “let ‘er rip”.

The risk of failing to tighten enough is riskier than overtightening. They can always slow down, Powell said (of course, slamming on the brakes is a bit different than tapping them).

It’s no longer about how fast they raise rates, but rather how *high* to get rates, and how long rates remain high. This likely means smaller hikes, but a higher peak. The endpoint - the terminal rate - will probably get to 5%+ if the Fed keeps ripping.

When asked about global consequences, Powell said that 2% inflation in the U.S. is good for the world. A stronger dollar is a necessary byproduct - even if it creates a huge dollaromino effect.

The labor market is still “too strong” (a statement buffered by the recent jobs report but we all know how iffy that statement is2) and consumers are still “too strong” as Esther George, president of the Federal Reserve Bank of Kansas City highlighted

"We see today that there is a bit of a savings buffer still sitting for households, that may allow them to continue to spend in a way that keeps demand strong. That suggests we may have to keep at this for a while."

And of course, it’s all a game of hide and seek with the market.

The Fed has to anticipate what market is anticipating based on expectations about Fed anticipations around market anticipations about inflation expectations based on Fed action. When Powell was told that the market was indeed Happy (it wasn’t) he made it very clear that he was Not Happy about that, which is telling.

So a slowdown in rate hike sizes, but not much of a slowdown at all.

Intention versus impact.

The intention of the Fed is to fight inflation, right? To get the economy back on track, sacrificing the now for the soon. But of course, the impact is wildly different. A loss of trust - especially as the economy slows down around us. Manufacturing is cratering. Financial conditions have tightened. Wage growth is trending downward. There is excess inventory, shipping rates have plummeted, the housing market is in turmoil, hiring freezes and layoffs are happening in some industries - the economic data is all pointing to a softening - and an unequal one at that. More anecdotes from earnings-

From PayPal’s earnings:

And the low-end income levels and middle-income levels are beginning to cut back on their discretionary spend. They're spending so much more on food, on energy, on gas, on rent. And we're beginning to see that impact those segments of the market. The high end of the market, by the way, is still spending quite freely and we're seeing that also in our results.

And from PRA, a global leader in acquiring and collecting nonperforming loans:

We continued to outperform our expectations. According to the Federal Reserve, U.S. credit card balances now exceed 2019 levels, while delinquency and charge-off rates are continuing to tick up, especially for card issuers that cater to non-prime consumers. This strengthens our conviction that more supply will enter the U.S. market in the coming months

The Fed has the intention to slow inflation - but the impact is going to much bigger - and concentrated on those that can least bear it. So solutions -

I’ve talked a lot about supply-side policies - as Vox highlights there is a “need for cost-saving renewable energy and dense housing, or policies that reverse the shrinkage of the labor supply since the pandemic”.

We need companies focus on being companies too - not stocks. S&P 500 companies now spend the most on buybacks and dividends versus R&D. This isn’t net positive for anyone - the intention might be to return money to shareholders, sure, but in the long run, shareholders will be harmed from a lack of future growth.

Intention versus impact.

Final Thoughts

Intention and impact can have the reverse effect too. As appliedscience11 talks about, most people agree on most things - healthcare, college, childcare - dying ideologies die loudly. We *are* making progress - we have the right intentions, it will just take time to have true impact.

The world is noisy. Empathy is difficult at times because we are so overwhelmed by our own worries. Being busy is a salve to perhaps avoid reflection. And of course, empathy is swayed by what we consume.

Things work until they don’t. As Benn Eifert said:

The people who did not do well with their hedges were people who were looking at the last crisis and trying to hedge that. You look at the last really big bad thing and think it could happen. And usually the last bad thing that happened isn’t going to be that much like the next bad thing to happen

Intention versus impact. Managing expectations. There is much more to be said, but that difference - between what is meant versus what happens is probably one of the most dangerous gaps of all time.

To end on a more positive note, Mary Oliver -

If you suddenly and unexpectedly feel joy, don’t hesitate. Give in to it. There are plenty of lives and whole towns destroyed or about to be. We are not wise, and not very often kind. And much can never be redeemed. Still, life has some possibility left. Perhaps this is its way of fighting back, that sometimes something happens better than all the riches or power in the world. It could be anything, but very likely you notice it in the instant when love begins. Anyway, that’s often the case. Anyway, whatever it is, don’t be afraid of its plenty. Joy is not made to be a crumb.

Thanks for reading.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

The content moderation council could help with this

Job openings are not the best metric to look at - quit rates show that the labor market is slowing, but overall, it’s still hot. It’s also bifurcated - tech and finance are laying people off, other industries are providing massive pay increases to try and get people to work

So many thoughts after reading Kyla's latest installment. My favorite sentence is: "Especially when we are distracted by the noisiness of the world around us, the world that currently keeps us in a state of just-enough-despair that we never feel quite comfortable". So right on the mark. I feel most of our species should read this. Addresses so many facets of our economy; our philosophies; our foibles and our joys. Thanks Kyla for your consistent thoughtfulness (and kindness).