The Parallel Economy and the New Rules of American Power

bots, manufactured recessions, and China

when the bots dictate policy

The Parallel Economy Mirage: A Bot-Driven Reality in an Age of Manufactured Recession

We finally got a softening inflation report, so not all is in a state of chaos! But across the United States right now, business owners, consumers, and workers have found themselves confused, and understandably so.

We have a few forces at work - (1) bot-driven information warfare has distorted our perception of economic reality and (2) seemingly deliberate policy volatility creates conditions for an economic downturn (3) and a Trump 'parallel economy' is positioned is emerging to capitalize on the resulting confusion - perhaps, reducing Trump’s market concerns. Understanding all of this requires unpacking four interconnected phenomena:

Bots: Automated (and hijacked) information flows have created an environment where most people don't know what's factually true anymore

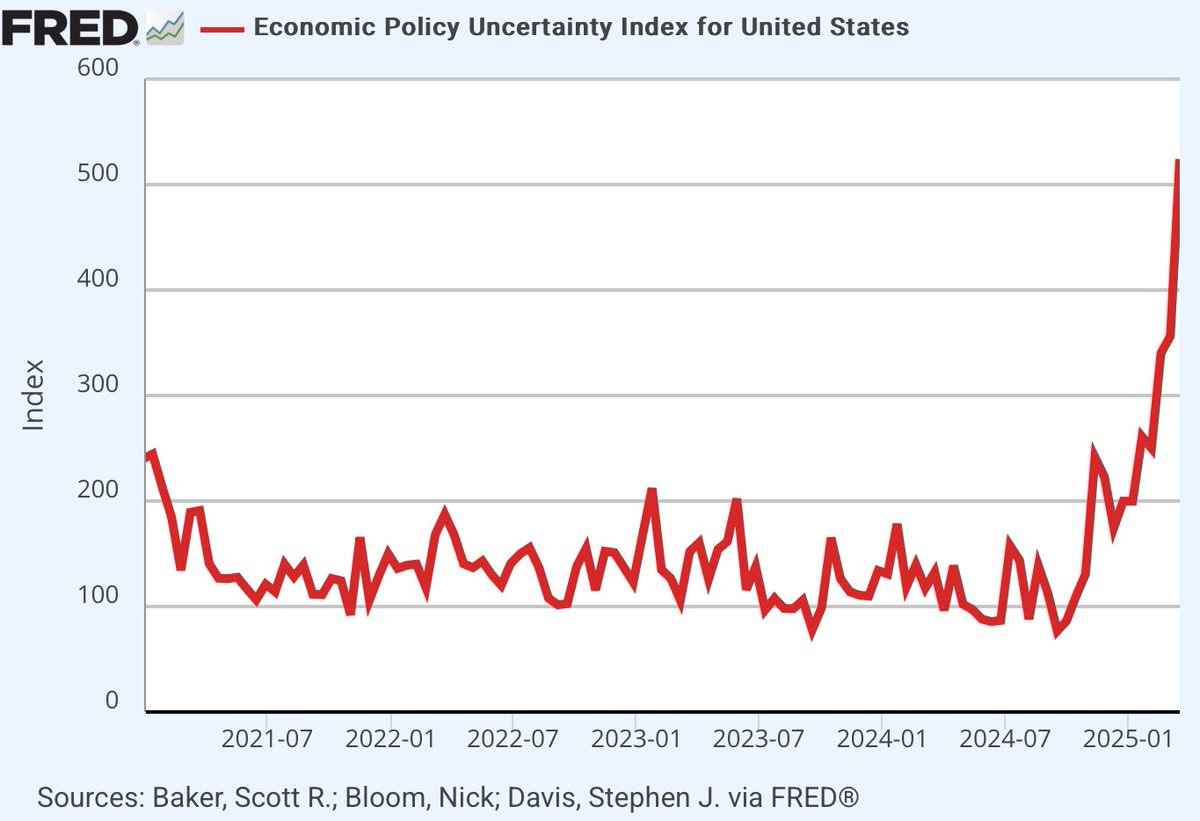

Recession: The administration appears to be intentionally engineering economic volatility as a "necessary detox” as I wrote about last week, with JP Morgan placing recession odds this year rising to 40% and Goldman Sachs to 20%.

Parallel Economy: The parallel economy built by Donald Trump Jr. is a reason why President Trump might not care too much about the market selloff.1

Fried Brains: We have ‘temporal dysphoria’. There is a profound mismatch between the pace of information cycles and the ability of humans to adapt to the change in said pace.

We're living in a reality shaped by automated outrage machines, while facing an economic downturn engineered through deliberate trade policy chaos. As this volatility harms everyday Americans, the Trump family could be positioning itself to profit from a parallel economy. Meanwhile, social media has so thoroughly warped our perception of time that we can no longer process events in a coherent timeline - there’s even a chart for it!

Let’s discuss.

Time, Tariffs, and Anxiety

The fact that we can’t exist in linear time not really surprising. Many people have talked about this, like Douglas Rushkoff in Present Shock (the NYT described the book as making “sense of what we already half-know”), Clay Shirky and filter failure, etc etc. But it is very apparent right now.

The tariff situation is walking back and forth along our economic spine, bones cracking with stress and uncertainty. After all, when are they going to happen? What?Why? How can Americans possibly recalibrate their career plans, investments, or family budgets quickly enough to match the pace of change?

They really can't. Each headline barely registers (maybe we text it to a friend, stare at the phone in dismay, sigh a bit) before being buried under tomorrow's (or the next hours) crisis. That impossibility in the face of constant change breeds either

Anxiety ("I'm falling behind!") or

Numbed resignation ("Whatever, I can't keep up").

Neither response builds the focused, patient civic engagement that functioning democracies require, and who can blame anyone for feeling this way. And naturally, our collective attention span becomes fragmented, incapable of following any single thread to completion. We text our friends a question, forget to respond. We make plans, then cancel. It’s not just us as a collective populace - it’s our leaders too. They get on TV with largely half-remembered arguments. We exist in a state of perpetual half-conclusion, where nothing is ever fully processed before the next urgent matter demands attention.

And that’s the state of the information ecosystem. It’s all half done.

Tariff Volatility

Tariffs are half done too. America has witnessed swinging trade announcements affecting relationships with Mexico, Canada, and China - in a single day, we saw Canada enact a 25% surcharge on electricity they bring into New York, Michigan, and Minnesota as a response to US tariffs so Trump then doubled Canada steel and aluminum tariffs2 again threatening them as the 51st state, and the Trump quickly undoubling as Premier Ford plans to meet with Commerce Secretary Howard Lutnick3.

It also seems as though Congress is attempting to surrender their power to revoke Trump’s tariffs (remember, Trump is using emergency powers under the guise of fentanyl and border security to enact these tariffs - Congress is the real body of power that has tariff authority). This could increase his ability to set tariffs and create even more trade and stability issues.

And if you zoom out, Pax Americana - that grand postwar project of American leadership - was built on two fundamental qualities we're now losing domestically: (1) patience and (2) focus. The Marshall Plan wasn't designed for immediate returns; NATO wasn't constructed overnight; global reserve currency status wasn't achieved in a news cycle! These were multi-generational projects requiring sustained, methodical attention - precisely the kind of commitment to time our frenetic information ecosystem now makes nearly impossible.

But what created this environment?

Bots: Reality Collapse Online

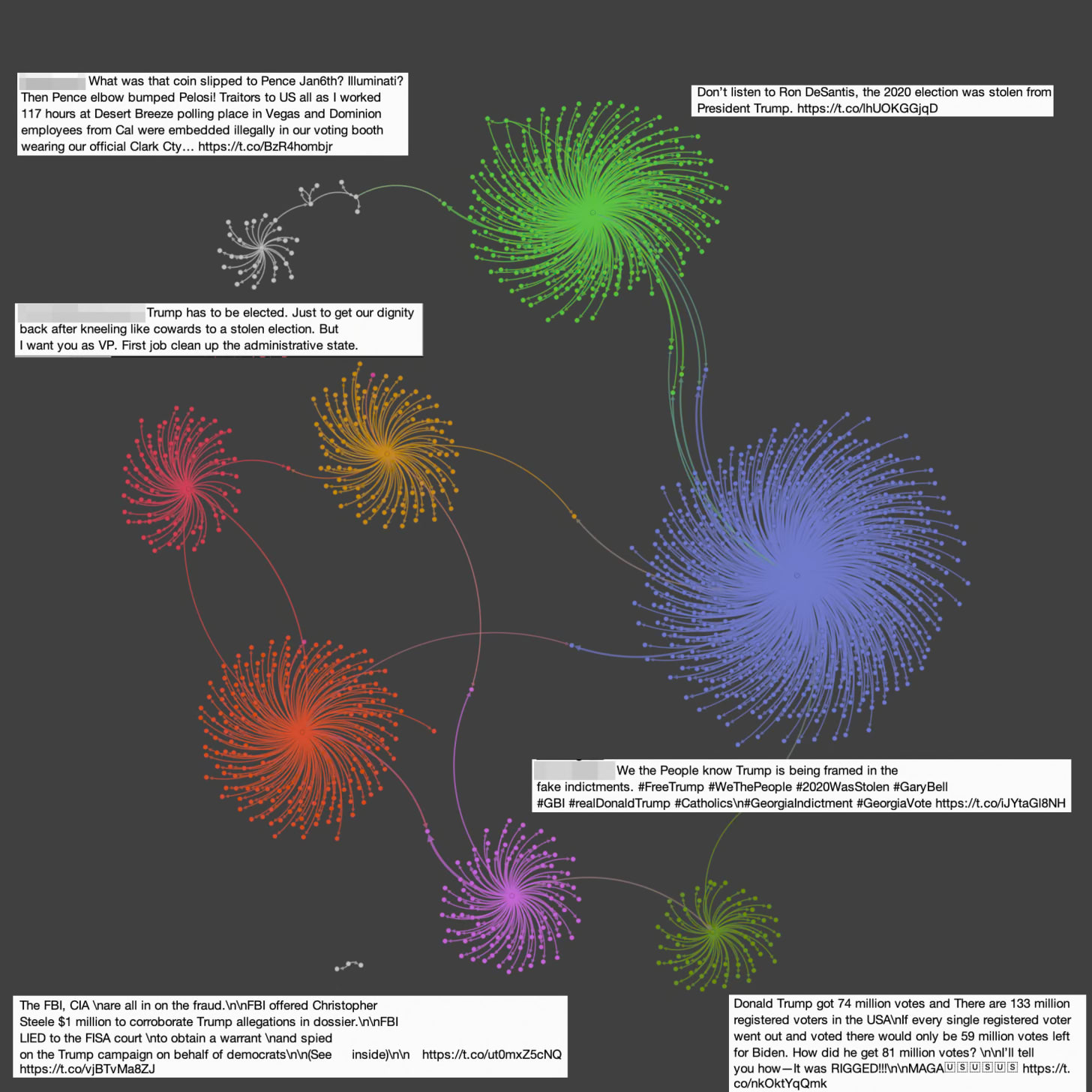

I think bots are one of the most underdiscussed problems we have, partially because they are so difficult to track. We don’t know how many bots are out there (although there do seem to be sprawling networks that get millions of views, as Timothy Graham has documented). But as Musk himself said

It is impossible to tell with unverified accounts whether you’re dealing with a small or large number of real people, as sophisticated bots are virtually indistinguishable from humans.

So according to Graham’s research, 1,300 bots garnered about 3 million views during the first Republican primary debate in 2023. They create all sorts of divisiveness, like spreading conspiracy theories (the Springfield cat situation) and harassing certain people (they like to get in my comments a lot). It’s very difficult to track bots, but their prevalence and usually strange pattern of speech make it certain that they are there.

There’s an extremely alarming video showing 50 social media accounts being run by an AI agent to which Elon Musk responded with an even more alarming take:

The bots are somehow more human than human, which is somewhat true, at least on the digital stage. We've created a world where (inflammatory) simulations of human interaction have become more "real" than reality itself.

On top of this, a large percentage of Musk's own replies come from bots, digital ghosts screaming at him in a machine that increasingly shapes his perception of economic reality. It’s not just Musk - JD Vance is also extremely online, Trump is a prolific tweeter - the bots have invaded the United States of America:

Facts, gone: They have created an information environment where factual economic understanding has been replaced by tribal signaling

Narrative, in: Conditioned people to accept simplified narratives about economic issues

No discussion: Accelerated the pace of discourse to the point where appropriate time scales for economic analysis have been lost (and discourse is lost too)

The 20 Trump Supporters Take on 1 Progressive video shows Sam Seder, host of The Majority Report, debating some young conservatives. The video itself is mostly interesting, because it’s a lot of top-down vibes-based analysis. It was a lot of “I think” and “I read somewhere”, a lot. Very little regard for fact and extreme confidence in opinion. And it revealed yet again that there are

Fundamentally different conceptions of American identity

Different conceptions of the proper role of government

Different conceptions over what constitutes a good society.

None of that is new! But some of these takes were frankly what I’ve seen from what seem to be bots in my own comments section. They are narratives that disregard all fact (like one guy was for certain that US government agencies get tax cuts for hiring diverse candidates, despite agencies not paying taxes).

This bot ideology is influencing how people feel about the real economy (including key decision makers like Musk). And honestly, part of the fuel behind the fire for an economic downturn could be these bots, which really are malicious actors trying to destroy the US. And the economic downturn is coming.

Manufactured Chaos: Do We Need a Recession?

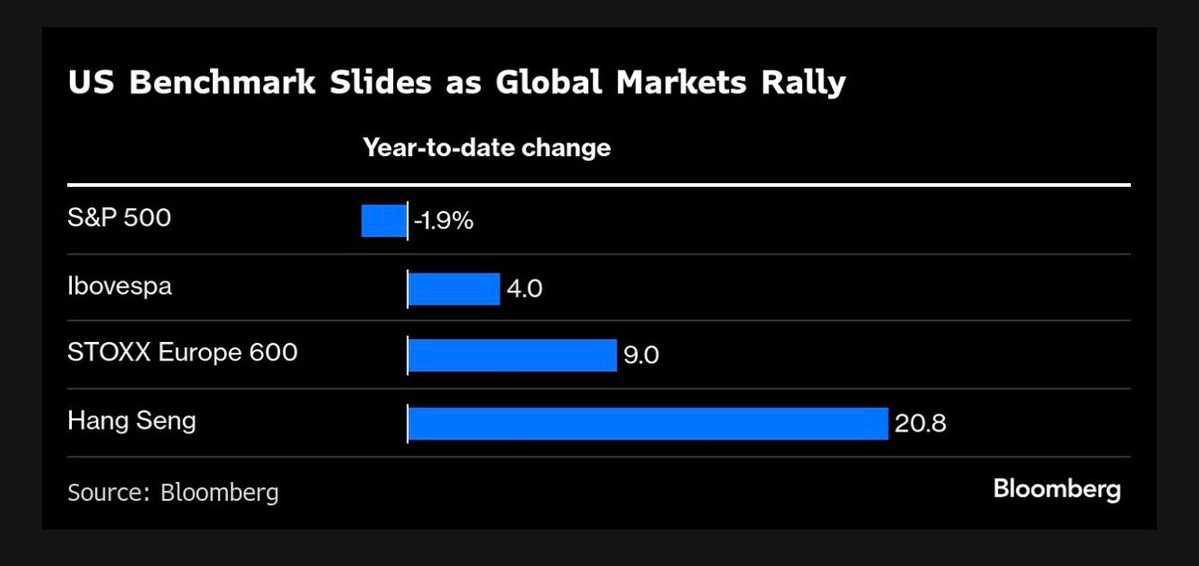

Where are we in the economic cycle? Tariff waffling has led to dramatic market fluctuations due to Trump’s shoulder shrug about recession concerns (although he’s understandably walked that back a bit)4. Citi has downgraded the US to neutral, upgrading China stocks, as China has outperformed the US since the beginning of the year. Part of this is the DeepSeek trade too - it’s not all tariffs hurting the market, the AI trade was overdone.

But outside the Magnificent 7, or the big tech stocks, we’re starting to see companies absorb the uncertainty too, beginning to guide lower on earnings over economic fears, which could translate into material problems for the stock market. Blackrock’s Larry Fink:

People are pausing, consumers are pausing, M&A is pausing, corporations are pausing, everybody is pausing and you start -- you're going to start seeing that in the economic results.

Fink has also come out and said that the deportations are going to crash the agriculture and construction sectors. He said:

With the whole idea that we’re going to have to use private capital to build out this economy — are we going to have enough workers. I’ve even told members of the Trump team that we’re going to run out of electricians as we build out AI data centers — we just don’t have enough.

People are chirping in the comments underneath the video where he says this saying “Larry doesn’t care about cheap labor and wants to keep the globalist machine running” (Trump has blamed recent market selloffs on ‘globalists’) - but even if that’s true, Fink is right.

We should bring jobs back: A lot of people will say (and rightly so!) that it’s good to bring jobs back to the US. We need them, especially considering what AI could do to the labor force.

But if we want to bring jobs back, we have to have the policies in place: What the Trump administration wants and what it allows for are two different things. ‘Drill Baby Drill’ was a big campaign message - but they’ve fired the workers who could approve the permits to drill.

And make sure we have enough people: Beyond that, there is an economic equation to solve - are there enough people to do the jobs? Not even how expensive is it all - do we have enough human labor to keep this thing going?

And… redesign the economy? The United States has moved beyond manufacturing as an economy - as Steve Hou pointed out, the US is a service-based economy that has “moved up the value chain over time”. Bringing back manufacturing could work - but domestic supply chains are complicated, factories are complicated, and there seems to be an assumption that the public will just move economically backward as things get more expensive.

There is an assumption that the economy can just absorb all this financial pain. There are all sorts of consequences that come with firing people, a lack of understanding on what ‘bringing jobs back’ even means, and ignores the fact that the US is a land of intermediate goods, importing bits and pieces to make a final product.

A construction contractor I met in Northern Kentucky a few weeks ago put it bluntly: "I'm supposed to be bidding on projects that will finish in 2028, but I have no idea what materials will cost next month, let alone next year. I can’t see straight." Behind the abstract economic statistics are real people making real decisions with increasingly little information to go on.

But - maybe we reshore everything back to the United States and all the jobs return and everyone fired gets rehired and it’s perfect - the problem then, is no one will want to trade with us. Political instability isn’t exactly appealing in a trade partner.

The Orchestrated Downturn

Instability is also not appealing for the general population. There has been contradictory messaging from officials about upcoming "detox periods" versus a campaign proposal of imminent prosperity. No one is saying the same thing, or they walk back whatever they said, while implementing policies that create immediate market volatility. For however you feel about what’s happening - that’s how it’s happening.

I wrote about the why behind all of this potential orchestrated downturn last week. Since then many others have called this an attempt to Volcker the economy - intentionally apply immense pressure to economy. Here, the administration seems to want to slow the economy so rates drop, debt gets refinanced, etc.

Trump and Musk seem to be copying Javier Milei, the president of Argentina, who came in with a literal chainsaw to help revive the Argentinian economy. It worked. But the US is not Argentina. As TS Lombard wrote:

Musk’s short-term-pain/long-term-gain thesis owes a lot to his chainsaw-wielding hero Javier Milei. Argentina introduced stinging austerity measures after Milei's election victory in December 2023, basically by freezing government spending while inflation was running in triple digits. After a brief recession, the economy has already started to recover – much faster than anyone expected. Inflation is coming down, and Argentina has swapped twin deficits for twin surpluses.

Milei's chainsaw worked! But copying the policies of a country that had massive endemic corruption and was on the brink of hyperinflation is, er, problematic. The public readily accepted Milei’s nasty medicine (they explicitly voted for it) and any chance of an economic revival had to start by crushing inflation. Confidence couldn’t return when inflation was running at 200+%. The US is in a very different situation. Yes, inflation is a bit high, but not so high that Musk and co should deliberately engineer a recession.

There is economic pain in the US, especially in the form of structural affordability, with the high cost of housing, childcare, and eldercare. And naturally, there's energy for tearing down institutions (and doing it haphazardly, for however you feel about the policies) and norms (without understanding why those norms exist), but precious little for the patient, methodical work of building new structures, communities, or systems to replace them. It’s just Wreck-it Ralph, except we are wrecking the 80 years of peace and prosperity many fought for, and many died for.

Alternatives to a Recession

The result is a swirling chaos (endless headlines, ephemeral crises) that yields no real new institutions or stable communities. It makes more sense to blow up an economy that wasn’t working, but the US economy (even with its problems) was doing okay. When Trump was asked about a Recession, he responded with:

We’re going to take in hundreds of billions of dollars in tariffs and we’re going to become so rich, you’re not going to know where to spend the money

Which is right, if we destroy all our trade relationships, we won’t know where to spend that money. I will recognize that there is truth in some of what Trump has messaged. He said:

What I have to do is build a strong country. You can’t really watch the stock market. If you look at China they have a hundred-year perspective. We have a quarter. We go by quarters. And you can't go by that. You have to do what's right.

Yes! The US is very well-known for short-term thinking. And thinking long-term could do us some good, especially in trade relationships. But what Trump seems to be hinting at is the idea that a Recession is necessary, that Americans should ignore what they're experiencing now for some promised future prosperity. But we don’t need a recession to fix the economy. Matt Darling:

Recessions are not a necessary part of the business cycle that lead to further improvements later. They are just human society not realizing its potential for an extended period of time.

There are unimaginable consequences: Nick Maggiulli wrote an excellent piece on why we should never hope for a recession, writing “Such declines have higher-order effects that could create problems for you that you would never anticipate”.

Homes are only cheap for those that can afford them: Most people probably won’t be able to buy a house at 50% off - that goes to those who have a lot of capital, like corporate landlords, as Marketplace wrote about here.

There is plenty of research on why we don’t need recessions

Milton Friedman believed that controlling monetary policy was the right way to correct the economy, not catapulting it into a downturn.

The ‘Green Recovery’ is a path, which is all about economic revitalization through regulatory and fiscal reform, rather than pain.

Ezra Klein and Derek Thompson cover a whole different path in their very good new book Abundance. You can move beyond demand-side subsidies and focus on supply! You can trust individuals! Zero-sum thinking should be eradicated! We have to revaluate alliances and allow reform! But as Henry Grabar wrote in his review, talking about these things know feels “like discussing how you’d like to redecorate your house while your neighbors strip the copper wiring from your walls". But - there’s a path.

There’s always the opportunity to expand, improve economic functionality, basically, make things better slowly, versus alternating between Very Bad and Very Good, especially if we are thinking in one hundred year cycles. But there is a difference between capability and capacity.

There is no promise the path to slowdown will work either. Olivier Blanchard wrote:

The reason for the apparent slowdown is extreme policy uncertainty, which is leading consumers to worry, firms to wait to invest, and demand to fall. In exchange for nothing particularly good in the future. Just a pure loss.

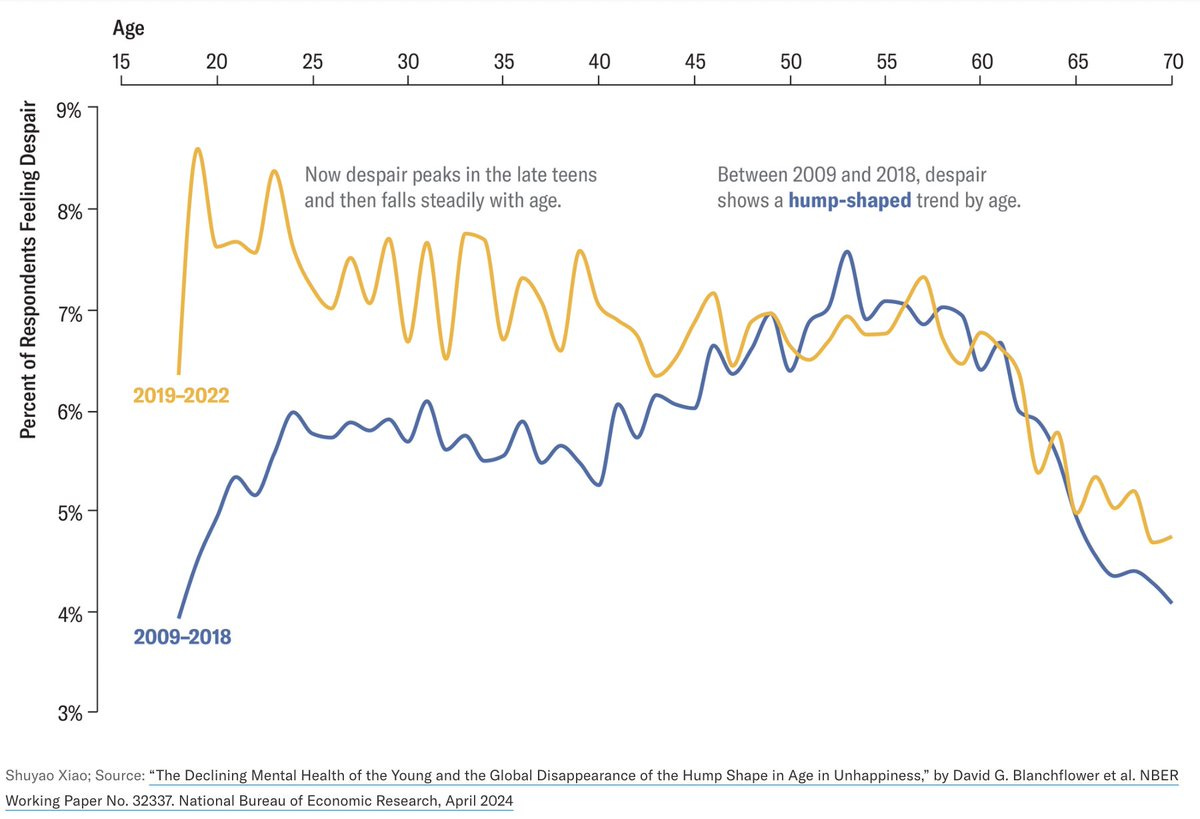

The recession rhetoric often suggests that current generations must experience pain for future generations to thrive which is again rooted in compressed time perception. In reality, economic harm absolutely reverberates through generations rather than "resetting" things. Just look at 2008. Many millennials have barely recovered.

Destruction can leave room for creation, but you still have to create. And there is something being created - right alongside the real economy.

The Parallel Economy: Profiting from Division

Bloomberg has a terrific writeup on 1789 Capital, the investment firm that Trump Jr joined instead of joining the White House. However - he did join the White House in joining 1789 Capital- he is “tapping into the MAGA ecosystem” and “monetizing his father’s vision for America” by sniffing out “the true MAGA faithful” to build this parallel economy which are “right-wing ventures that position themselves as alternatives to mainstream businesses”.

So this is essentially an attempt to build an economy for the true MAGAs, who in the short-term, can capitalize on cultural grievances, and in the long-term, potentially can build some sort of infrastructure to consolidate economic power during the recovery.

It will be a tough road - 1789 is apparently attempting to raise about $5b which is pennies compared to the $30T real economy. But it’s interesting as a project because they are -

Creating ideologically-aligned financial institutions to replace traditional banking

Investing in companies that position themselves as "anti-woke" alternatives

Using cultural signaling (like the Happy Dad seltzer) to attract consumers

Leveraging Trump Jr.'s massive social media presence to direct attention

What 1789 Capital is trying to accomplish is a world where economic participation becomes an extension of identity politics. And if you go and watch that Sam Seder video, you can see that there is emotional investment in cultural division, meaning that there is appetite for consumer facing ventures that align politics with consumption.

It hasn’t worked. The companies in this universe haven’t done too well so far - the right-wing version of YouTube, Rumble, is down 18% since their IPO, the anti-woke marketplace PublicSquare is down 73% and Truth Social, Trump Media & Technology group is extremely volatile.

But when economic understanding takes a back seat to cultural grievance, it doesn’t matter. The narrative does!

A form of this happened in 1990s Russia, where the oligarchs essentially took over and plundered the wealth from a system, leaving the masses in destitute. There was gatekeeping of political connection, shock therapy, and a suffering endured by the public for the promise (and never actualized) economic prosperity.

But this path makes a lot of sense. If you destabilize mainstream economic structures while simultaneously building alternative ones, you create perfect conditions for people to accept unfavorable terms. Feelings of despair in America now peak in our youth. It didn't used to be this way. People are feeling immense amounts of pain, all set to be worsened by a downturn. Capitalizing on that via political alignment makes sense - I don’t think it’s good, but it makes sense.

A parallel economy that places ideology above market clearing prices is probably not the best model to address that despair. Ideally, we’d see free markets, encourage home building (not enact tariffs that make that harder) and set ideology to the side so the economy can truly prosper. But - polarization is too profitable.

And it’s hurting us domestically, and on the global stage.

Pax Americana: Global Cost of Domestic Chaos

Like I said earlier, we are witnessing the gradual unwinding of Pax Americana - the grand postwar project of American leadership. For decades, American economic, military, and cultural hegemony created a relatively stable international system. That system is now visibly (intentionally) fraying, adding another layer of uncertainty to our already chaotic experience of daily life.

The reductive tactical thinking of “beat down our buddies and everyone else” is a system that prioritizes immediate victories over building anything sustainable. As America retreats from investments in literally anything that isn’t anti-woke and whatnot, competitors are accelerating their investment in tech, science, AI, etc. The global system is splintering, and each region is bracing for a more self-reliant future.

China is still battling deflationary winds but investing heavily (and chatting up our old allies). They have announced a trillion RMB ($138 billion) long-term national venture capital fund while simultaneously dominating renewable energy manufacturing across solar, wind, batteries, and electric vehicles. Their massive investments suggest they plan to emerge the sole victor of an era defined by confusion elsewhere. They have their own version of Starlink, which they are launching in over 30 countries. Their biotech sector is booming, as Odd Lots covered. Nuclear physicist Liu Chang, who was instrumental in helping the US achieve fusion energy has left Princeton to return to Beijing. And China and Europe will also work closely together on AI.

China has positioned itself as an alternative center of gravity, with President Xi proposing "a community with a shared future for mankind" while steadily expanding economic influence across continents.

European firms like ASML continue to dominate key semiconductor manufacturing technologies, and the region’s renewed path to defense spending has turbocharged R&D (despite headwinds). While the U.S. is busy slashing its own CHIPS Act, Europe is (albeit, forced to) quietly carve out a leadership role in the very fields that promise the jobs of the future. 2/3rds of arms imported by European members of NATO were from the US - which will change.

These shifts mark the logical extension of our domestic surrender to digital fabrications of reality! Just as the distracted, overwhelmed American consumer increasingly retreats into algorithmically-curated realities, America as a nation now responds to digital simulations rather than material conditions. The bots are helping to shape these types of policy, and we are seeing the consequences of that.

The U.S. dollar's status as the world's dominant reserve currency – long taken for granted – faces new pressures as policy volatility increases. The reserve currency is based on rule of law and stability, which is quickly disappearing. The United States has been added to the CIVICUS Monitor Watchlist due to declining civil liberties, as there have been severe encroachments of power, including the detention of Mahmoud Khalil, who played a big role in in the Columbia protests last year. Trump is demanding that universities purge students who disagree with him. For however you feel about what Khalil did - the precedent this sets is extremely dangerous for ‘free speech’ - and for stability and low corruption… and for the USD.

The erosion of Pax Americana is, in essence, what happens when a global hegemon becomes unmoored from material reality. When digital simulations, rather than human experience, drive national decisions, international leadership becomes impossible. The same AI-powered bots flooding your Twitter feed are, at scale, unraveling the fabric of global order by manufacturing outrage, polarization, and ultimately, paralyzing indecision.

Things Move Quickly

All of this works because it exploits vulnerabilities in how we process information and time.

When everything happens at tweet speed, a deliberately engineered recession can be sold as a quick "detox" rather than years of real human suffering.

When bots flood our information ecosystem with tribal signaling rather than factual understanding, we lose our capacity to evaluate economic claims critically.

When a parallel economy offers ideological shelter from the storm, it creates the perfect conditions for capital extraction under the mustache-and-glasses disguise of cultural alignment.

I am still traveling quite a bit (I write to you today from NYC, yesterday Miami, tomorrow Chicago) and the conversations I am having are with a tired, tired population. I was invited salsa dancing by a very kind Uber driver in Miami, and it reminded me of how easy it is to get lost in this, and it's designed for us to get lost. It's flooding the zone. It works! Even if it isn’t strategic, it’s wearing everyone down.

Building something better requires more than just the negative space left by torn-down structures. It requires the patient, deliberate work of construction—the very thing our bot-driven, temporally dysphoric culture makes increasingly difficult. We have to reestablish our relationship with time, which is an essay for a different day.

But it’s possible. People like Klein and Thompson are creating a blueprint to follow. We just have to separate ideology from economic participation - which things like the parallel economy will make much more complicated. But profiting from ideology only works for the few that can sow that division - not for everyone else. We also need to fix the bot problem - the United States is an incredible place and I love it very deeply - and it deserves more than destruction via social media.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Tommy Tuberville has said that the stock market was “overbloated” and Tom Emmer has used similar language saying “stay the course”. John Authers wrote about it a bit more in Why Trump Cares Less About Market Pain This Time.

Steel and aluminum are two things we should not mess with - they are inputs into housing, cars, infrastructure, anything and everything in the built world. Canada is 50% of US aluminum imports.

This really is a threat at this point, especially considering the dismantling of the American empire.

There’s a bunch of other stuff happening - The FAA is splintering and Musk is installing Starlink (which poses all sorts of problems, including a lack of security and risk management). NASA has eliminated its Office of the Chief Scientist, which will substantially weaken the role of the US in climate, space and tech. USDA has cancelled $1b in funding for local food for school lunches, hurting both farmers and children. Elon Musk has said that he wants to cut Social Security and Medicare via DOGE, calling them entitlements, ignoring that ~20% of the population relies on both of these services and that people pay into social security their entire lives. The Trump campaign also promised to *not* reduce these benefits. Hedge funds are now paying up to $1 million for weather experts to get an edge in trading commodities which is the unfortunate beginning of commodification of what was once a valuable public service. A clinical trial for a new drug to treat mouth, throat, and voice box cancer in veterans was put on hold - acting as if these patients somehow have the time to wait around, while the President sells Teslas on the White House lawn.

How do you process so much information so lucidly and quickly and consistently? And THEN manage to communicate it all in a digestible, contextualized way that sidesteps memetic warfare, engages seriously with the material reality of each angle, and then also manages to end with unforced optimism? Without losing your mind or needing regular escape/withdrawal (either from the digital or material realm)???

While traveling and spontaneous salsa dancing?? This is 4-minute mile stuff I’m serious

Super happy that you’re using your influence for objective takes in a world that’s deliberately being confused and misled.