pumpkin spice policy

The TL;DR of this newsletter is that the Fed is the main gardener of markets and the economy, and they are going to carve faces into the pumpkins at any cost to scare away the ghost of inflation. Here are my notes from the week.

Pumpkin Policy

The Federal Reserve’s Waller said this beautiful statement when addressing illiquidity in Treasury markets:

A lot of people complain about Treasury market strains and liquidity… a lot of people complain about “Treasurys aren’t liquid.” What does that mean? It means people aren’t willing to pay the price that you’re selling at. Okay well, lower the price.

On Oct 31, the liquidity for pumpkins is very high. But on Nov 1, the market liquidity for pumpkins goes to zero. I'm not going to step in and try to fix the pumpkin market"

There is no liquidity problem if you lower the price!

Well actually: But if the Treasury market gets smashed into the street by a bunch of teenagers, Waller and the Federal Reserve are likely going to have to step in.

Prices aren’t great barometers for health: There are plenty of buyers, but at potentially destructive prices. The logic of “ah yes, well just wait for prices to fall *enough* and someone will step in and buy” is a nightmare to anyone who has tried to sell anything (I’m sure pumpkin patch people can relate)

And pumpkin policy is in full play.

The Fed came out swinging this week - Williams was like “hey rates need to get even higher”, Cook said “ongoing rate hikes”, Kashkari said “I expect we will see cracks in U.S. financial markets”, Mester said “the U.S. is an unacceptably high inflation environment”, Bostic says “purposeful and resolute in seeing inflation lowered”, Daly said “we don’t raise rates until something breaks”.

Williams even gave this whole speech “A Bedrock Commitment to Price Stability” (what a TITLE) in which he said “the Fed's commitment to achieve and sustain 2% inflation is a now bedrock principle”

He states this 1) helps people understand what the Fed is doing and also 2) anchors long term inflation expectations1. He also stated that he thinks unemployment will rise to ~4.5% by the end of 2023.

The Fed has made it VERY clear that they are not going to pivot, that this time it’s different - that the era of easy policy has come to an end (for a WHILE). But the stock market is like “well maybe they will give me another chance right? we are on a break, not a break up <3”.

And of course, the economy is not the stock market, and the stock market is noisy and whiny. But the Fed has to pay attention to it, because as Joe Weisenthal highlighted -

People looking at moves in financial market moves, and taking them as Verdicts on the merits of a given policy… an odd form of market fundamentalism

Markets nudge what the Fed does. So even if Waller is like “Let Those Pumpkins Smash”, the Fed is going to have to come in and clean them up. Fed policy is sort of like a prism right now.

The Fed Policy Prism

There are two (main) inputs to Fed policy, but the impact of those inputs is like this wide rainbow of chaos.

The inputs - jobs and inflation metrics - are sort of wonky.

Jobs: I have a full YouTube video on the jobs report, but the labor market *did* slow down based on payrolls data, which is what the Fed wants. However, it probably didn’t slow down enough, so the Fed is going to keep ripping.

The unemployment rate ticked down (Fed doesn’t like) but job openings fell (Fed does like). The labor market is still tight.

A metric that Powell likes to look at - the ratio of job openings to unemployed workers - fell to 1.7 from 2 meaning that there are now only 1.7 jobs openings for every unemployed person, which is “good”

Inflation: The Fed has made it pretty clear that they don’t see inflation at the point where they want it, but that’s largely because the Fed is looking in the rearview mirror as they barrel down the highway.

Rent costs are going way down, healthcare inflation is going down, supply chains are whipping back, companies have a ton of inventory - all of this will take time to work through, but they are positive signals.

However, the Fed operates their rate hike car by looking backwards.

There are two layers to the giant worldwide impact that I want to talk about - the dollar and the bond market.

Dollarominos

The U.S. dollar is the first domino. I’ve written extensively about this but the dollar is arguably just so important because of the economic ripples it makes when it gets going.

When the dollar tips, it knocks over a bunch of other stuff.

Raising rates and dollar demand: When the Fed raises rates in order to battle inflation, other countries and investors are like “wow the US is looking pretty solid! I am super into that, and want to invest! I demand dollars!”

When more people demand dollars, whether that be because of 1) safe haven status or 2) demand for dollar denominated assets - that increases the value of the dollar

The flex of a stronger dollar: But a stronger dollar ends up flexing on other economies. As discussed in previous newsletters, it makes energy imports more expensive for some countries, as well as increases the cost of dollar denominated debt. It also increases the export costs of U.S. corporations.

What to do about a stronger dollar? The U.S. Treasury could hypothetically intervene here, as they did with the Plaza Accord. But it probably doesn’t make a whole lot of sense for them to do that because the Fed is going to keep raising rates! It would be like trying to wash your car in the rain - it’s still going to get dirty.

Stronger dollar fights inflation: Also a stronger dollar does help with the U.S. inflation fight by reducing import costs… but that could work against the efforts of the Fed because consumers could be like “wow everything is so cheap now, let me go spend” as Tracy Alloway highlights, which again - washing the car in the rain.

The U.S. dollar gets stronger: So it seems that the dollar is going to continue to rip, which does create all sorts of domino impacts domestically and abroad. However, the Fed is like “well the global economy better strap in and prepare because we are !fighting inflation! here in the United States of America”

But the dollar is just the first domino.

The Other Tipping Dominos

The Fed is also shrinking their balance sheet, which essentially means they are letting some of the stuff that they bought during the pandemic begin to rolloff. And what *that* means is that the Fed is no longer going to be a structural buyer in bond markets… and bond markets are feeling that impact.

No longer buying: The Fed is no longer the loofah of the bond market, so JP Morgan released a note that stated “We remain concerned about the (lack of) structural demand for Treasuries” which isn’t great for functioning of the Treasury market and the financing of the U.S. government.

And that goes back to pumpkin policy - the Fed has to step in if the Treasury market becomes dysfunctional (we saw this in action from the Bank of England). Roberto Perli of Piper Sandler says it will be ~7 months before the treasury market pumpkins begin to rot, so there is time.

Higher interest payments: The U.S. government debt hit another record which inflation adjusted is “fine” but as the Fed raises rates, that does put pressure on interest payments - with ~$1T more in interest payments over the next decade. It’s just another constraint on the government, which frankly doesn’t need anymore.

Ideally the government would *help* the Fed battle inflation, which is something Kashkari highlighted this week (helping to build more housing, policies around better labor market allocation, energy production etc) but they are just in a silly goofy mood over in Washington DC

Higher mortgage costs: Yeah home ownership! Haha, wow! Mortgage rates hit ~7% (with the buyer threshold much closer to 5.5%), and nearly 70% of homes in the United States have a mortgage of < 4%. Home prices are likely to drop 10%, rental costs of ticking down, but it’s just very messy.

I am partnering up with Bloomberg on some economic videos, and I made one about how wacky the housing market is if you want more on that

OPEC2: The EU is likely to put price caps on Russia. OPEC said “hmmm we don’t want that to happen to us… we are going to cut production”. Which isn’t great, because of the whole energy crisis thing we have going on (China is buying SO MUCH coal). And to the whole “we can’t have green energy policy without green energy investment” - GE is cutting jobs at their wind unit. So.

This will likely raise costs for everyone over time - energy is the common denominator for everything - no matter the price, as Japan recently showed with a $900m loan to their top utility to buy more LNG

The UN??? Also the UN stepped out this week and was like “hey central banks cool your jets! things are BREAKING” but as we know, the Fed is willing (or seemingly willing) to handle a little breakage at this point

Banks See Opportunity: There might be a gap in Treasury markets, but banks are definitely vulturing around to swoop in as things begin to shatter!

Goldman is going after private assets from UK pension funds because a lack of liquidity in private markets (circling back to pumpkin policy) and my golly, the banks are there to be the last drop of water in the desert when you are dying!

Dollar flex: Yeah that is also still happening

So there are all these second order effects from pumpkin policy and dollarominos, many of which will take time to play out.

Final Thoughts

My favorite quote this week was from Venkatesh Rao (who drops utterly profound things as often as a clock hand ticks)

“They’re up their own asses with jargon”.

I like that quote because when I talk to people outside the finance industry (and usually I begin blabbering about the Fed) it becomes apparent how many words are just sort of… goofy? And that’s most industries, but as I’ve repeatedly highlighted over the past few weeks, I think that finance is exceptionally bad about it, and it impacts the effectiveness of Fed communication.

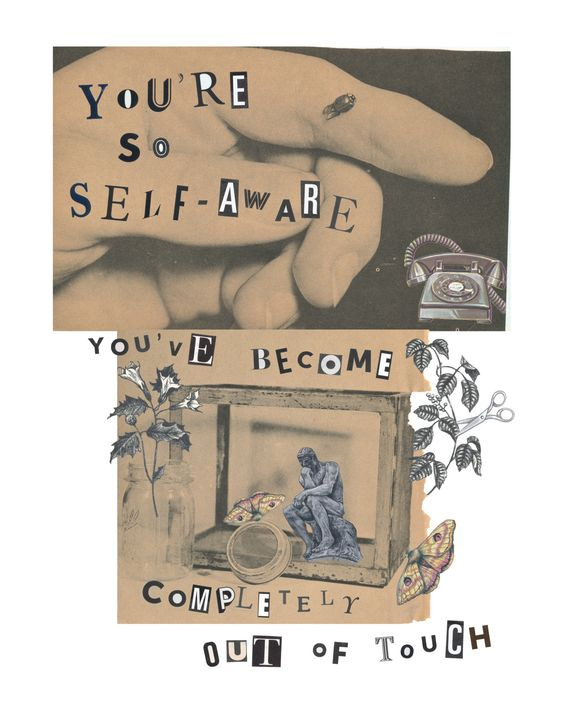

And going back to the Fed prism - I think this tumblr-esque photo encapsulates the underlying problem with pumpkin policy. The Fed is *so* focused on fighting inflation, on maintaining credibility, that they aren’t maybe as aware (or as cognizant) as they should be on the impact that tipping dominoes have.

The Fed is between a rock and a hard place. Pumpkin policy is important because the Fed is the gardener of the markets, whether they like it or not. The prism is reflecting a rainbow that might need to happen to get inflation down, but it could be blinding too.

Things are okay too!!!! Things are okay. The labor market is remaining strong, inflation is starting to recover, tick downs in the housing market could be good (eventually), and overall markets are so much more resilient now than they were a decade ago.

The thing about all of this (which everyone knows) is that it’s a chess game but real people are the pieces being moved across the board. The 4.5% unemployment rate that Waller highlighted would be another 1.4 million people who would lose their jobs. And that’s the frustrating part about the Fed dilemma is that the tradeoffs, the thats-how-it-has-to-be-isms are so blindingly apparent. A final quote -

Most of the things in life you truly care about are likely to be very ambiguous, and if you can't foster some ability to make a place for ambiguity, you're likely to be doomed to act in the service of its elimination-which is really a fancy and roundabout way of saying that you'll feel and suffer from anxiety much of the time.

Learning to love ambiguity can be a very powerful, if rather counterintuitive, act. By love here, we're not talking about falling in love or being in love. We mean love as an act. You can learn to care for and cherish ambiguity. You can invite it into your house for a while, give it a glass of lemonade, talk with it, and listen to what it has to say to you. You'll often find things in the midst of ambiguity that you can't see or experience anywhere else.

Thanks for reading.

Newsletter Subscriptions

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

What do you get as a paid member?

Q&A drop box + links roundup - This will be sent out in a biweekly email which will include a place to ask questions as well as links of what I’ve been reading

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Tell me that isn’t vibe setting like come on

This isn’t really caused by central bank policy, but just wanted to highlight it

Another brilliant essay from Kyla. I think this should be required reading by all Federal Reserve members and most of us should read this essay at least twice!!

Great article. Do you have a source to credit that final quote on ambiguity?