Some thoughts on crypto narratives and polarized perceptions of the same things

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

Topics Covered on YouTube:

DISCLAIMER: I am invested in crypto. I like crypto a lot! However, I try my best to be impartial in all my work. None of the below is meant to be definitive “ah yes, Bad Thing” or “ah yes, Good Thing” just an objective analysis around a very dynamic subject.

In this piece I am going to talk about

Crypto narratives from inside and outside the ecosystem

Role of brands and financial institutions in shaping mainstream interpretation

How it all ties together - and the narrative overlap

You can watch the video of this article here if you’d like.

Crypto has a narrative problem.

I think this problem is pretty apparent to most people - the divisiveness of different projects, the vitriol at brands for launching crypto integrations, the interpretation of the cryptobro persona, and of course, the general vibe underneath any NFT tweet.

It is honestly horrific at times - people appear to truly hate NFTs and to hate elements of the crypto 1 ecosystem, as shown below (tw: death).

There was a video released recently called “Line Go Up”, a video that really, really hits hard at crypto. It’s a well researched piece around the perception that people *outside* the crypto ecosystem have of those within. At times the piece is way too harsh, becoming more attack vs analysis, but the core theme that Dan Olson lays out is:

Our systems are breaking or broken, straining under neglect and sabotage, and our leaders seem at best complacent, willing to coast out the collapse. We need something better. But a system that turns everyone into petty digital landlords, that distills all interaction into transaction, that determines the value of something by how sellable it is and whether or not it can be gambled on as a fractional tokens sold via micro-auction, that’s not it.

Or more succinctly

Buy in now, buy in early, and you could be the high tech future boot.

The video is correct in some spots (factually inaccurate in others) but the core takeaway from a lot of rebuttals like this one from Robin Schmidt from The Defiant were like “yeah, you know, the video is RIGHT, there are elements of crypto that are based on unsustainable hype - we are fixing that - but there’s also a lot of good things.”

Tim O’Reilly wrote a really good piece about web3 mentioning Sal Delle Palme’s argument:

“[If] Web3 heralds the birth of a new economic system, let’s make it one that increases true wealth—not just paper wealth for those lucky enough to get in early but actual life-changing goods and services that make life better for everyone."

Crypto isn’t interpreted as “true wealth” right now - it is seen as a function of ponzis, scam, exploits, etc. It takes time for things to work, for systems to calibrate - but what Line Goes Up did really well was distill the different narratives around the perception of the crypto ecosystem.

The thing about narratives is that different people can read the same book and have completely different takeaways.

We all approach the world with different filters, different lenses, and that ultimately shapes what we see.

BUT

I think Line Go Up and crypto are kind of talking about the same stuff - saying the same things, but differently - Dan outlines unhappiness with the System in his video - that’s also what crypto is all about. Towards the end of the piece, he talks about opportunities shrinking, about isolation, about the future seeming to disappear before our very eyes - underscoring that crypto is not the answer here. But this is also what crypto talks about - making a better System.

So why is there such a divide?

That’s why it’s important to discuss narratives.

The Narratives

note: I am going to be making very broad generalizations, so please take w a bottle of salt!

People outside the crypto ecosystem

They are like “wow, this kind of sucks? why would this be the future? when they see (1) ponzis, (2) the pump-and-dumps, (3) the (honestly) absurd allocation of capital into different shitcoins and say - “how would the world *ever* be better off by embracing this?”

People inside the crypto ecosystem

They know a lot that exists beyond the Shitcoins of the World - but the problem is, shit stinks2. It can be difficult to see beyond the shitty shit - to see how crypto can and has changed lives, the potential power of ownership and meaning, and what the underlying technology can unlock in terms of efficiency and execution for archaic industries.

You can’t have a perfect solution in an imperfect world.

BUT

The Overlap of the Inside and Outside

It seems that there are two distinct groups (simplifications of course) -

People who want freedom from the system (r/antiwork, FIRE, elements of socialism, etc)

People who want money (crypto, finance people, vcs etc)).

*Of course* there is crossover between the two groups - quite a bit actually - a lot of people in crypto aren’t in it *just* for the money, and a lot of people in the freedom section just want a world that feels a little bit more hopeful.

Both money and freedom are inherently functions of one another

It’s difficult to have freedom without having money (it’s just how it is, for better or worse) and the drive of money is often times to have freedom.

Both money and the desire for freedom are about being able to make choices that you want to make, spending time how you want to spend it, and engaging in things that you care about while knowing that you and your family are secure.

Freedom = f(time allocation, choice, money)

Money = f(stability, freedom, choice)

This makes sense. Most everyone is frustrated with the System, as the comments under Dan’s video and in various crypto discords highlight. There is increasing desire to be free from the 40-hours-a-week-9-to-5-jobforhealthcare-retirementplan-commute-30-minutes lifestyle. And crypto is inherently an answer to that - it’s people at least trying to disrupt a system and make it (on paper) more fair, more accessible, and to shift the power distribution.

But it isn’t interpreted this way, broadly speaking.

There are two delineations of the narrative.

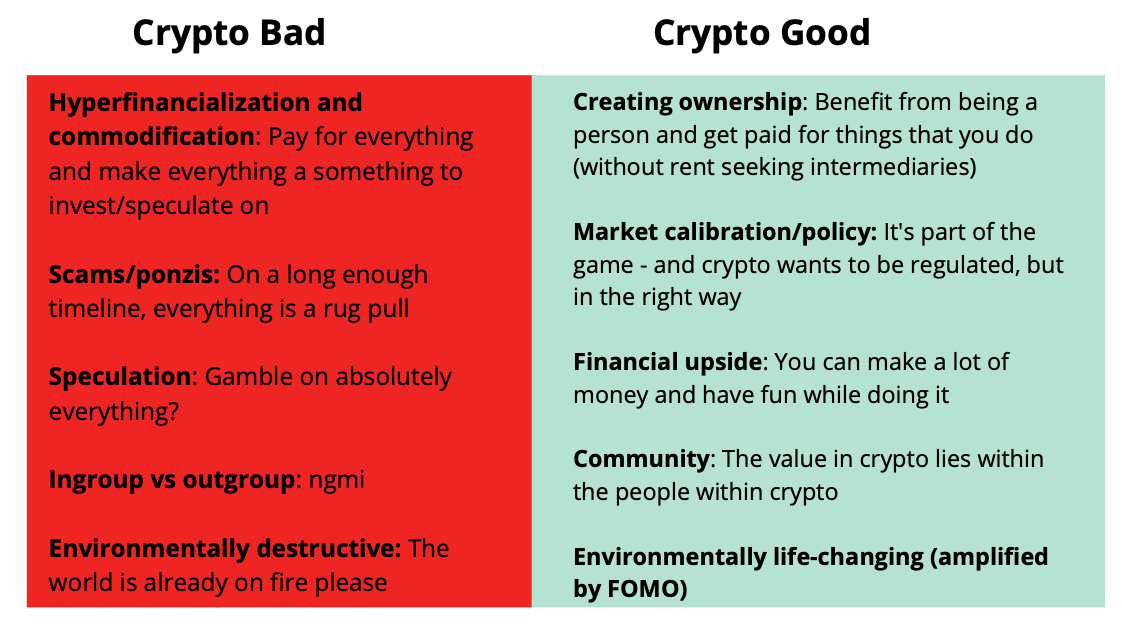

I am first going to discuss the “Crypto Bad” narrative, then the “Crypto Good” narrative to underline what the differences in interpretations are - Crypto Bad sees hyperfinancialization whereas Crypto Good sees the ability to create ownership, etc.

The Crypto Bad Narrative 😡

Those outside the ecosystem see 5 key things when they look at crypto (once again broad generalizations, these are some of the more extreme takes):

1) Hyperfinancialization and Commodification (of your soul)

Pay for everything and make everything a something to invest/speculate on: Do we really need to make every single thing a microtransaction? Is it entirely necessary to break access into dollars, and to have every aspect of our lives become another speculative market?

A lot of people want a return to simplicity - and crypto *complicates* that

2) Scams/ponzis

Scams, pump and dumps, rug pulls are definitely one of the most well-known parts of the crypto ecosystem. Scams are the common denominator. Ponzinomics are a whole different ball game, “what is the intrinsic value besides thing go up” - and when the answer is “nothing”, well - what?

3) Speculation

We have a very big gambling problem in modern society. Lottery tickets are such a paradox (they help to fund education) but also gambling is an incredibly harmful and very very very painful addiction.

Crypto seems to encourage massive speculation, which is very hard to separate from gambling (something something positive expected value).

The vibe is very much, “bet on this coin because Elon Musk might tweet about it ;) and if he tweets, to the moon.” This narrative is a thread in the GME/AMC saga too - if we all do it together, it will go up in price.

Both GME/AMC and crypto have an element of an anti-establishment baked into the concept, but like ??? also what - how is betting on mooncoin go up doing anything for society? (what even is society?)

Also a lot of the NFT art is just… not good? This just seems like fancy gambling? You’re going to pay hundreds of thousands of dollars for a picture of a xyz, in this economy? Ok - and still, you can make money off of it?

4) Ingroup vs outgroup

“You’re ngmi” they say. It’s very common for communities to adopt their own language (primarily to signal who is cool versus who is not) and if you’re out, well - good luck getting in because the brain is literally working against you.

5) Environmentally Destructive

The Earth is on fire? you want us to simply accelerate the Earth’s demise so you can make $100 bucks on a coin named after a dog?

Also the pressure that crypto mining puts on already weak grids is just ?

Crypto Bad Narrative, Summarized

Crypto is a microcosm of the world it emerged from - it’s very hard not to have the impact of legacy systems bleed into new systems. And the current world looks like this to a lot of people:

And crypto only makes that worse, to many. It is the (1) badness of banks during the GFC amplified, (2) the destructiveness of Facebook multiplied and (3) environmental destruction of oil producers dumping their product into the ocean intensified.

It’s the widening wealth gap - but saying the silent part out loud - “I can afford to spend HUNDREDS OF THOUSANDS of dollars on a monkey picture, sucks to be you living pay to paycheck hfsp”

In a world where millions simply scrape by, it can feel brutal to see that. Not saying that it’s good, bad, whatever (who knows) but that’s how many *feel*

We have a lottery society, but it’s not hidden behind gas station tickets in crypto - but rather for all the world to see, and to brag about. It’s getting rich from something that doesn’t seem to make the world at all better - which can feel… bad… because the world is already kinda… bad, to many.

The one sentence summary of “Crypto Bad” and the entire thesis of Line Go Up is ultimately:

Our systems suck - making our lives speculative commodities isn’t the answer.

But on the flipside of that…

The Crypto Good Narrative

And of course, crypto is not entirely like that (of course it isn’t, nothing is ever usually as extreme as we think it to be). Before we get into this part, it’s very important to highlight that there are different segments of crypto (obviously but still). (1) Some people are literally just in there for money and (2) other people for real world use cases of the technology. Crypto sees the 5 points of the narrative more like:

1) Creating ownership

Through engaging with This Thing, you get This Token, which will enable you to Benefit and Own the Things you engage with. Tokenize to get the value from it. Simply Benefit from being a person - which is kinda cool - and don’t pay rent seeking intermediaries (decentralization). Get paid for the things you do. And build a better world because of it.

2) Market calibration

Losing money is kind of part of the process of learning :-/

Rug pulls are part of the game: If you invest in enough projects, you’ll encounter some sort of rug pull. People will tilt the table slightly in their favor, and all of the sudden - you are liquidated. This isn’t a good thing - but alas.

Enough scams, people will learn over time (hopefully) and become more discerning, reducing scam effectiveness (once again, hopefully - 2021 numbers looking a bit rough)

Exploits are part of the game too - Wormhole is a very unfortuate example of that

Ponzis games vs Ponzi schemes: These are a bit different- we are in the depths of MLM in web2, so of course there will be some ponzinomics in web3. The core thesis boiling down to “If you HODL, we all HODL, and become massively rich”. That works until it doesn’t.

Most people know that tokenomics that rely on “more money come in, thing go up” doesn’t *really* work

2.5) Policy

Crypto policy is interesting because it’s the system trying to calibrate around something entirely new - and politicians have no idea what they are regulating.

Regulation is synonymous with an element of acceptance - and usage, which is why this is so important. Crypto wants to be regulated - but in the right way.

3) Financial Upside

You can really just make gobs of money in the space, if you’re positioned correctly (you can also lose gobs too, markets are two-sided interactions).

So people say, “hey why not participate in this pretty cool opportunity to make some money beyond what I make as a Worker?” Literally, why not?

HOWEVER, *markets are two sided interactions*. It’s a zero-sum game - all markets are. Some end up as exit liquidity (very similar to the antelope that runs the slowest being eaten by the lion). This isn’t the main goal (usually?) but rather a function of the environment of lots of fast and furious projects.

ALSO HAVE FUN with financial upside - Dune Analytics just raised $69,420,000 (because they can and because yes life is a meme)

Everything is simply ironic and self-deprecating. Don’t take yourself too seriously because at that point - you *really* don’t understand what this is all about.

4) Community

The value in crypto lies within the people within crypto. People build together - L2 scaling features to make Ethereum more accessible, they build alternatives to Ethereum, they becoming hyperfocused on Doge, they buy a Bored Ape - the common denominator in all of that is the concept of community.

Sometimes I feel so alone in the normal life like nobody understands me but here in crypto, everyone gets it

Sometimes I feel so alone in the normal life like nobody understands me but here in crypto, everyone gets itThat’s also what crypto offers - a derivative of religion, a place to feel like you are amongst people who value and respect you.

5) Environmentally life-changing (amplified by FOMO)

This is from Zeneca, around the concept of regret and missing out on certain trades. It does a really good job at encapsulting the FOMO that exists - “ah dang, I didn’t get in, and thus all wealth will be lost to me” - while also underscoring how much wealth is out there.

And *seemingly* everyone is FOMO’ing in or at least embracing the environment. The lines between web2 and web3 are beginning to blur, and innovation and investment are everywhere.

Crypto Good Narrative, Summarized

It’s about access and opportunity, about creating paths for those that previously had none, about connecting the world to this common goal of truly *owning* things. It’s about taking the power away from social platforms selling the soul of your data to Big Ad. It’s about David winning against Goliath (unironically, “showing the power of his God” aka crypto to an extent).

It’s about creating community (even though it can be confusing but that’s okay!!) and changing the world. For the better. Protect, own, benefit.

Take the widening wealth gap and shrink it. Provide alternatives. Don’t allow the power dynamic to get so skewed that it’s almost impossible to balance the scale again.

The one sentence summary of “Crypto Good” is:

Our systems suck - and we can have a choice in how we choose to protect, own, and benefit from the world around us

The Interpretation of the Narrative

In summary of both sides of the narrative -

But alas, both of those are very extreme interpretations.

I wrote about narratives a few weeks ago and the problem with the narrative interpretation of web3:

So this narrative of what web3 could be - which would probably be net-beneficial for most people - gets skewed because the narrative gets skewed. It could be percieved as an equitable, cooperative, and accessible world, but it isn’t. From an outsider’s perspective, the narrative is not being translated in the right way. Most people still see crypto as an get-rich-schema-for-already-really-rich-people, and that is not… appealing. It’s really two main threads

Economic change: Crypto is going to change how the economy functions, digitize everything, make us own everything, and change how we work, play, etc

Ponzinomics: This is really just a promenade of wealth, and its a bunch of rich people getting richer and leaving everyone else behind.

It is *always* about perception. It’s about narrative. Everything at the end of the day is a byproduct of how people interpret it.

If you zoom in on either argument, there are flaws to both. Crypto is not perfect quite yet (?nothing is?), and requires a massive tech stack in order to really get deep into the ecosystem. And democratization of wealth is kind of fuzzy. As Matt Levine wrote:

There are endless profiles of people who have become billionaires by starting crypto exchanges, trading platforms, market makers, derivatives businesses, etc. (Meanwhile I have never read a profile of someone who became a billionaire by using crypto to solve any problem other than trading more crypto but never mind!)

The crypto ecosystem is a stacking of blocks - and we can see narrative interpretation play out here. It’s composed of brands, financial institutions, and ~more~.

Narrative in Action

Brands

Brands want to play. They want to remain relevant. So Brands develop NFT projects and build in the Nike metaverse, and even attempt to become the incongruous metaverse itself (which definitely hurt in their recent earnings). It’s about testing out the ecosystem (for Zuck, it’s about controlling it but still), figuring out how they can leverage the technology, and allowing fans to engage alongside them. It’s a function of:

Relevance: Might as well keep up with the cultural zeigest and mint some NFTs.

The Future: Attention is one of the most valuable commodities in the world. If you can figure out how to tap into that, you might buy yourself more runway into the ever-uncertain expanse of space before us.

This can either go very well or go very badly.

but also…

See, it’s confusing.

Financial Institutions

Traditional finance institutions and the venture capitalists.

Note: regulation of the financial institutions and crypto is a whole different story (check out Coin Center for more on that)

Tradfi

So these guys like to make money. They are money experts, they know the flows, they know the system, they *Get it*. They specialize in markets, in finding discrepancies, in truly making Line Go Up.

So yes, they are going to be into crypto. This is their DNA - derivates, leverage, yield farming etc etc with HUGE upside? Say less. And they are in the crypto ecosystem now (BlackRock is launching a Blockchain ETF and the quest to get a spot ETF is long embattled). They see financial opportunity here.

The Ontario Teacher’s Pension Plan invested in FTX’s most recent round - a huge sign that the institutions are HERE (and that they’ve been here). This is for a few reasons:

Yield: It is very difficult to make money in some segments of the market. Bonds are basically emaciated cash reserves, some stocks have gone up a bit too much to see any future returns (maybe?) and it’s just tough out there for your typical stock picker. So they need yield - crypto is yield! It doesn’t matter that it trades like the Nasdaq right now because maybe one day it won’t.

Diversification: This holds hands with yield - crypto is an answer to “wow is everything actually Apple/Google/Facebook?”. It provides the opportunity to lower the overall concentration of funds and portfolios, which is a Big Thumbs Up in the finance universe.

Financial Upside: Yield is here too - but crypto has made a lot of people lifechanging wealth. It’s about number of occurences - a couple of odd bets here and there, and one could be a winner (this is also the exact definition of venture capital, which I will touch on later.)

So yeah. “Why wouldn’t we?” is basically the financial institutional narrative to investing in crypto.

Venture Capital

I wrote about this last week, but VCs are ~here~.

Crypto and high-flying tech are both flush with a lot of VC dollars, a lot of wall street dollars, a lot of global macro narrative dollars. Because of this, those dollars move according to the risk assessment of their holders - meaning that crypto kind of ends up trading like big tech, a lot of risk on, risk off cyclical movement.

This isn’t a bad thing - it’s just how the market prices the risk that it sees.

VC dollars are flowing in - HUGE amounts of VC dollars, pushing projects up to $100-$200m valuation, pre-product, pre-idea, pre-pitch deck - and that puts pressure on the entire market.

VCs are an interesting character in the space - sometimes they are the enemy, sometimes the friend, but the common denomiator is that they are the financier, offering millions and millions of dollars to (seemingly) anyone with a tokenized revenue model and the mention of web3 in their pitch. The awkward/necessary (?) thing about venture capital is that they are seeking returns. They invest in things literally because Line Go Up - and they can throw pasta at the wall and see what sticks, but their main goal is to be able to have a solid exit.

Return driven investing backdropped by FOMO and hype: They are investing in crypto companies because one day, there is an inherent expectation that this will return them a Lot of Money, which makes everyone happy. Of course, not every single company will (most won’t) but the ones that do make it all worth it.

VC is speculative - it’s either a bet on founders or the idea itself. And these mini-bets are an infusion of capital that right now is putting a floor on the entire space.

Quick Thoughts on the Fed

There are other influences - including The Federal Reserve of course - or really, what the Federal Reserve stands for. This was very apparent over the past few weeks as the Fed announced that they will indeed be raising rates (and they mean it this time!) so the stock market and crypto pretty much lost their minds the entire month of January. Crypto became beta to tech - which shot the whole diversification narrative down.

The Fed announced that it was Time to Tighten Economic Conditions, and that no longer would things be easy - so people reallocated away from tech/crypto and into stalwarts like energy and utilities.

Until they rotated back - because we do, live in a loop after all.

But the market is pretty uncertain right now - we can see that reflected in the VIX, by muted inflows, by just general market movement. Geopolitical risk, is economy actually okay?, general speculative bubble worries - things are ~spicy~, to say the least. This is compounded by a few things, all of which impact crypto too:

Energy markets: I think that crypto has a fair amount of risk here that is often underdiscussed. Rolling blackouts in Central Asia and Russia don’t bode well for stable energy access.

OPEC had a 16 minute meeting in which they agreed to increase production by 400,000 barrels a day for March - but the worries of underproduction, underinvestment, and resource constraints are strong.

Speculative dry up: If energy prices start to inflate (like really inflate), that works to execute the Fed’s goals for them of contracting the economy (#efficiency)

Speculative dollars are funneled back into less speculative assets (like oil) which deflates the entire speculative bubble. So. That could be bad.

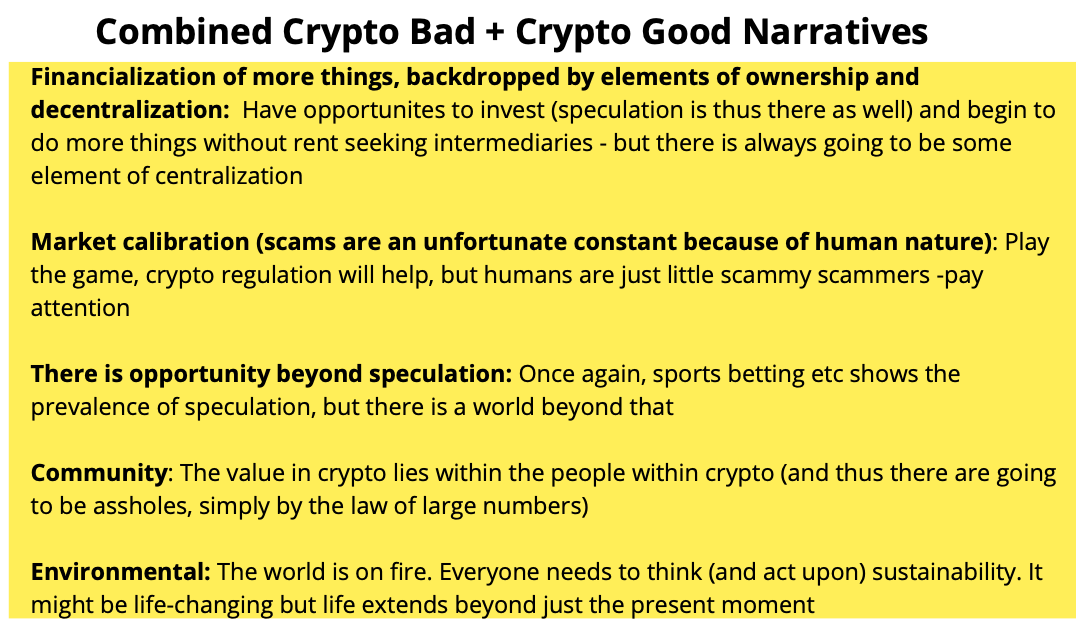

The Narrative, Summarized

Well, the point is that crypto is aware of what needs to improve - and there is more overlap between the crypto bad and the crypto good than I think people realize.

So i think it looks more like this

Yes, there's financialization of more things, but it’s backdropped by elements of ownership and decentralization

Market calibration - scams are an unfortunate constant bc of human nature.

There's opportunity beyond speculation to actually have true investments.

Community - people do make crypto valuable, but there's also assholes everywhere. Avoid the assholes.

Environment - the world is on fire. We have to have sustainable energy. This goes beyond crypto. This goes directly to policy makers.

We have to think about life-changing opportunities, but we also have to think about life beyond the present moment.

Of course, this is a rather subjective and very qualitative analysis of the ecosystem.

Markets are both qualitative and quantitative. Markets are somewhat reflections of the world that we want to see - we invest in companies that we hope will Do Good For The World (most of the time...)

But sometimes, the world seems not good.

Both inside and outside crypto, there is clear unhappiness with how the world is moving forward. The fact that we are reverting back to coal production, the fact that we *still* have issues with worker’s rights, that we simply can’t wrap our minds here in the U.S. around how to have healthcare - it’s kinda like

“Is the world just a massive shitcoin?”

So.

What do you do? Where do you find hope and meaning?

We have two groups that actually have relatively similar goals (crypto bad and crypto good), but different interpretations of the narratives (and tech, process, etc) that it takes to get there.

There is a lot that crypto can do to improve it’s perception - Casey Newton highlighted some - including making transactions more reliable and implementing scaling solutions (faster) (which people are working on). He highlighted Molly White’s piece on the importance of cleaning up privacy concerns on the blockchain.

There is the hype part of the narrative (This can be the Future) and the reality (This is the Future).

Both crypto skeptics and crypto enthusiasts have valid points - maybe hyperfinancialization to the point where we are paying to unlock our coffee machine and our toothbrush (as Cobie points out) is not good.

But having an idea for how we can build a better future that allows for access, opportunity, and benefitting from previously very gatekept systems - is pretty good. It’s just about how it’s perceived - and ultimately, how it’s implemented.

Humans are gonna human at the end of the day - and a lot of the narrative is around that. We are always not going to get along to a certain extent. But I think these two seemingly polarized groups - those that resonated with Dan Olson’s video and more, and those that are deep within the crypto ecosystem, have more in common than they might think - and I think there is room for some reconciliation - which would be very valuable to beginning to build the better future that both seem to want.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

When I refer to crypto, I am referring to the broad ecosystem - the metaverse, the tokens, the networks, NFTs, DeFi, etc

haha

Great piece. I think another interesting aspect to the narrative difference that I've noticed between young friends of mine is a divide between those who are financially well-off and those who are struggling to get by. Most 'successful' young people I know don't have much interest in negative yielding bonds, overpriced housing, expensive equities, or commodities like gold--they see crypto as a good investment opportunity and are happy to do the research and see past the scams.

On the other hand, my friends without investments don't have a reason to go past that first layer and just see crypto as an extension of a broken system. When they get conditioned by financial and climate issues that are poisonous, a lot of them stop looking for solutions and are now adopting something akin to China's Lying Flat situation (which resonates through antiwork).

I'm not sure how the two sides will resolve things.

I appreciate that you weave elements of morality, social responsibility, insiders versus outsiders and FOMO into the narrative. The rubber may never hit the road but we have to continue forward, holding that image.