Trumpcoin and TikTok

the attention economy and the meme economy

I think all of the below important to think about. But please note: everything could all go amazingly well, and I really hope it does.

Note: In the original piece I stated that Cuba launched their own memecoin, and that was a hack. My apologies for that.

Trumpcoin exists now

At 9:44 pm ET on Friday, January 17th, the rules of power changed dramatically. Trump and team1 created a multi-billion dollar memecoin a mere few days before his second presidential inauguration. It was extraordinarily successful.

By Sunday, Trump and team had tens of billions in paper net worth from pure narrative value and by Monday, he was both president again and one of the world’s richest individuals—entirely through attention-based speculation!

Upon entering office, he has discussed a series of sweeping executive orders, such as promising Jan 6 pardons, managing the TikTok ban, and an immigration crackdown. All of these will be discussed in turn as the politics of his presidency will unfold in the weeks and months ahead, but for now, I want to focus on two things: Trumpcoin and TikTok. Together, they reveal something extraordinary about how attention has really become the ultimate currency.

Trumpcoin Mechanics

Trumpcoin "has nothing to do with any political campaign or office," or so the official line goes. But its launch was a massive success.

Trump and team created $60b+ in paper wealth at one point, as reported by Kobeissi Letter, catapulting him in Top 25 Richest People in the World (the coin is about 90% of his net worth). Trump’s crypto platform, World Liberty Financial, has also bought a bunch of .eth usernames, meaning there is more in the works.

Several other people also became fabulously wealthy, with 6 wallets holding over $600 million at some point. Almost one million wallets were holding the coin!

Within hours, Trumpcoin became the template for narrative-driven wealth creation.

Then, Sunday afternoon, Melania launched her own coin (apparently created by a different team) which created a situation where Trumpcoin money left to go buy Melaniacoin, causing about $35 billion to evaporate from Trumpcoin.

A TikTok memecoin was launched by a student advisor of Trump, Ryan Fournier, who rugged (twice) for about $25 million (and said, “I literally sold because it was going down increasingly”).

It’s pump and dump season! It’s simple memecoinonomics:

Hype: A coin launches with buzz and excitement.

FOMO: People pile in, driven by fear of missing out.

Rug Pull: The creators sell their holdings, crashing the price and leaving investors with nothing but narrative.

It’s a bit sloppy. It’s a bit embarrassing! It’s extremely effective!

The Evolution of Value Creation

Trumpcoin demonstrates the raw power of attention in modern markets. Historically, value creation followed a clear progression:

Capture attention through being a business that sells things that people like (Apple and the iPhone, for example)

Convert attention to business improvement (take money from stock market and build better iPhones)

Build better products, generate real cash flow, and compound value over time.

This was the Warren Buffett playbook—attention as a means to an end, with cash flow and tangible assets at its core. The basic formula is attention → improvement → value → compound. Trumpcoin doesn’t bother with those middle steps. Its process is simple:

Capture attention.

Convert directly into token value.

The attention is the product. The narrative is the value. None of it is new.

The Feedback Loop: The Perfect Attention Machine

We have been here before. I’ve written at length about attention, and had half a chapter dedicated to it in my book. The GameStop saga showed us how collective attention can move markets. But at the presidential level, it rewrites the rules of wealth creation, rewrites the rules of power and is really the final nail in the coffin for showcasing attention as the ultimate driver of value in modern markets.

This moment in time is quite unique because of:

The speed at which wealth was created (36 hours to $70b+)

The scale (if it goes to $2,100 a share it will surpass the value of bitcoin)

The source (direct political influence conversion!)

The integration (platform threats + token launch + power)

This is compound power, not just compound interest, and I think all of this happening at the same time as the TikTok ban is important.

The TikTok Ban

In April 2024, a unified Congress passed a TikTok ban. A unified Supreme Court also ruled that TikTok US divesting itself has to happen in order for it to continue operating. Biden kicked the problem to Trump (I wrote about that here).

Trump said he would ensure TikTok would be okay (despite him trying to ban it a few years ago). Trump also met with China’s President Xi and was like, “That was awesome, we are best friends, we have plans for TikTok and a lot of other things.”

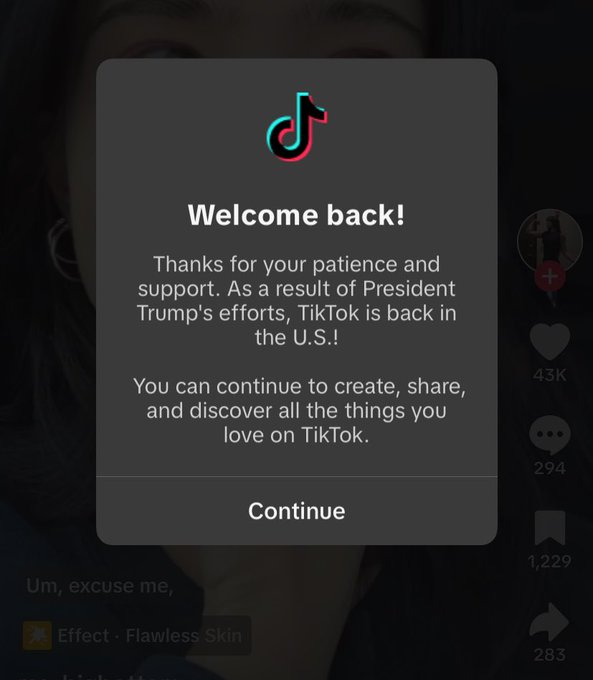

TikTok did go offline (as planned) on Sunday! But then it came back online the same day, thanking President Trump for bringing it back! Which was somewhat illegal of them!

And now Trump wants to buy 50% of TikTok and says he will surpass the Supreme Court and all of Congress somehow to reinstate the app, which is a pretty big swing!

TikTok’s story is part of the same feedback loop driving Trumpcoin. Owning TikTok would give Trump:

Platform Control: Access to millions of users and their attention.

Narrative Domination: A direct pipeline to shape public perception.

Economic Leverage: A tool to potentially amplify Trumpcoin’s value and consolidate wealth.

TikTok illustrates how global platforms are battlegrounds for attention and power. And not to 4D chess this too much, but it’s multiplicative power dynamics. Think about how this could compound:

The Perfect Attention Machine

What happens when you control:

Political position via executive power, regulatory threat capability, global influence, with instant market impact

Platforms via attention distribution, narrative shaping, and reality perception (plus user behavior data)

Token wealth via instant value creation, global accessibility, and pure narrative

Market power via price movements, trading dynamics, and finanical leverage

You get what might be the first true attention monopoly! Each piece makes all other pieces more powerful! It’s really a masterclass in the Art of the Deal.

It’s not just the money. It's the power! It’s attention through the memecoin and Tiktok, political power with the inauguration and US presidency, and money through the tech CEO alignment. It’s all perfectly situated and absolutely explosive at the present moment, and that’s a machine that is extraordinarily valuable.

Political Position ➝ Market Threats ➝ Token Value ➝ More Control ➝ Repeat.

Political Position Creates Leverage: If you can threaten to ban platforms (or people or enact sweeping tariffs, you have immediate leverage. If you do it through executive orders and ignore checks and balances, there is no traditional regulatory process needed. The threats alone move markets and create opportunities through immediate power projection.

Threats Create Market Opportunity: The markets are going to be very reactive to any political signals, and any sort of threat becomes a negotiation tool. All sorts of opportunities come from that.

Market Moves Amplify Token Power: You could argue that political action could drive Trumpcoin price, and a higher token price could mean more political influence and bigger political moves, because money is very much power.

Token Wealth Enables More Control: You could use Trumpcoin money to buy 50% of TikTok and use that platform to capture more attention, driving Trumpcoin price even higher (who knows if this will happen, but anything is in the realm of possibility). Infrastructure control expands. The power base solidifies. The attention distribution, the narrative shaping, the reality perception are all tremendously powerful.

What happens when political power, financial wealth, and narrative control all belong to a single entity?

The Attention Singularity

This is the birth of the Attention Singularity, where power, narrative, and wealth merge into one self-reinforcing system.

Think of the Attention Singularity like a black hole, but instead of gravity, it's attention that becomes so powerful it warps reality itself. We're watching the birth of a system where attention directly creates wealth (like $60B from Trumpcoin in 36 hours), wealth instantly enables power (potential TikTok acquisition), power captures more attention (platform control), and each cycle gets faster and stronger than the last.

Traditional limits like physical constraints, geographic boundaries, or institutional checks stop mattering because digital attention moves instantly and globally, while narrative overpowers physical reality. Once this feedback loop starts, it's self-reinforcing: attention creates wealth, wealth enables power, power shapes perceived reality, and reality drives more attention.

I am being sweepingly dramatic in these statements, but they are important to think about.

Back to the Real World

It’s the financialization of everything. The world is for sale! Each turn of this cycle concentrates power faster than the last. For example, bribery became a bit easier! Favors are as simple as buying Trumpcoin! That’s a wild thing! Some people say that it’s more like a ‘fan coin’ and that you can buy the coin to show support to Trump, which sure! But -

There are also real world concerns with the rise of memefication and speculation and grift. Real production could become secondary to narrative production - why bother with things like cash flow when all economic activity can simply be attention harvesting?

The more we treat things with no economic output as valuable, the less we'll actually produce. This isn't just about crypto or memes - it's about what happens when narrative production outpaces real production. It creates a deeper split of people (I am forgoing nuance in favor of simplicity):

Attention Harvesters: Create wealth through narrative and accumulate power rapidly wth minimal physical constraints

Real World Maintainers: The people who keep society functioning and deal with physical constraints. These people essential but undervalued.

As more capital and talent flow to attention-based ventures, essential infrastructure could become neglected and society could become more fragile. I am in LA with these fires, and my goodness, we need people who can be in the real world and fix burned down homes and maintain infrastructure and nurse communities back to health.

You can't fight fires with attention. You can't rebuild homes with narrative. Reality still needs maintaining. Speculation is good in the sense that it can maybe (hopefully) funnel money into these causes, but it’s grim if you zoom out too far.

Looking Ahead

This isn’t just about one token or one presidency—it’s a preview of how power will function in the Attention Age. The rules of the game are changing:

Speed: Wealth is created faster than regulation can react.

Scale: Attention-based systems amplify power exponentially.

Reality Distortion: Narrative becomes more important than production.

The implications are clear: we’re entering an era where wealth is created faster than regulation can respond, and reality itself is shaped by speculation. There are a few things to keep in mind:

For investors: Memecoins like Trumpcoin show the growing dominance of speculative assets. If you’re an investor, this signals a shift: attention is now a measurable driver of market value. You should probably have a memecoin strategy, if that’s of interest. Position yourself accordingly.

For consumers: The rise of platforms and tokens driven by narrative suggests that your attention is more valuable than ever. Be mindful of how you spend it as every click and view reinforces this economy

The Attention Singularity could reshape power and wealth creation in ways we can’t fully predict. If harnessed responsibly, this shift might fuel innovation and opportunity and I HOPE IT DOES! I genuinely hope it does. But ensuring this requires a collective effort to balance speculation with tangible progress—because reality, unlike narratives, cannot be ignored forever.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

There is speculation that he really didn’t know it would do all of this, which is completely valid. But somebody near him probably did.

You are describing the dotcom era. The idea of “eyeballs” before actual revenues and cash flow. Worked for a while, then came crashing down. It wasn’t real, except for a small few like Amazon who made massive wealth in the long run. But that didn’t prevent AMZN from dropping over 90% when the dotcom bubble was pricked.

When I read essays such as this one, Kyla, it scares me into thinking we are near a major market top. The dotcom mania was followed by a bust and the U.S. stock market that went nowhere for the decade of the 00’s, but did have two 50%+ drawdowns. Are we nearing that time again? Not sure, but your piece makes me think it’s ominously close!

I would argue that these coins are not value creation, but rather value extraction.

Much of finance can be described as the diversion of money away from the production of goods and services, and while it enriches some, in aggregate, this diversion of money away from production does not create value, but rather diverts value away from the "real" economy to the "speculative" economy.