Why Money isn't Real

or how SHIB flipped DOGE, why Facebook become Meta, and what it all means

Last time, the trucking crisis, small businesses, supply chains, ad spend, Zillow, and hyperinflation, today I am talking about the disconnect from reality.

If you’re already subscribed, thank you! if you’d like to subscribe hit this button here:

YouTube/podcast up soon

The meme markets are the markets.

I wrote back in January:

Memefication is a function of information access, and subsequently, the market is fueled by this meme access. This is a broader sociological phenomenon, but meme markets show the growing power of the retail investor, as well as the structural cracks in the current market.

Borrowing from Dawkins:

Socrates may or may not have a gene or two alive in the world today, as G.C. Williams has remarked, but who cares? The meme-complexes of Socrates, Leonardo, Copernicus and Marconi are still going strong.

The meme complexes of the financial system are going strong. The market is no longer driven by fundamentals - it’s driven by memes. No longer a metaphor, but a living structure – the stonk market.

Our entire world has become the stonk market.

What happens when money no longer becomes money?

At a high level, money is increasingly becoming divorced from our reality. There are likely a couple of reasons for this:

Gold standard: I know this is a tired tirade, but money that is “backed by the full faith and credit of the U.S. government” is money that is backed by guns and power. It only has value because we all collectively agree that it does.

Hyperinflation is a great example of this not working: Weimar Germany. People stopped believing in the German Mark (because no longer did the government make sense), which led to its downfall

Collective belief driving the value of assets: This is a really big theme in the markets. People believe that something should go up by x%, so they funnel their dollars into it, it goes up, more people funnel money into it, it goes up more.

A lot of stuff stems from the mindset below: “but what IF IT DOES”

So when you look at the dog coins, notably DOGE and SHIB, it sort of makes sense. They are driven as much by collective belief in a meme as the U.S. dollar is driven by collective belief in the full faith and credit of the U.S. government.

Schrodingers Dog Coin: SHIB

SHIB took off recently, just like DOGE did before it. The memecoins never pretend to be anything more than a meme (mostly). But someone made an absurd amount of money off a $8,000 initial investment - atmospheric returns, really.

The most interesting thing about the SHIB trade is they likely can’t get out of it.

How are you going to pull $5.3billion from a meme coin and not cause a crash? Where is the liqudity on the other side of that trade?

So much of crypto relies on inflows - people betting that it will continue to go up, so these the dog coins truly do trade beta to flows (meme fundamentals)

But then the paradox begins:

Are you really rich if you can’t get the money?

If you can’t get the money, doesn’t that mean the money isn’t yours?

Is the dog coin alive or dead?

There is always a centralized ring around the pump-and-dumps (there has to be, or else you can’t get the collective belief). And this is fueled through FOMO fundamentals.

FOMO: There has to be some sort of “move now”, a “wow dude if you don’t get in now, game overrrrr” sort of ideology

These are the underlying fundamentals of this game - it’s not cash flow and profitability, it’s fear and get-rich quick

The gamble: The SHIB coin and broader memecoin phenomenon is interesting because they don’t pretend to be anything that they aren’t. It’s a dice roll.

But someone is always pumping: Memes only get you so far. SHIB sent Vitalik $1.4billion in $SHIB as a marketing scheme, which he promptly donated. $SHIB had to scramble around, get the bags to pump, and the fastest way to do that is to meme yourself (and probably have some sort of inside game, as Matt highlights below).

The Game is Always Being Played

Recently, Punk 9998 was bought for 124,457.07 ETH ($532,414,877.01 USD) - an ABSURD amount of money right??? - and it was essentially two wallets pushing money around.

A great marketing move (get in the game, millions of dollars dude!!)

Massive amounts of FOMO fundamentals

And that’s what you have to do right? Because none of this would work if there wasn’t this element of FOMO, if people didn’t feel like they were missing out on once-in-a-lifetime wealth.

Because if you can make $500million off selling a Cryptopunk - why wouldn’t you?

Who wouldn’t take the upside of that bet - sure, I’ll throw money into the ring!!!

Why wouldn’t you? - and that’s where the value comes from.

FOMO fundamentals.

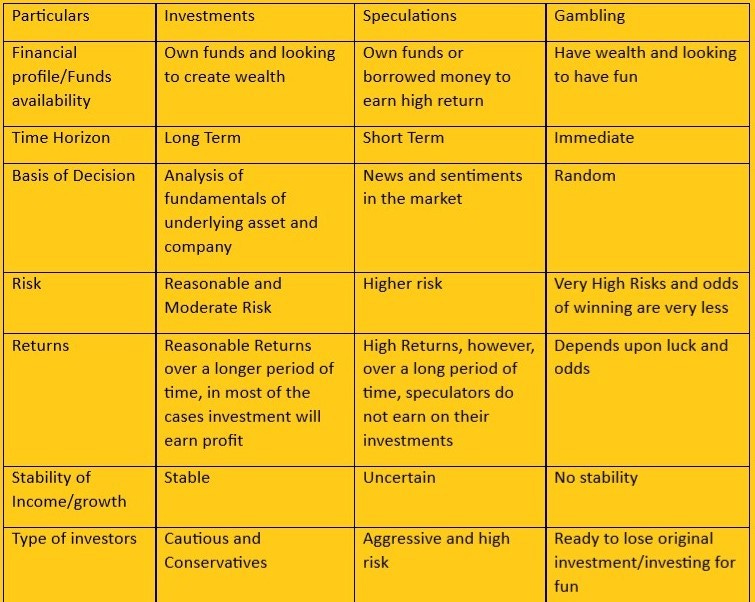

Speculation vs Gambling

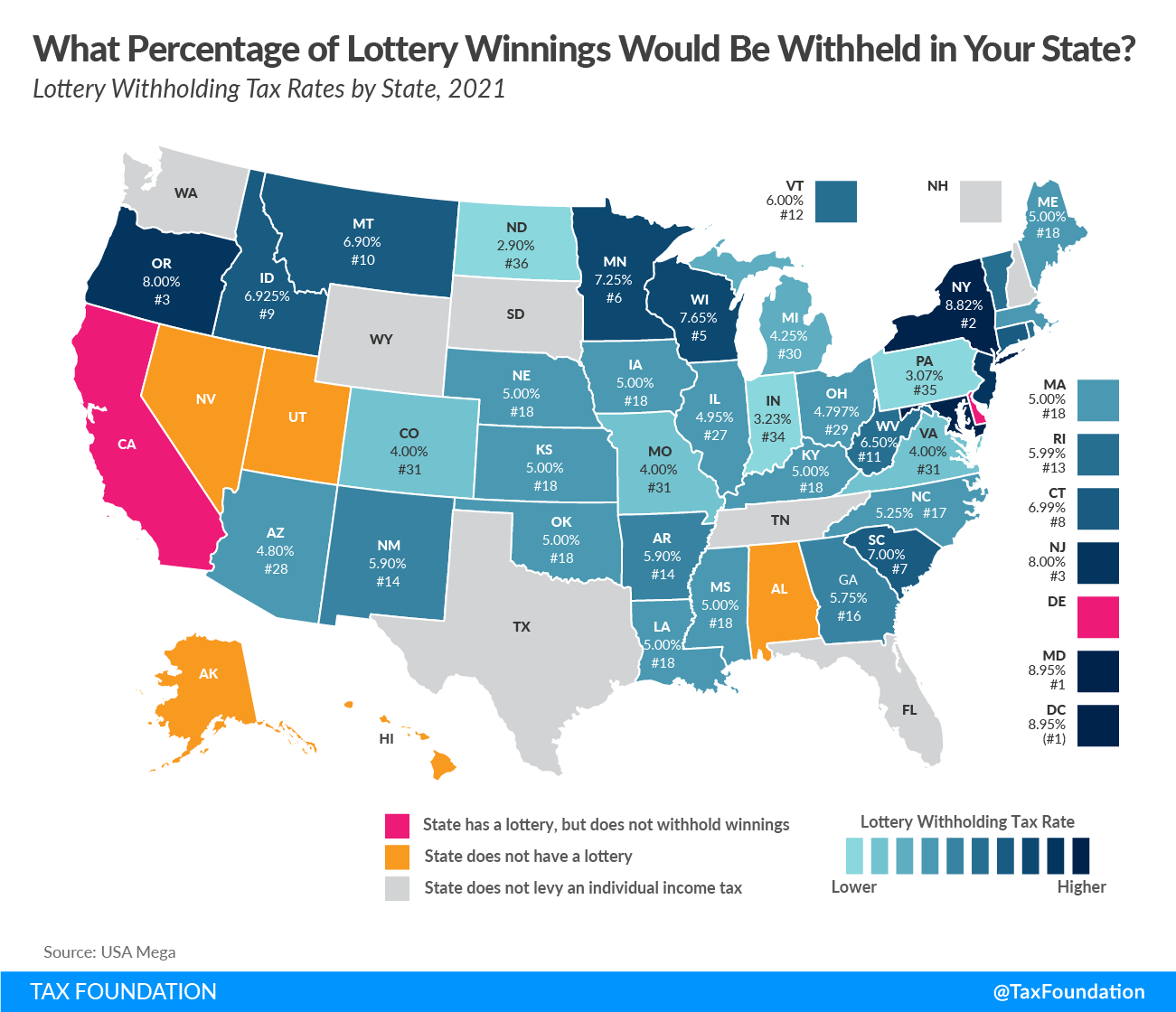

Zooming out, there is a big question around what this means for society at large in terms of how we interact with money. The U.S. government has long encouraged lottery (they even use it to pay for education, which help to fund some of my college journey, weirdly enough)

We have a get-rich-quick mindset in our society. We like to take risky bets because we are bad at pricing risk, which is then compounded by FOMO, etc.

This sort of behavior shows up in the stock market too - there is not a great fundamental reason why the stock market should keep going up (earnings aren’t that good on aggregate, and guidance has been weak for a lot of companies). So why does it keep going up? Gambling or speculating? FOMO?

People are placing bets on companies like Tesla, which trades at an absurd valuation relative to their fundamentals. But that doesn’t matter (I wrote about the Elon Premium as the reason why). People price Elon in as part of the narrative - and the meme is a great value in today’s market structure.

But then the broader narrative then spins into the idea of speculation vs gambling (are you speculating on Tesla, or are you gambling) - does it really matter anymore?

That’s the main difference.

Gamble: Negative expected value - You gamble with the knowledge that you could lose it all (and more) and that the cards will likely not fall in your favor.

Speculate: Positive expected value - When you speculate on the markets you put $50 in Doge with the hopes to make $500 million.

There is an element of non-randomness to speculation - and it shouldn’t be an investment thesis (probably). There should probably be more thought than just “oh maybe will go up” and more thought into WHY and HOW it should go up. But speculating has absolutely asymmetric upside in this market environment.

On that $50 in Doge, maybe you lose it, but maybe you make $500 million.

Why wouldn’t you?

The Most Entertaining Outcome is the Most Likely

Meme King Elon was right about this one. In a world where speculation is the best investment thesis and fundamentals are based on FOMO, the funniest thing will be the most likely thing. Because why not?

We often use inductive reasoning in finance -

“This company has x cash flow, cash flow is a good sign of a good company, so this is a good company”

[observation → analysis → theory]

But in Meme Markets, its more deductive reasoning

“dog coin goes up, this is a dog coin, dog coin go up”.

[idea → observation → conclusion]

So everything stems more from an idea - and then an eventual observation. There aren’t fundamentals, its more so - “is this funny? yeah it is funny. it will go up”.

That’s the underlying thesis behind why SHIB flipped DOGE - it was momentarily funnier (and might be because Elon said he DIDN’T own it).

It was FOMO fundamentals

It was get-rich-quick.

It was an asymmetric upside bet on other people think that the dog coin was funny too, taking in situational context from what happened with DOGE, and saying “eh, I will throw $20 at it”.

That’s the most entertaining outcome. That is the most likely.

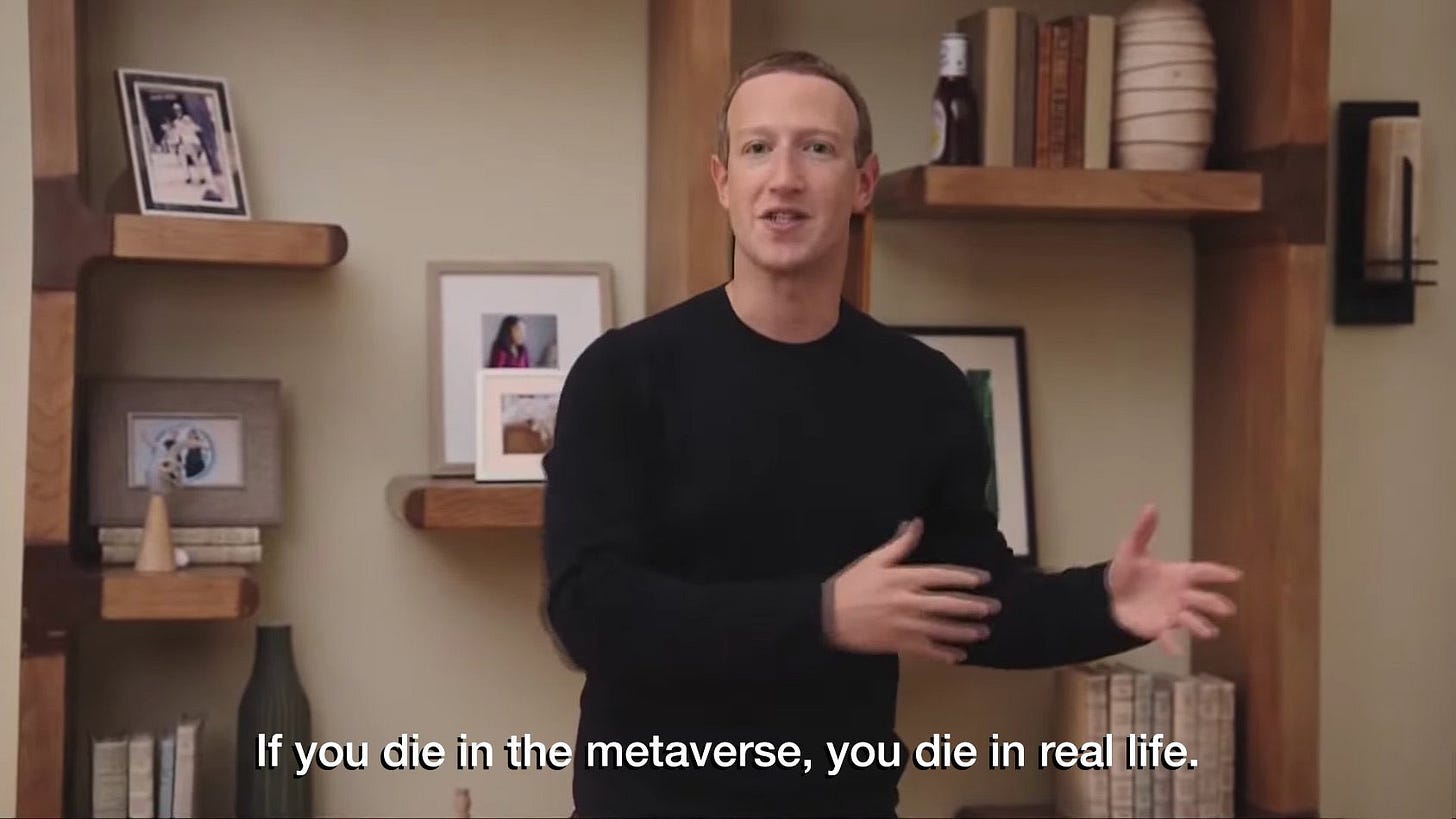

Meta

The company formerly known as Facebook stepped right into a meme (this part is sort of an aside).

Facebook announced that they were going all in the Metaverse, changing their ticker to $MVRS. Zuck is all in on Metazuckbergverse. But from a company perspective, it is actually interesting - because Zuck is working backwards. As Ben Thompson wrote (emphasis my own):

The biggest difference, though, is Zuckerberg: while Page and Sergey Brin, as I wrote at the time, “may be abandoning day-to-day responsibilities at Google, [they have] no intention of abandoning Google’s profits” to pursue whatever new initiatives caught their eye, Zuckerberg quite clearly remains fully committed to both the “Family of Apps” and “Reality Labs”; more than that, Meta is, as Zuckerberg said in an interview with Stratechery, a continuation of the same vision undergirding Facebook:

I think that this is going to unlock a lot of the product experiences that I’ve wanted to build since even before I started Facebook. From a business perspective, I think that this is going to unlock a massive amount of digital commerce, and strategically I think we’ll have hopefully an opportunity to shape the development of the next platform in order to make it more amenable to these ways that I think people will naturally want to interact.

This is always want Zuck wanted to build. He could have cashed out of Facebook years ago, retired, called it quits - but he stayed, because he believes in the Metaverse. There is something deeply admirable about that (from a commitment perspective, still not a fan of the Facebook at all).

The world is increasingly malleable (and meme-able).

I wrote about the Metaverse here with my friend Kushaan more. And getting back to the main thesis of this piece, a snippet from my piece with Kushaan:

The fact that many of these worlds (in the Metaverse) also have their own currency means value can be generated in many ways – even real money isn’t a detriment to increasing your worth within a Metaverse.

Money is becoming more of a gateway into other systems. Money is a meme.

But the Metaverse (and crypto) broadly is not just about revolutionizing finance, it’s about revolutionizing the way that we interact and consume culture.

It’s cool!!! And exciting. But it’s also overwhelming because it feels like our heads are leaving the ground - go play in this new reality - when our physical, feet-on-the-ground world, still needs so much improvement.

The Disconnect

The thing that has been so odd to watch during the various meme and stock run-ups are the subtle feeling that society is crumbling around us. Supply chains are a mess, energy prices are volatile, the yield curve inverted (momentarily) and yet - yet it all still goes up. Ryan Petersen, the CEO of Flexport, has done an excellent job at chronicling the supply chain crisis.

The summary of this thread is that companies are incentivized to strip companies to their bare bones, and because they are operating at minimum viable production levels - and there is noooo margin of error.

No excess capacity

No extra inventory

No employee loyalty

And then this absolute banger - some public companies are no better than dog coins.

The accounting hacks are hard to decipher - the way that public accounting works now probably isn’t the way that it should be for the next generation of companies. We saw software companies buckle around accounting law in the early 2000s - no one knew how to value them, so they were able to play with accounting to inflate all their metrics, then boom boom bust.

It was about how big you could get - not about the ~fundamentals~.

Companies were more focused on advertising versus actually building.

That’s a bit of the problem we have now - the incentives are skewed away from capital investment in infrastructure because that doesn’t look as pretty.

You can’t meme a supply chain because it actually physically exists.

The Meme and the Physical

Clayton Christensen wrote about the New Church of Finance back in 2012:

If we are to see our economy really grow, we need to encourage migratory capital to become productive capital — capital invested for the long-term in empowering innovations. But until deeply held belief systems and complex codes are changed, I fear we will continue to experience over-investment in efficiency and meager attention to empowering innovation, growth and jobs.

There are three types of innovations, he writes:

Empowering: Take something complicated and expensive and create access for more people (Model T for cars, Apple for computers)

Sustaining: Better products at better profits (The Prius replaces the Camry)

Efficiency: Low cost providers in an existing framework (Walmart)

Christensen argues that more money has gone into sustaining and efficiency - which isn’t great for the economy because that is not where *true* economic growth lies. And this is because people believe too much in the ratios - and what is measured is managed away.

We prioritize profit over innovation (and this of course circles back to policy). We have made accounting and all metrics a meme that companies can follow.

We have strayed away from the physical because it’s not easy enough to meme. The incentives are skewed.

Final Thoughts

Memes are great. They get people invested. They allow for a certain element of growth and inflow because they are:

Funny

Trade FOMO fundamentals

Create investable narratives

Are real, because memefication manifests an element of reality

So despite all the memecoin run ups, the stock market going absolutely bonkers, public accounting being a bit ~loose~, and the Metaverse likely being our future - we have to remember that even though a lot of it doesn’t *feel* real, it is.

SHIB is real. It’s a meme. The U.S. Dollar is real. It’s a meme of the collective belief in the full faith and credit of the U.S. government. Accounting is a meme. It makes companies go up even when they shouldn’t.

Everything is a meme! (except the supply chain)

But money IS REAL (little bit of clickbait on the title).

But we can’t forget at the end of the day that we *exist* feet on the ground. A bit dark - but if you die in the metaverse, you die in real life.

And maybe memes will solve the neverevending questions we have for the future - but we have to start reconciling the digital and the physical.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

And yet all these meme coin valuations are listed in USD...

Excellent. Love your stuff.