Trust and portfolio construction - Podcast version here and YouTube up later this week!

Today’s newsletter is brought to you by Spectra School

People make a lot of the same mistakes in finance over and over. We want you to not have to do that. The course dives deep into the history and structure of markets to show you how markets really work – and how they’ll continue to work over time.

Learning theory in the classroom is great, but this course teaches practical skills and frameworks. We focus on cycles, biases, data literacy, psychology, and real world tools, tactics, and strategies. We focus on the behaviors that a finance professional needs to have in the incredibly complex and competitive world of finance.

And it’s not a course on what to think. It’s a course on how to think. When you can think better, faster, and more clearly than your peers, you’ll have an edge in markets. Check out Spectra School today and use code TLMPKYLA.

A Lot of Things Are Happening!

Last week, I spent about two days on a plane. Flew somewhere, flew home. Over the course of that 48-hour trip, it felt like the entire world had shifted. As I was zooming through the sky above, the fragility of our global systems was on full display below. A short list:

South Korea’s Parliament scaled walls to vote down martial law. France’s government collapsed over their budget. The United Healthcare CEO was shot and killed. They arrested someone. The Assad regime fell in Syria after a decade of civil war.

The US labor market shows continued signs of softening, with a “slow to hire, slow to fire” market (Last week, I interviewed Mary Daly, President and CEO of the San Francisco Federal Reserve, about how the Fed thinks about things.) Google developed Willow, a quantum computing chip, and hinted at parallel universes in the press release (???) and Bitcoin hit $100k - an increasingly complicated bet against institutional trust. Inflation continues to be sticky.

I think the big takeaway over the past few days (months? years? is time real?)1 is that trust—which is fragile, fraying, and increasingly rare—has become very important in this fractured world. Trust—or really, the lack of it—has become the world's most valuable commodity. And like any valuable commodity, you can invest in it. None of this is investment advice, just ways to think about things.

The Trust Portfolios

So how do we invest in a world where trust is the scarcest commodity? I see a few distinct approaches, each betting on a different vision of the future.

Think of companies like ASML - they make the machines that make computer chips. That's it. That's their whole thing. But they do it with such precision, such verification, such trust-building excellence that they've become irreplaceable.

They're not just a company; they're infrastructure. And in a world where trust is scarce, being trustworthy infrastructure is incredibly valuable. They are bridge builders. You can design portfolios around trust:

System Protection Portfolio: This is for people who look at the headlines and see more fragmentation coming. They're not betting on collapse exactly—they're betting on the need for defense and security in an uncertain world. It's not doom and gloom investing—it's recognition that protection has value when trust is scarce. (low trust)

System Security: Crowdstrike, Palo Alto Networks (protecting digital infrastructure)

Physical Security: Lockheed Martin, Raytheon (protecting physical infrastructure)

Asset Protection: Gold, Silver (protecting stored value) and crypto (hedge against systemic stress)

System Maintenance Portfolio: Some people see our current institutions as stable and constant. They're betting on the resilience of existing systems. (high trust):

Financial Infrastructure: JPMorgan, Bank of America (maintaining financial systems)

Risk Management: Berkshire Hathaway, Prudential (managing societal risk)

Core Technology: Microsoft, Apple (maintaining digital infrastructure)

These are two separate portfolios, and which one you align with is entirely up to you. It is my opinion (not advice) that we will be in the current low-trust environment for a while, but we will eventually find our way back to high-trust. That requires a different portfolio than Systems Protection or Systems Maintenance - it requires System Building.

The Systems Building Portfolio

So ASML - they're part of what I call this Systems Building Portfolio. These companies thrive in today’s fractured landscape while actively building the systems we’ll rely on tomorrow. This isn't about promises to "rebuild trust." It's about creating systems so reliable, so verifiable, that they work whether trust is high or low. Think of companies building tomorrow's infrastructure while solving today's problems.

This would be ‘innovation with trust infrastructure’. This isn’t pure ESG or social impact; it’s companies that are solving immediate problems while also building tools and systems that foster long-term societal stability.

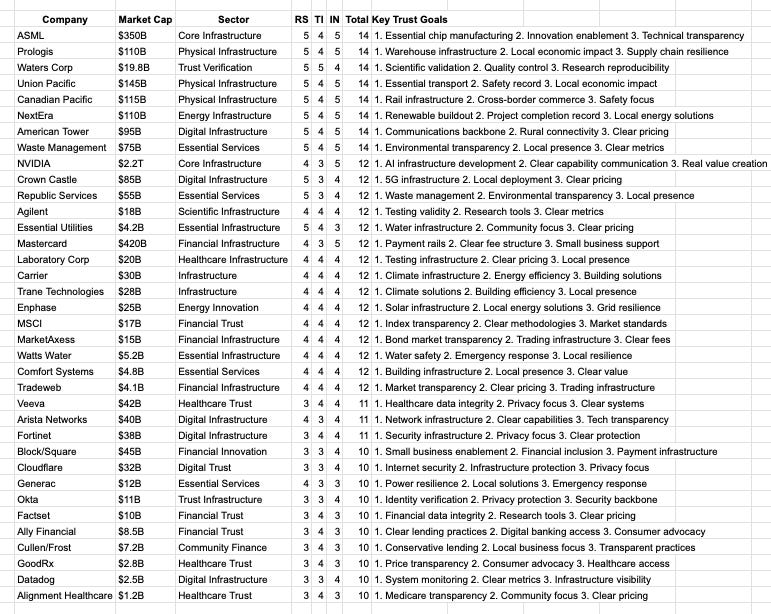

And so how do you evaluate companies that could serve in any of these portfolios? A quick framework could be:

Revenue Source (RS): Are they building something real and verifiable?

Trust Impact (TI): Does their success create more stability?

Infrastructure (IN): Are they building lasting systems?

So a really simple model could be a scoring system (1-5 scale for each category) with Nvidia as an example:

NVIDIA

Revenue Source: (4/5) - Clear value from chip sales, some concerns about pricing power

Trust Impact: (3/5) - Transparent about AI capabilities but high prices limit access

Infrastructure Number (5/5) - Essential AI/computing infrastructure

Score: 12/15

And then you can apply that subjective framework to a bunch of companies.

This isn't investment advice—it's a framework for thinking.2 You could apply these same criteria to any company you're considering. The key is finding businesses that aren't just surviving in today's low-trust world, but are actively building systems that will matter tomorrow.

The catch? These companies are hard to find. Many try to build trust but can't survive long enough to succeed. Others claim to be builders but are really just exploiting the chaos.

That's exactly why this matters!! If you can identify the real builders—companies creating verifiable value while laying groundwork for what comes next—you're not just investing. You're backing the infrastructure of tomorrow. (big bold claim, but important)

To understand why these portfolios matter, we need to step back and examine the broader forces shaping today’s trust landscape.

Why Trust Matters Now

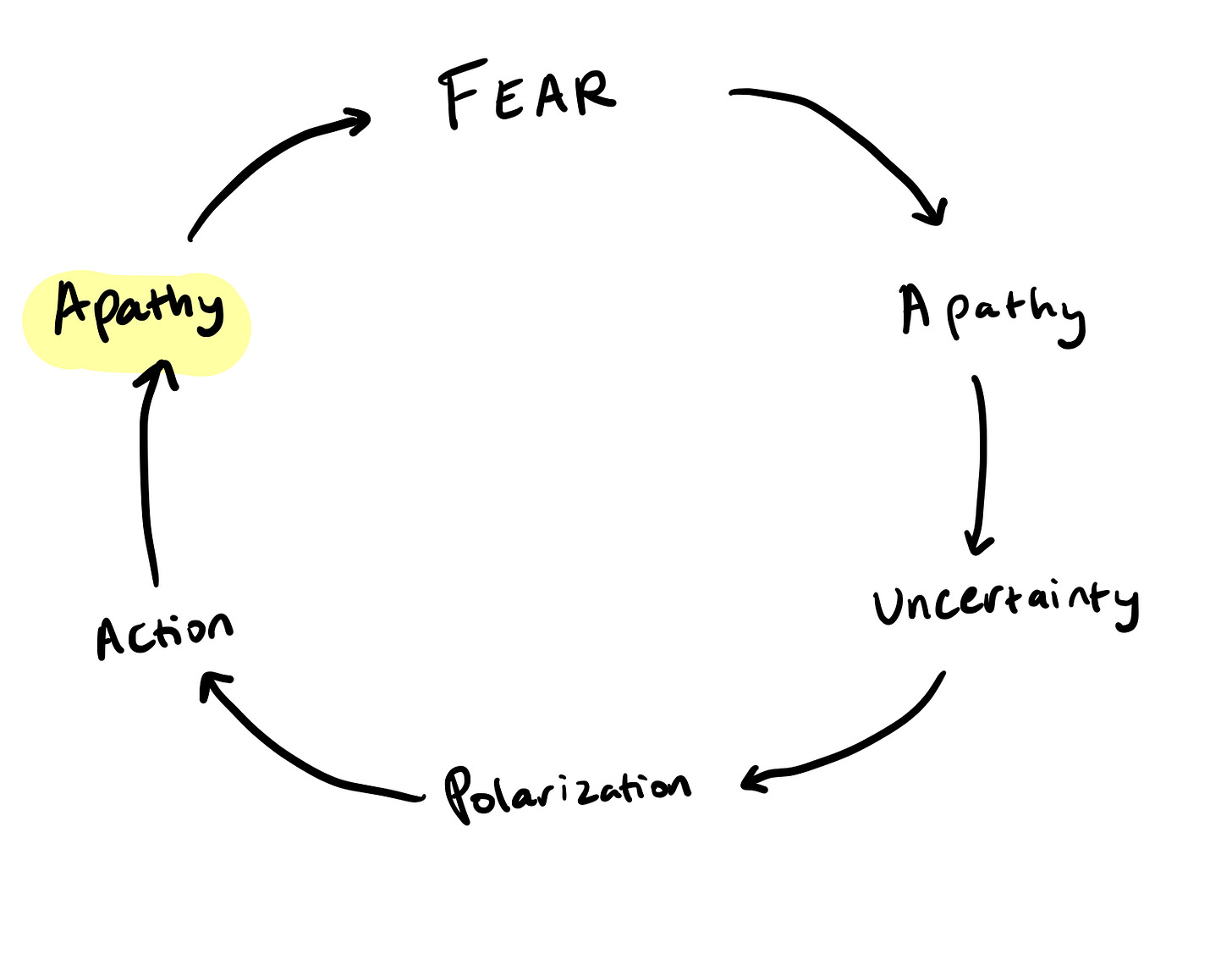

So I think we are stuck in bit of a loop. The Cycle of Apathy. It began in 2020.

We cycled through Fear - lockdown, death, isolation, and economic uncertainty.

We catapulted into Apathy in 2021, with evident societal exhaustion and burnout.

Structural cracks post-pandemic coupled with the loss of consumer support from fiscal stimulus led to Uncertainty in 2022, with continued problems with inflation, banking crises like the SVB collapse, housing market instability, and tech layoffs.

Uncertainty naturally breeds fear, and in the absence of trust, people seek scapegoats or simple solutions—leading to Polarization/Tribalism in 2023, with increasing immigrant/border tension, partisan divide, a sharpening of the culture war, and an erosion of faith in institutions.

And we are currently in the Action phase of the cycle, where steps to address polarity are taking place across the world. It’s everything I listed at the beginning of the piece and what I talked about in the Why Donald Trump Won piece.

The problem is, we usually go from Action back into Apathy.

Hank Green recently published a video with a similar idea, more focused on the media’s role. He explored the historical pattern of:

New Media → Information Overload → Trust Breakdown → Populist Response

The general idea of the video is that we get exposed to a new form of information dissemination (radio, newspaper, TV, social media), we get firehosed, we lose trust in one another and then we seek solace in the form of anti-establishment, charismatic leaders, us vs them, etc. That’s the Action part.

Many would argue that the Cycle of Apathy has been on repeat since 1965 - 1980 or so. It’s a liminal space where you sort of look around and say ‘huh time really is a circle’, the continued staircase of progressive ideals versus conservative backlash, Fourth Turning stuff. Like most things, I don’t think all of it is true, but some parts are helpful.

The Apathy part circles back again when people lose faith entirely (this is the loop part). That’s kind of where we are headed again - because this isn’t about information cycles, it’s about something more personal: a fundamental promise to each generation that's been unraveling.

The societal pinky promise broke. This is the basic implicit agreement that if you work hard, you'll be able to afford a home, have a stable job, and build a better life than your parents.

Housing affordability, childcare, eldercare, promises of stable income, promises of jobs, etc - that handshake between citizens and government has dissolved.

When people can’t afford homes (which I think is our BIGGEST problem) it erodes their sense of security and stability, feeding frustration and mistrust.

People feel betrayed by systems that seem rigged against them, leading to that general disinterest3, all backdropped by the asset economy versus wage economy, shifting technology, economic instability, eroding trust in institutions – all of it creates a world where people feel like observers rather than participants in their own future.

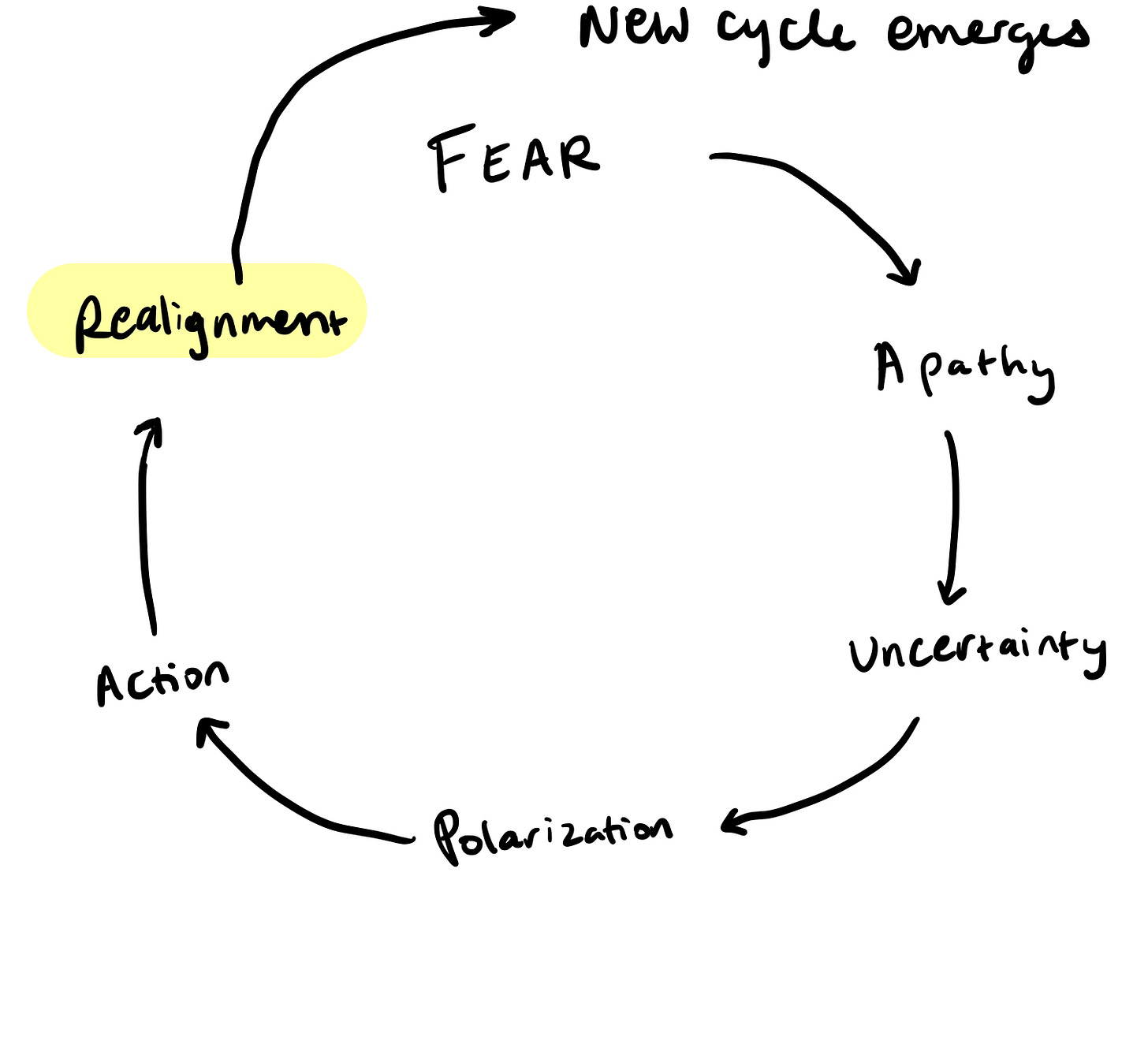

Realignment

So, how do we fix it and make sure we don’t loop back to Apathy?

I think it requires a Realignment—a collective effort to rebuild trust, anchored in three pillars:

Trust: A shared belief in institutions, leaders, or systems.

Truth: A common understanding of reality, which is now fractured by misinformation and tribalism.

Consensus: Agreement on collective action, which is impossible without trust and truth.

Realignment is a cultural and structural shift that breaks through the apathy loop - it’s challenging because we would have to create shared trust, tools that defragment, and break out of this cycle.

There’s the broader societal component, which is more complicated.

It’s happening in quiet pockets across the world. While headlines focus on collapse, cities and companies are rebuilding with innovative solutions to housing, transportation, and energy.

But embracing change at a high level would be like the Post-WWII recovery and the New Deal-era policies that rebuilt trust in institutions through massive support for the populace. I’ll save that for a different piece.

Then, there’s the individual component, which I think comes in the form of investing like I talked about in the beginning of the piece - it’s about agency in a fractured world.

And this is where I have failed you, dear reader, in the past. I haven’t offered solutions beyond pontification (of which there are far too many pontificators!). A big goal of mine is to offer paths toward agency throughout 2025 and beyond. Investing is a path toward agency - you can take action for yourself and build for your future.

We have YOLO/FOMO fundamentals—a dynamic where speculative risk-taking coexists with fear of missing out (more on that in a future piece)! Nothing is how we expect it to be, and that’s okay. You are in charge of yourself. So I am returning to my roots a bit4 and giving some actionable takeaways.

Everything I’ve talked about throughout the piece are signals of a broader shift in how trust flows through our systems. And they point to a few important questions for investors:

How do we build value in a world where trust itself is being repriced?

How do we invest in this rebuilding?

How do we put capital to work in a way that both protects value and helps create the future we want to see?

That’s what we have to focus on right now.

The Next Cycle

History shows that realignment is challenging but not impossible. It requires patience, resilience, and action at every level—individual, local, and institutional.

The question really isn't "How do we rebuild trust?" It's "How do we function and build value in a low-trust world long enough to create the conditions where trust might eventually return?" as we reestablish the societal fabric. There’s an opportunity to invest in what’s next at the root level. Here’s what you can do right now:

Pick your stance. Do you think we're headed for:

More fragmentation? Look at the System Protection portfolio

Stability? Consider the System Maintenance plays

A bridge to something new? Focus on the System Builders

Start small. Pick one company that fits your thesis.

Run it through the framework:

Revenue Source: Are they building something real?

Trust Impact: Does their success create stability?

Infrastructure: Are they building lasting systems?

Set a calendar reminder for six months from now. When it hits, ask: -

Has the company strengthened or weakened trust?

Are they still building what matters?

Has the trust landscape shifted?

The future isn't something that happens to us. It's something we build, one project, one solution, one kept promise at a time. And right now, in the middle of all this chaos, you have the chance to put capital behind the future you want to see. Just start with one company. One verifiable solution. One small bet on trust. That's how we break the cycle.

Let me know what you think below.

Disclaimer: This is not financial advice or a recommendation for any investment. The Content is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I’ve written a lot about trust and uncertainty and polarization and I’ve talked a lot about structural affordability, media narratives, and fragmentation.

I apologize for not taking a firmer stance, but I really do want this to be seen more as a framework than company picks

A good example is Occupy Wall Street and how hard it is to create real change

Long-time readers will remember that this newsletter began with an investment focus. Even longer-time readers (which is only my Dad and Nick Maggiulli) will remember Scanlon on Stocks and my options trading analysis

I was busy reading James Fallows’ newest piece on rebuilding trust and on the importance of local solutions to build up connections, civic skills and governance, and I have to say this post was a nice complement. I also think that labor unions will be crucial in creating the conditions to rebuild trust--while Hamilton Nolan said a few times that they might need to start using funds for massive organizing drives, I believe unions that get in on the industries of the future, specifically energy startups, will be the smartest institutions out there in the future

Interesting post and thread ~ thank you. Could it be possible that we are headed for all of the above (greater fragmentation, stable roads that forestall this, and new undiscovered roads?). I think all three can be true of companies, and of reality itself. The danger is in thinking any one group or individual has the 'corner on the truth." Complex world, and trust is often something we can evaluate analytically, with data, and also with our experience. Thank you.