The Theories of Interconnectivity

or why a trillion dollar coin and George Soros actually make sense

Tuesday, I wrote about the supply chain crisis, the energy crunch, and ~what it all means~. Today I wanted to theorize on the interconnectivity between it all.

YouTube/podcast up soon (please subscribe for updates heh)

A few days ago, I tweeted this out.

There was so much happening, and everything *feels* interrelated, but I couldn’t put my finger on what it all meant.

How does natural gas tie into US Bank launching a crypto custody service?

How does McConnell kicking the debt ceiling until December impact how a16z hires?

How do mainstream NFTs (spearheaded by brands) impact Evergrande in China?

A lot of my stuff tends to drift into the theoretical as I think it’s super important to understand the rails connecting the roads in order to process what’s going on.

The more disparate everything feels, the harder it can be to process.

That can distract from being able to make clear-headed decisions on anything.

My goal with this piece is to hopefully explain some idea behind what’s going on. Note, I dont really consider myself an “author” of these theories, more a curator (which there is a theory about haha).

So here are some general theories about the world, which I plan to update over time.

The Theories

The not-enoughness theory

The absurdity theory

The speculation theory

The communal decentralization theory

The artificial influence theory

The flexation theory

The regulation-as-validation theory

The information synthesis theory

The not-enoughness Theory

Consumerism is a leading way of economic growth, and governments rely on that to push the needle forward (Keynes and Friedman battle it out to this day) - which can leave infrastructure underinvested in, and cause supply to not match the level of demand required by consumers - leading to shortages!

Supply and demand mismatch: I think we geniunely have a consumerism problem in the United States. Fast fashion, Amazon prime, even how we interact with NFTs - all of it points to a society that consumes and clutters.

GDP growth: The whole model is by design. Governments want to encourage us to consume because that is how they make their money. So they say “o, you want to spend that cash?? say less” and that’s how we end up with an economy arguably overreliant and dependent on consumer spending.

Lack of infrastructure investment: Consumerism is inadvertently probably one of the reasons that we decide on whether or not we invest in quality buildings and roads (bit of a stretch, but perhaps). We really don’t need to ~invest~ if the consumer is backstopping the economy right?

Boiled down: Like sure the government could ~grow~ the economy by making things better, but we could also just ~not~ spend that money instead?? Isn’t that how politics work after all - pretend to be mindful of spend, you get voted in again???

Supply! Where does it go: Turns out when you don’t invest in infrastructure, things fall apart :) who would have thought! So now you can’t produce to match that ~required~ level of demand, which ends up being bad!

Shortages: When demand exceeds supply (or when there literally isn’t enough supply) we get shortages. This is compounded by labor shortages, raw material markets going wonky, and stucky boi boats in the ports - with the key driver being underinvestment

The absurdity theory

The money system makes no sense, and because it makes no sense, we have to have solutions that also make no sense.

The debt ceiling: Somehow, someway, the government keeps pretending that its going to default on the debt - debt that they have already accrued, mind you. This conversation happens every few years - they usually raise the debt ceiling (so we can “pay” for the debt). But now they are joking around like “aha what if we just didn’t figure this out :) wouldnt that be crazyyy” And then they laugh.

Bipartisan dysfunction: The main problem here is that the two parties just refuse to get along because both want to remain in power ?? these people just keep pretending that stepping on each other’s necks is the way to run a country.

Blocking: Republicans aren’t the winners right now, so they are ready to kick some dirt on Democrats - they figure if you can’t win, might as well default on the debt in order to prove that THEY are the posterity party to the public :) and thus you should vote for them!

Kicking the can: But things are moving. McConnell was like “you know I’ve been in office for the last several centuries, don’t want to deal with this” and ran a vote to move the debt ceiling discussion to December (around December 16th to be exact).

So now everyone will ignore it until then, and then the drama will repeat once, and yes, this is a Season 2 of Debt Ceiling Island

Accounting Absurdity: The Stalwart has made it his personal goal to fight for the trillion dollar coin. He has a lot of great points, including the fact that this is an accounting hack that SHOULD be used because why shouldn’t it be. It is a sign that the U.S. government is willing to do what it *TAKES* to be a somewhat functioning government

The existence of the Debt Ceiling is a long term threat to the economy. I'm very nervous that politicians will use short-term, short-cut solutions to it, like hiking the debt ceiling. We need bold, long-term, structural solutions like the coin

The existence of the Debt Ceiling is a long term threat to the economy. I'm very nervous that politicians will use short-term, short-cut solutions to it, like hiking the debt ceiling. We need bold, long-term, structural solutions like the coinWut???? There are arguments all over the place here - no, the government shouldn’t do this because you cannot just ~make~ one trillion dollars, but also you literally can just make one trillion dollars, and that realization is kinda scary

Absurd problems require absurd solutions. We’ve kaleidoscoped our understanding of how the money system works - and have created essentially a false sense of reality around what the debt ceiling means. Now we are here.

The speculation theory

Shiba coin is up because Elon Musk has a shiba puppy, and if he tweets about it, that is its fundamental value (tweets = cash flows here). People invest in things like shiba and weird NFT projects because there is 1) essentially unlimited upside so 2) it doesn’t make sense to not invest - especially when there is 3) risk arbitrage and 4) a sense of nihilism

Go up because why not go up: Flows are a key driver of price. A large portion of why things go up is because more money is going into it. Crypto has had a lot of institutional and mainstream adoption over the past year, so crypto goes up, and by proxy things like shiba coin are also going to have inflows.

Speculation: A component of this is gambling - which is a function of FOMO and pricing in the probability of unlimited upside. So people see shiba coin, they see people making money in shiba coin, and they go “wow, I would like to make money tOO” so they invest. (Lily has an excellent piece around this function here)

Risk arbitrage: We seriously don’t understand risk. We don’t understand the psychology of fear, the math of uncertainty - all of it makes little to no sense to us. So risk isn’t something that we price properly - we just say “oh, other people are doing that, I will do it too” - we speculate.

Communal structures of governance: Speculation is enhanced by how we think of group interaction. So I am going to be responsive to what members of my ingroup say (shiba coin goes up because #shib trends on twitter), because there is an element of trust. I price risk differently when its a “group effort”, because my risk flows are influenced by their flows

Risk Pricing = ThingGoUp + [CommunitySupport x FactorofInfluence]

Nihilism: I don’t think this is the main factor, but I think a lot of people are a little upset with the structure of society. It doesn’t feel “fair” (fair being a subjective proxy for access to resources and opportunities). So people are probably more prone is misprice their risk because ~why not~

Marginal value: At the end of the day, my speculative dollar is worth more to me than my static dollar (lily has written a lot about this too) and so why not throw into crypto dickbutt and a shiba coin?

Gambling: We have a get-rich-quick problem in society, so speculative dollars > static dollars, even when the relationship should sometimes be opposite.

The community theory

We have operated as individuals for a very long time, so its hard to imagine a world where the individual isn’t the sole focus of the conversation - crypto is the first to make headway on what communal decentralized governance could look like, but the process is bumpy.

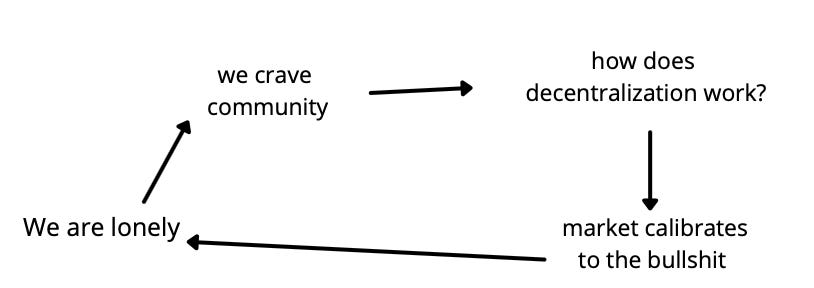

Individualism: How do you solve for individualism? The pandemic clearly showed that the U.S. operates with one person in mind, and that’s themselves. Simon Sarris wrote a note describing how people see each other in cities, which is as obstacles - you’re in my way, you’re not a human, you’re a stuck thing.

Communal governance: I wrote a bit around how crypto was trying to solve for the Individualistic society - we’ve been silo’ed humans since the Industrial Revolution, because it became more about singular production + division of work versus group production + division.

Crypto community: Crypto turns that narrative on its head and says “Actually, we can own means of production with groups, buy a token to get access to this DAO (solves for monetary incentives).” Time will tell if the model works, but its making inroads into reshaping how we think about interaction + building

Decentralization as a cure: Then the question becomes: does it make sense to operate in a completely decentralized world? Who makes the really hard decisions- can communities do that? Surely they can to an extent, but there are unavoidable bumps in the process (like rug pulls, scamcoins, etc)

Market calibration: to an extent, all the scams a function of the market figuring itself our. Unfortunately, all markets have to develop a bullshit meter, and that comes from dealing with bullshit, and calibrating from that

The influence theory

We are defined by what we look at (you are your 5 closest friends and you’re also the content that you interact with most), but as the online becomes increasingly artificial and detached from reality, what does it truly mean to “influence”?

Beauty filters as beauty standards: A lot of data has come out recently around the role that apps like Instagram as we try to mold ourselves to match the standards of the artificial. Influencers are notorious for modifying the way that they look - to the detriment of their audience who then asks - “why do I not look like this??”

Influencers as standard: The interesting thing that happens here is that there is some sort of evolution as to what the standard becomes - standardization is a function of commonality, so the more we see people that fit the “beauty filter” aesthetic, the more we think we are meant to match it

Standardization of the artificial: So once the artificial gets standardized, it becomes even harder to sort through the noise of what is real versus what isn’t. I think that this will have lasting impacts on the psyche of my generation and the ones following - where our sense of reality is warped by consumption.

The flexation theory

We want to flex all the time. We want shiny, big things to flex on, and that is broadly a function of shiny, big assets, which don’t always translate to “real world” value.

Clout is currency: Sometimes, people operate with one goal in mind and that is to flex on their friends as hard as they can, especially in younger generations. No longer is it “quiet wealth” (not sure if it ever really was) but now it’s LOUD wealth

Flexation: inflation but for flexing - think of how we operate with flex dollars as currency - youre going to need to flex bigger and harder in order to match that next level flex.

With clout as currency and flexation as the backdrop, it makes sense that we have NFT projects moon - you have to show that you are doing the thing harder + better than everyone else

Digital flex vs Physical flex: Flexation culture trickles down into infrastructure. I have focused a lot on supply chains and the energy crisis recently, and think that there is so much more that could be done in hardtech/deeptech investment.

b2b saas: think of all the consumer tech companies that have gotten billions of vc funding - that sort of “mindset” is going to carry over to how people choose to flex - and so we are going to see the advent of the digital flex (NFT on apple watch, metaverse clothing etc), at the risk of the physical being left behind

The theory of regulation as validation

Regulation is not a bad thing. It actually is a good thing

Let us regulate u pls: The SEC is trying to figure out what crypto is, and the main way that they are going to do that is by suing various crypto companies. This makes those crypto companies

Be responsive to the demands of the SEC

Gives the SEC easy access to info

Helps SEC create framework bc they are figuring it out along the way

Validation: So regulation is not always a super harmful thing - it sometimes means that things are going really well (or at least there are a lot of inflows) because you need to be regulated

The theory of information synthesis

We have a lot of stuff thrown at us all the time. We are never given any sort of framework to sift through the deluge so it just ends up piling on top of us, and it becomes increasingly hard to parse signal to noise when this happens.

Curators: This is where the ~flywheel~ of the creator economy comes in (overused term but alas). Curators have a responsibility to sift through the noise in order to prevent people from collapsing under the strain

Funding mismatch: This is something that drives me nuts about “creator economy” startups (these are generalized statements and probably over emotional) - They dont talk to creators (the people they are building the product for!!!) and somehow have millions in funding :-/ which is good for them but poorly allocated

Creators and curator monetization model: So there is a mismatch in funding and use cases - which hopefully the interface of curators can help drive forward, but for now, the creator economy will likely flatline if resources keep being misallocated

Curators are probably a solution to most of the things I laid out above. They are a human interface to the algorithm, to the money system that makes no sense, etc. They are a point of leverage in a very noisy world.

Final Thoughts

The theories will be updated as I gather more information about the world, but I thought it would be good to put pen to paper on some of this stuff.

Thank you for reading and for entertaining my more metaphysical takes - I will have more market facing content soon, and am working on some fun projects around that!

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Interested in the 'nihilism' effect that was really interesting and refreshing to see from someone who can articulate macro concepts so well. more please.

I love when you talk about S & P 500 performance, then relate it to the current news market. Are you still allowed to do that, Kyla?