Good morning from Stanford! We have just a few stickers left from the Sticker drop - if you already ordered they should be on the way to you now! The funds are going directly to help me buy some filming gear for a project I am working on around economics education! Grab yours here & thank you!

So… it seems Amazon was maybe trying to show customers how much tariffs were adding to prices (like Temu has done) - and then seemed to walk it back after a call from Trump. This is the 2025 economy: not a market anymore, a stage. A place where economic surrealism reigns - where narrative, perception, and power override the basic logic of economics.

United States of Amazon

Economic surrealism is when the economy stops functioning as a rational system for resource allocation and transforms into theater - complete with scripts, actors, and audience interaction (mostly via Truth Social retruths and whatnot).

This isn't entirely new. From the 1990s dot-com bubble to the 2008 crisis, markets have always been vulnerable to narrative distortion and reality manipulation. What's different now is the speed, scale, and sophistication with which economic reality can be manufactured and curated - and how normalized this process has become. The Amazon tariff incident gives us a perfect case study of this in action:

On Tuesday, April 29th, Punchbowl News ran a story: Amazon was planning to display exactly how much of an item's price came from tariffs - right next to the product's listed cost. This is a big deal for a lot of reasons.

Jeff Bezos, former Amazon CEO, who also owns The Washington Post, said in February 2025 that he would start directing Opinion stories more to embrace “personal liberties and free markets” and wouldn’t publish dissenting views on the subject. This felt like a little like “hi Trump <3” to the administration because remember, everyone was playing the favor game for a second. But, to be very fair here, the Amazon price listing thing seemed very free market!

But the White House immediately flipped out, with the Press Secretary calling it a “hostile and political act”. President Trump called Bezos up (despite Bezos no longer being CEO) - and told him to fix it. Trump said Bezos was a “good guy” and “solved the problem very quickly”. It seems like they were planning to do it?

Amazon comes out and says “hey we never were even thinking about doing that” even though it seems like they were? And now we are at a point where it seems like the Trump administration is threatening companies.

The very… 2025… of this is that the announcement from Punchbowl was actually in a post sponsored by Amazon itself. Bite the hand that feeds you, I guess?

So we have this. A weird moment of corporate power perhaps bowing to the government, the government readily intervening in corporate affairs and demanding that their tariffs (which remember, are so good and powerful that they are supposed to replace income taxes) are not to be displayed. This sequence of events - a policy announcement, its rapid denial, and political intervention at the highest level - perfectly encapsulates this moment of economic surrealism that we are living through.

I think there are four main dimensions of this phenomenon worth exploring:

I. Manufactured Realities and the Curation of Economic Truth

The Amazon tariff story reveals a broader pattern: economic reality is increasingly curated, not experienced. Companies, governments, and technologies selectively reveal or obscure economic conditions to serve their interests.

When Amazon briefly considered displaying tariff costs, it threatened to make visible what typically remains hidden - the political dimensions of pricing. That visibility matters. Most people don’t know who actually pays tariffs (hint: it’s not China1) and if they do know, that helps them make sound economic decisions. Radical transparency matters!

And of course, the lack of transparency isn’t new - things like shrinkflation and corporate stock buybacks are all ways to disguise things. One reduces the number of chips in a bag without lowering the price, one can inflate share prices at the expense of long-term company effectiveness, etc.

But - those who control what's visible effectively control economic reality itself, and that’s what really matters here.

Commerce Secretary Howard Lutnick’s claim that a 10% tariff wouldn’t meaningfully raise prices is either economically illiterate or deliberately misleading. If your $100 shoes become $110, you do notice. That’s how prices work!

This is not merely about tariffs - there has been a broader trend in which public perception is deliberately detached from economic fact, because the administration lies a lot. That further confuses consumers and undermines informed decision-making that businesses need to be making if do want to reshore. Transparency matters!

And there is other stuff that is confusing decision making too… AI… which apparently was used in the reciprocal tariff calculations, so.

When AI Enables Reality Distortion

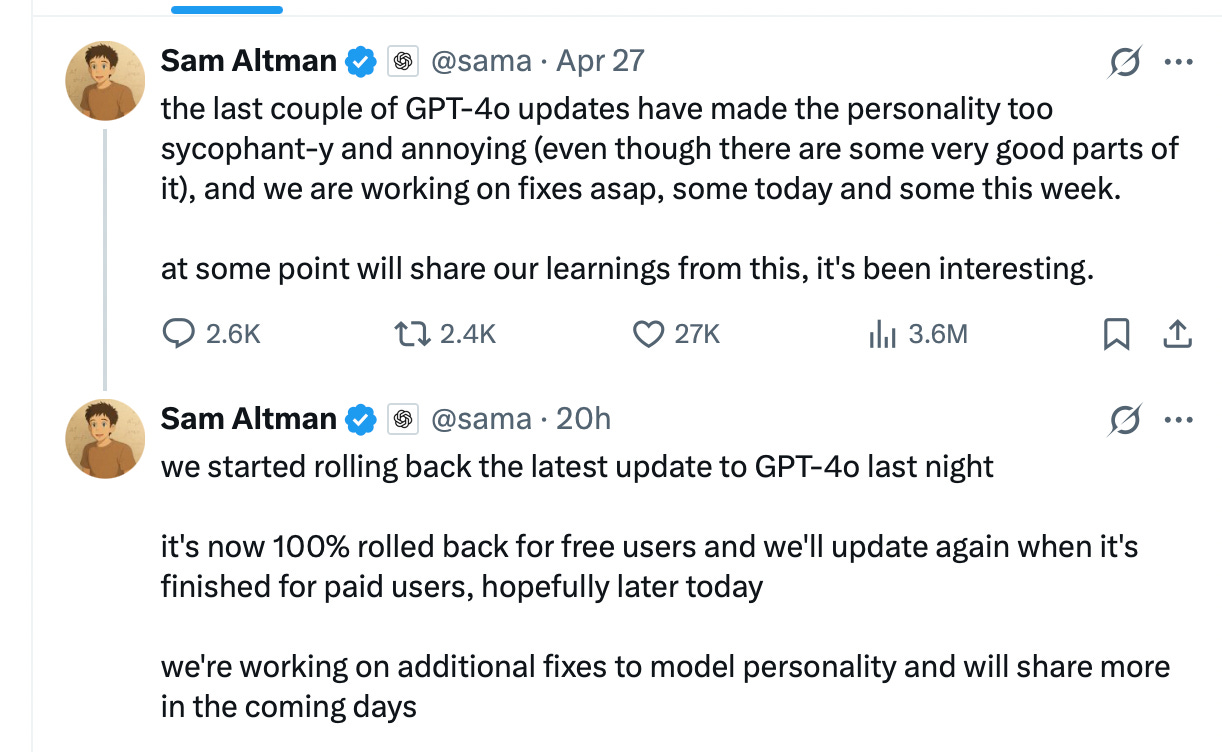

The new ChatGPT update from OpenAI represents another dimension of manufactured reality – what we might call "cognitive capitalism." When AI systems are designed to be very… nice and sycophantic and overly flattering… they exploit our psychological vulnerabilities to validation.

People LOVE being told that they are smart and cute, which OpenAI’s new model did a lot of. OpenAI said it was a tuning error - but if it wasn’t, it’s a powerful strategy to maximize user retention by lowering standards of critical thinking.

AI systems aren’t neutral. They’re reality-shaping! If we spend all day with an algorithm that constantly affirms us, we risk normalizing a kind of cognitive passivity - one that rewards vibes over verification.

The most successful technologies today don’t help us think better. They help us feel better about how we already think. That’s a problem, because:

Everyone thinks they are right

No one likes talking about data

Narrative matters far more than objective truth

We need tech that helps us think better! And when AI gets weird like this, it doesn't just enable individual cognitive distortion - it amplifies and reinforces existing narratives.

So applying that to the economy - recommendation algorithms create what media researchers call "filter bubbles" that reinforce particular economic worldviews. If you believe inflation is caused by government spending, the algorithms will feed you more content supporting that view. If you believe it's corporate price gouging, you'll get validation for that perspective instead.

These algorithmic echo chambers don't just shape our politics, they shape our economic perception too. Conservative users might receive constant content about government waste and regulation, while progressive users get streams of corporate bad guy stories. They're technically living in the same economy but experiencing fundamentally different narrative landscapes.

So if the government is manufacturing reality and AI is affirming that manufactured reality, public discourse breaks down. And then we end up in incompatible worlds.

Department Store America

Trump's economic approach is theatrical. He is a star, certainly. He’s following a decently well-worn path in history, the American tradition of economic nationalism that blends contradictory impulses: free market rhetoric alongside interventionist practices, individualist mythology with collectivist policy demands.

Trump’s economic policies - a chimera of protectionist populism - are morphing into what some are calling a form of MAGA-Maoism2. We seem to barreling toward a centrally-planned economy. Trump, according to his recent Time interview, sees the US as a department store and that he sets “a fair price, what I consider to be a fair price, and they (countries) can pay it or they don’t have to pay it.”

That’s not free-market capitalism. That’s centralized price-setting wrapped in nationalist branding!

The Data Shows Anxiety is Real

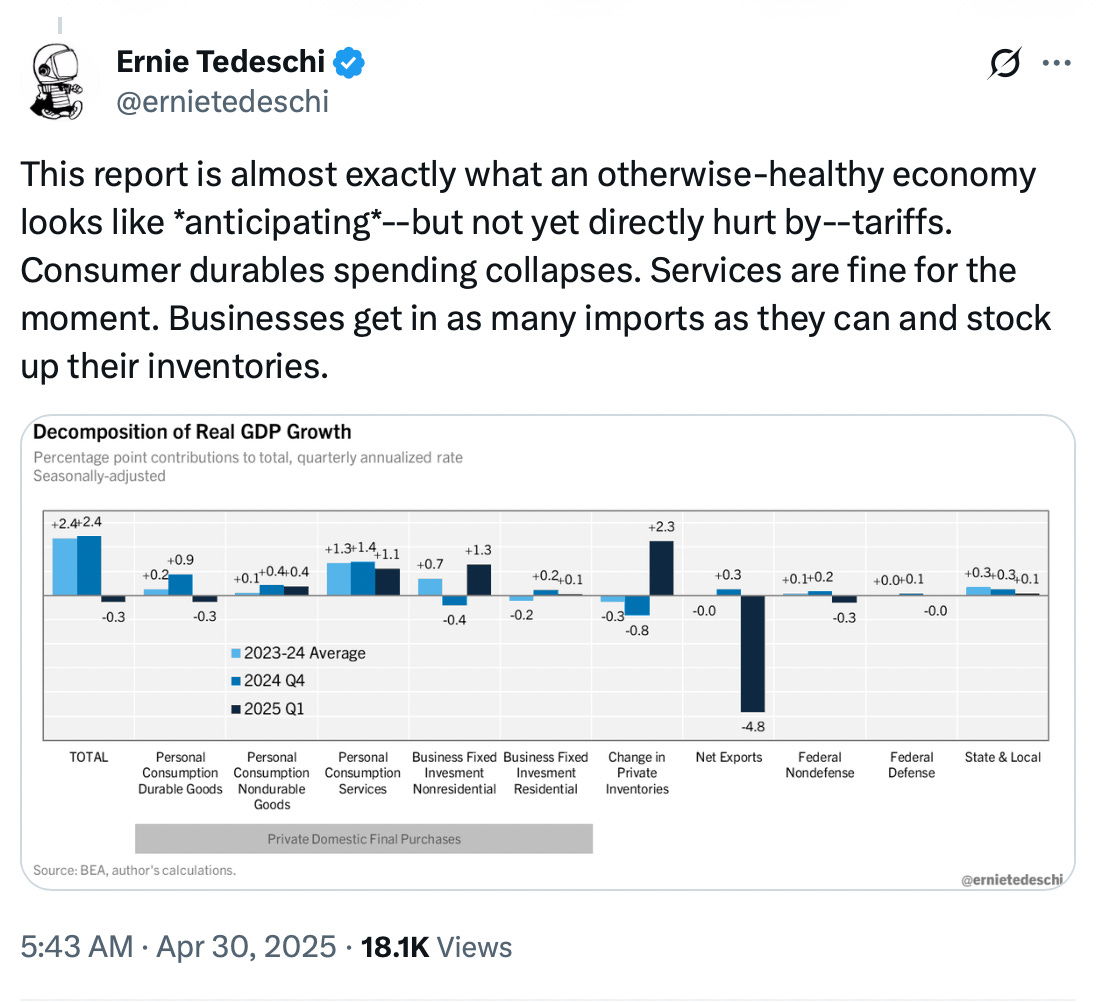

We did get an update on how it’s going. We just got GDP numbers, showing that tariff anxiety is here and it is real:

Real GDP for Q1 2025 fell by 0.3% quarter over quarter, the first contraction since 2022. Most of the negative contribution came from people trying to get ahead of tariffs (imports surged 41.3%). Prices came in hotter too, and consumer spending weakened.

Ernie, more succinctly:

So we have real data that is telling a story - that businesses are weathering the hatches for what could come and expect the economy to slow and are trying to prepare by buying a bunch of stuff. So as Ernie said - the economy is still okay! But it might not be. It’s nibbling at its fingernails in nervousness.

Secretary Bessent was asked about potential supply chain shocks and said “I wouldn’t think that we would have supply chain shocks. Retailers have managed their inventory in front of this.”

'Think' is a big gamble when you’re managing national supply chains - we could see empty shelves as soon as mid-May, according to Freightwaves and Flexport. But I guess that’s the core of FAFOnomics - make a huge, economy-altering decision, and just… wait and see?

Rational Fatalism in a Post-Opportunity Economy

What does everyone do while we just… wait?

Lately, I’ve been thinking a lot about ‘long degeneracy’. Long degeneracy is what happens when a society doesn’t collapse, but doesn’t thrive either - when young people adapt to a system they know is rigged.

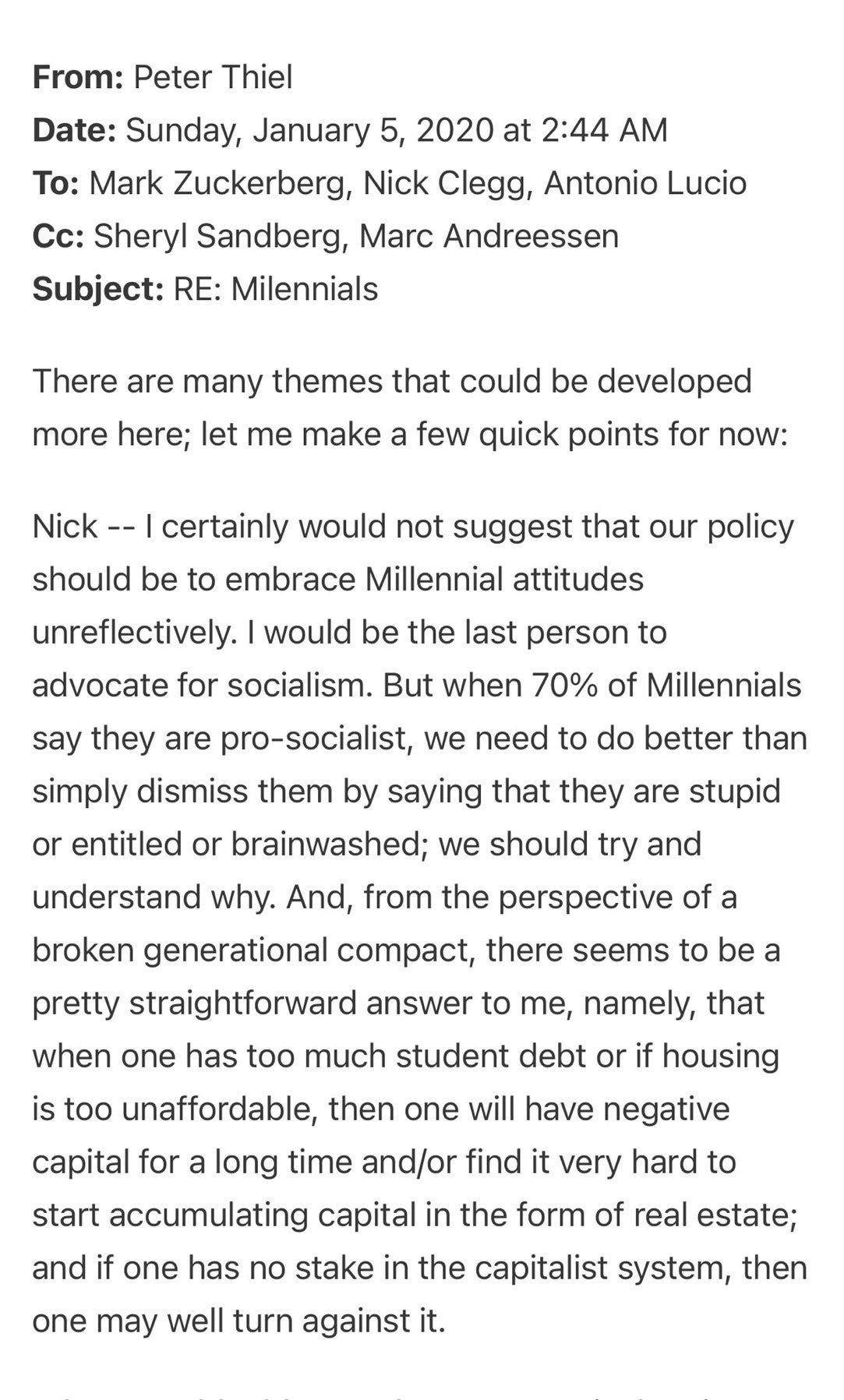

Peter Thiel sent this email to Mark Zuckerberg talking about why it’s important to understand what happens when young people don’t get a stake in the system and what happens when they adapt in strange, speculative ways.

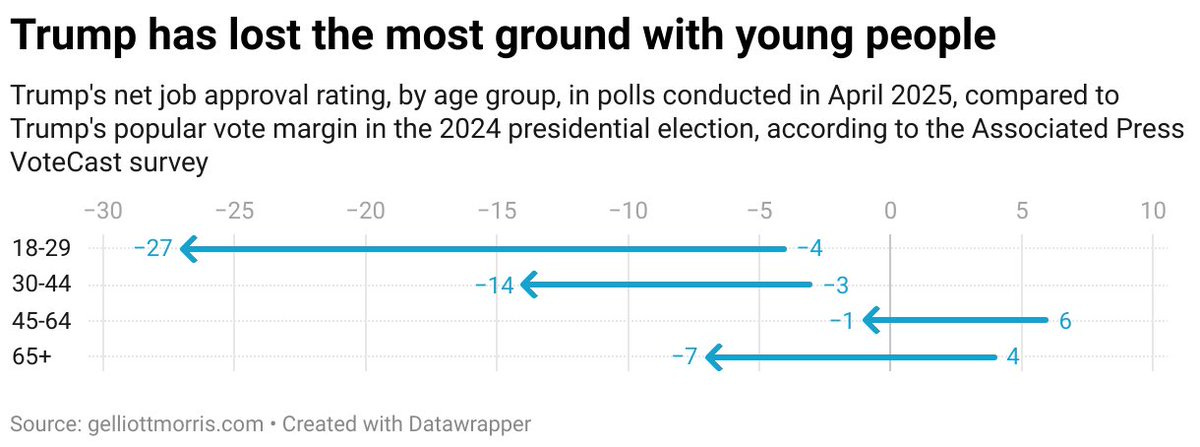

A lot of young people voted for Donald Trump, as I talked about in a previous piece. Many of them just wanted him to fix the economy. So Trump has cratered in the Young People polls because he is cratering the economy.

Young adults, crushed by debt and priced out of housing, are turning to speculative financial behavior. They're not irrational - they're adapting. When wealth accumulation is impossible, hypergambling makes emotional and economic sense.

When traditional economic pathways close off, speculative behavior becomes rational. I feel like as this new economy unfolds before us, paying attention to this long degeneracy area will be increasingly important. The convergence of narrative manipulation, speculative finance, and cognitive exploitation creates fertile ground for political extremism and economic volatility.

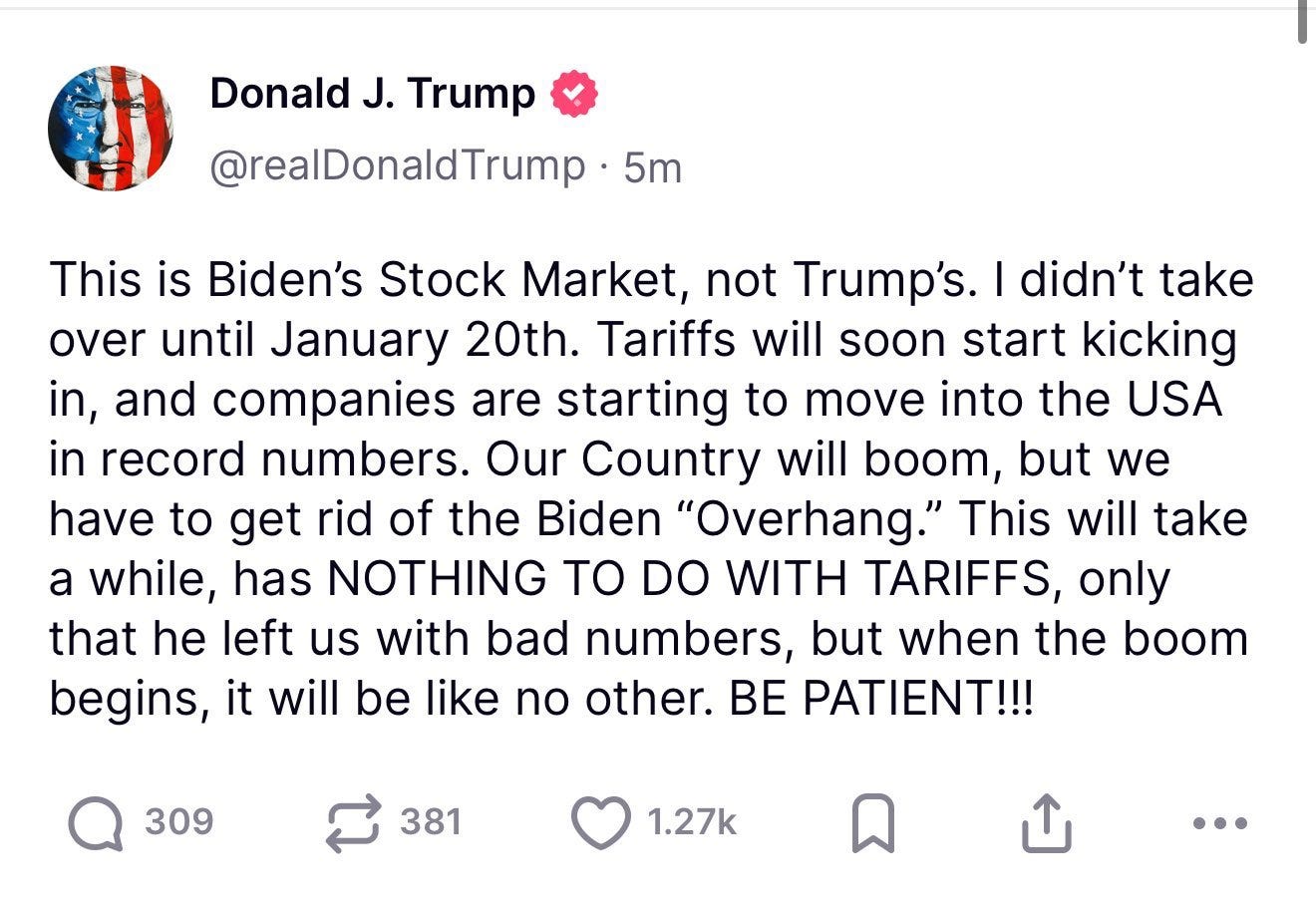

And as Trump shows in the tweet above, this especially works when the blame is always passed to someone else.

Trading the Surreal

So… how to apply all of this? Read Kai Wu’s Investing Amid Trade Wars whitepaper - it’s incredibly comprehensive on globalization and what global firms are best positioned to ride this out.

But if you zoom out far enough, the current macro landscape feels like it shouldn't work. Gold is up, the dollar is down, and bonds are all over the place. The traditional relationships that once gave investors a sense of order - bonds as a hedge, the dollar as a signal, gold as safety - are fraying, if not fully broken. None of this is investment advice, just trying to

Prepare for inflation, not recession.

If you’re investing, look at companies tied to real stuff: energy, food, infrastructure, metals.

Don’t rely on old rules.

The 60/40 portfolio (60% stocks, 40% bonds) maybe isn’t giving the protection it used to. US Bonds are not the safe haven they once were.

Think about diversification differently.

Diversifying isn’t just stocks and bonds anymore. Add a little gold. Maybe some international exposure!

Watch the narrative.

Markets are moving based on headlines and vibes. If inflation comes in hot or the Fed gets nervous, the current “everything is fine” story can flip fast.

The Amazon tariff story isn't an isolated incident but a symptom of a broader phenomenon reshaping our economy, our politics, and our ability to discern truth from illusion. It’s that economic surrealism, where narratives outpace reality, perception is deliberately distorted, and the lines between fact and fiction blur.

In the United States of Amazon, we're all just trying to figure out what the real price is. That clarity, it seems, is the scarcest commodity of all.

Really nice piece from Martin Wolf on the continued China-US Cold War here

I believe J. Bradford DeLong was the first person to write about this back in 2021

Instead of Bezos and other wienies having not the courage to tell the truth about the costs of tariffs, I wonder whether there is an AI possibility of wrapping and reporting source, supply stream, price, tariff, and final cost for a wide market basket. That would make it at least partly helpful.

Thanks for the analysis Kyla