the Fed’s dual mandate is dually focused on inflation'

Open a Treasury Account at Public.com and get a 5.3%* yield on your cash

Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash. Get a 5.3% yield on your cash.Get a 5.3% yield on your cash Get a 5.3% yield on your cash. At public.com/kyla.

The Testimony

Jerome Powell testified in front of Congress this week and the main takeaway was “we are absolutely going to keep ripping rates if we need to - and it looks like we need to.” On the second day of his testimony, he walked back a bit stating -

"If — *and I stress that no decision has been made on this* — if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

Elizabeth Warren posed a question that pretty much everyone has been asking for the past few months - “what about the labor market?”

“What do you say to the 2 million people who you plan to put out of work with your rate hikes?”

Jerome Powell then explained that well, if we don’t fix inflation now, it’s going to be a lot higher than 2 million down the road. The idea is that by not nipping inflation in the bud, the consequences to the labor market will be extreme.

So the Fed is balancing both the labor market and price stability, trying to make sure that they can get inflation down with their rate hike cannon but also trying to make sure that the projectiles that they are firing into the economy don’t hurt anyone that bad.

Of course, you can’t have it all.

I actually talked with Mary Daly about this in our interview -

Kyla: How does the Fed sort of think about that tradeoff where we have somewhat of a healthy labor market - low unemployment - but then people are able to turn around and get those jobs, especially in tech, versus battling inflation where the unemployment rate is going to have to tick up?

Mary: The inflation rate and the labor market, they're all related. So I'm going to go back to 2019, that's what I would call a really healthy labor market. We had low inflation and people were able to get multiple job opportunities. People who had been sidelined, people had sort of said, “well, you're probably not gonna work again.” They were coming back in. People had career mobility. They were accumulating income and wealth. That was a really solid economy that delivered a strong labor market and price stability. Now we have an unbalanced economy and while it feels good at the moment for a particular worker to get a particular wage gain - you said this and, and I totally agree - that it's being eroded every single day by inflation. That's not what I call a strong place for the economy to be in, because we need sustainable growth - the thing the Fed's working on.

The best thing we can do for Americans is provide a sustainable path of growth that gives people opportunities to change jobs, to find the career that matches their interest, to grow their careers over time, but then to bring that paycheck home week after week and be able to afford things that they afforded last week. And right now we can't do that. So I think that's the point of balancing the economy. You balance the economy to give people a full slate of options, not just a positive here and a take back there.

It’s about preserving optionality. The Fed wants to make sure that people have choices, that they are able to afford being alive and are able to get a job. That’s why they are hellbent on getting inflation down.

But of course, of course, of course, as I have written about, as many others before me and around me and with me have also written and talked about, the Fed’s toolkit is a sledgehammer.

And if unemployment does go up and a bunch of people start losing their jobs, it isn’t peachy rosy pretty times. The Fed forecasted unemployment peaking around 4.5% in their Summary of Economic Projections but if unemployment goes up, it’s going to go UP as this paper from EmployAmerica highlights. When unemployment goes UP, a Recession is pretty much unavoidable.

So there is one key question that is sort of the overarching thematic for our current state of affairs - is anything working the way it is supposed to?

Why aren’t we in a Recession now?

I’ve written a lot about Recessions and why we aren’t in one even though it feels like we are sometimes, but there are people who make their whole careers by saying things like “the plane engines are off… it is an absolute disaster”.

So why aren’t they right?

There are a bunch of reasons. Consumers are still doing okayish1, the labor market is still chugging along, things are mostly moving without much grooving.

Construction Employment

Eric Basmajian had a great thread outlining how construction employment was the foundation for the economy. When residential construction employment (specifically) falls, that ends up dragging down total employment. You can parse out the path of residental construction employment by looking at

building permits → units under construction → construction employment.

When permits tick down, that means a storm is a’ brewin. Those peaked back in April 2022. Units are peaking now. The idea is that construction employment will follow - but there’s a bit of a lag.

As Eric highlights, seeing this lag as Fed policy and rate hikes just straight up not working is a mistake and could lead to the Fed doing too much too soon. If the Fed keeps bringing the hammer down, that could completely blow permits out of the water and create a myriad of issues, like a 20-40% drawdown in residential construction employment.

Labor Markets

If construction employment starts to plunge downwards, that has massive reverberations on the rest of the economy. There are a bunch of different ways to slice and dice the labor market -

LinkedIn data shows hiring down from 30% since April 2022

JOLTS data showed that job openings are still up but are not up as much as they used to be. Construction jobs fell to 248k, a 240k drop from January.

Quits rates, which many think is more important than job openings, ticked down which is a sign that the labor market is slowing down a bit.

So the labor market is slowing and softening - and in key areas. But it’s not as slow as maybe the Fed wants it to be. And that’s where things get kind of hard, right! Like we have this entity that is under a massive microscope - every word Jerome Powell says gets scraped and dissected as people try to figure out what the Fed is thinking about.

The Fed is trying to be data dependent in a world where the data just doesn’t make a lot of sense.

A Bunch of Different Ways to Measure Different Things

I touched on this last week, but the data that we have isn’t always reflective of the reality that we exist in. Numbers can say one thing, but based on your input model of [experience, data, emotion] you can perceive and interpret these numbers completely differently than someone else.

Even when we look at PCE inflation, which is the inflation number that the Fed looks at, we aren’t really sure what is right and what is wrong! Economics is an art, not a science, and that goes for the Fed’s rate hike cannonball journey too.

And of course, there are hard lines for what data really means. Like if construction employment is falling, we have a situation on our hands. But interpreting labor market metrics - especially considering the gap between private and public data, openings vs quits, even survey response rates - is an example of how floofy this stuff can get.

So going back to that question - is anything working the way it is supposed to?

The answer is pretty much not really but we are trying our best.

Is anything working the way it is supposed to?

There was a great article from J.W. Mason highlighting the work of Niels Gormsen and Kilian Huber on the gap between interest rates and business response. The theory is that as interest rates rise, businesses should chill out, but that isn’t really the case.

A fascinating new study raises new doubts about how much of a role interest rates play in business investment. To clarify the interest-investment link (the authors) did something unusual for economists. Instead of relying on economic theory, they listened to what businesses themselves say.

The paper found that businesses don’t really think about interest rates when they make various investment decisions, but rather they think about demand. If people want things, the businesses are going to supply. That makes the Fed’s toolkit even more blunt because everything is interconnected. Mason writes:

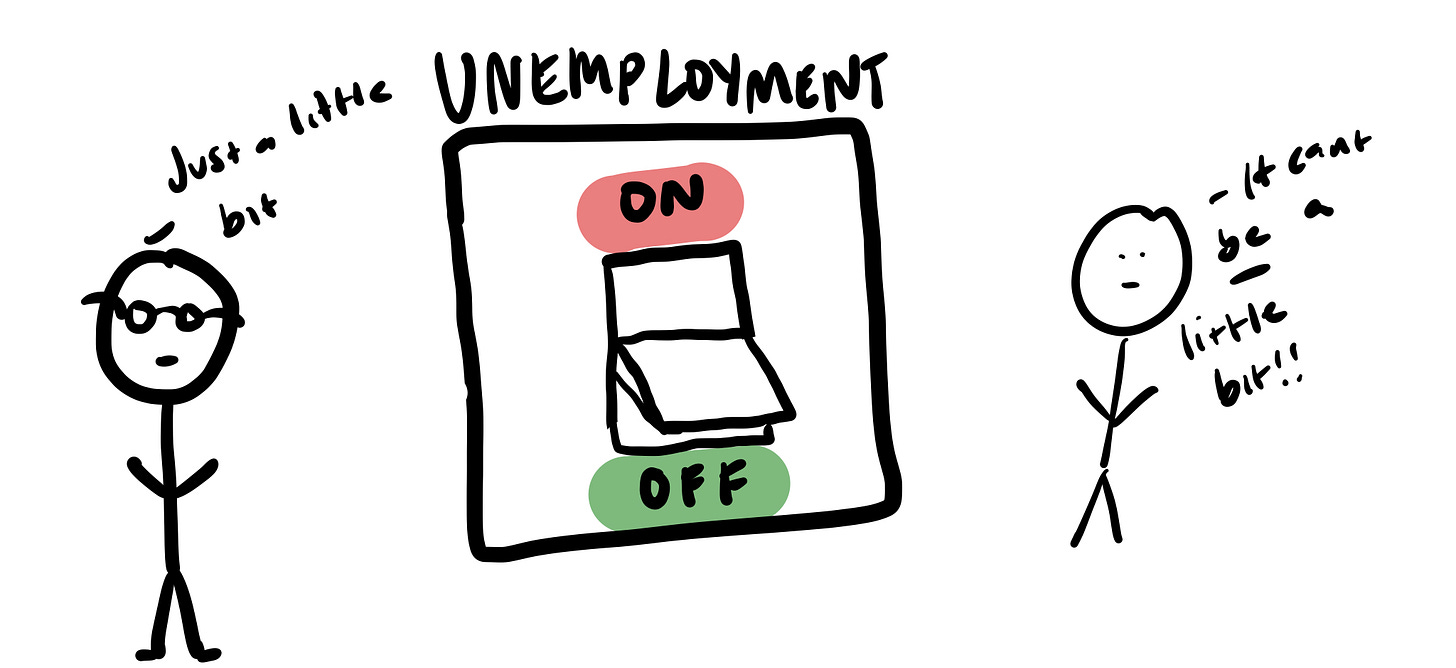

In a world where investment and demand respond mainly to each other, there’s less room for fine-tuning. Rather than a thermostat that can be turned up or down a degree or two, it might be closer to the truth to say that the economy has just two settings: boom and bust.

That makes policy setting REALLY HARD. The economy trends towards extremes, and trying to be nuanced about rate hikes is nearly impossible - which is why we need either corporations or government to help improve the labor market, reinvest in supply chains, etc etc etc.

There is also this graphic talking about what drives investment returns that I think is just kind of funny. On a ten year basis, it’s really just about people.

There is now an expectation that rates could hit 6% in the United States which has all sorts of implications for investment. The yield curve is absolutely freaking out. And everyone is standing around waiting for this seemingly inevitable Recession to drop out of the sky.

The stock market is still smiling and waving during all of this too which is sort of funny. Stock market is NOT the economy.

And that’s why that graphic is important - over a really long time frame, it really boils down to people. The economy is just a bunch of people peopling around.

What the Federal Reserve does really matters. It’s important that people are aware of the decisions that they are making and why are they choosing what they are doing. You can bark about how it’s bad that central banks exist or whatever, but the fact of the matter is that they do exist and we need to pay attention.

The Fed will now have to see if they swung their rate hike cannonball sledgehammer tool a bit too hard, too fast. I suppose in a very ideal world, this could be sentiment driven. People are very worried about a Recession - which might drive their behavior to slow down as we work through the rate hike lags, as people align to expectations of a downturn. The Fed is going after the labor market to try and slow things down, but maybe people being afraid of the very thing that the Fed is seemingly trying to avoid (a Recession) could help them achieve their policy goals.2

It’s all about preserving optionality - but there are clear tradeoffs in monetary policy right now between maintaining the labor market and battling inflation. It’s one of those wait and see things - are the lags going to work through? Is construction employment going to bust? What data set is even right to look at? Did the Fed go too fast and too furious?

I think all these questions remind me of the saying “most poets write the same poem over and over.” All those questions circle back to people, to humans, and ultimately, that’s what it’s all for. The economy is just a bunch of people peopling around. And that’s what makes all of this really, really difficult.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

*Yield reflects 26-week T-bill rate if held to maturity (as of 3/8/23). Rate is gross of fees.

When I say okay-ish, the -ish part is becoming increasingly important. More and more data comes out everyday highlighting that consumers are falling behind on utility payments, credit cards, auto loans, etc

There is a whole thread to pull on here around financial nihilism

I'm convinced that if you were to lose your current source of income, you could come to Europe and live a stable life by drawing caricatures of people around famous sights.

"The paper found that businesses don’t really think about interest rates when they make various investment decisions, but rather they think about demand."

Indeed, so true!🤘🏽